Guam Receipt Template for Small Business

Description

How to fill out Receipt Template For Small Business?

Have you ever found yourself in a situation where you require documents for either business or personal reasons almost every working day.

There are numerous legal document templates available online, but locating ones you can rely on isn't easy.

US Legal Forms provides an extensive collection of form templates, such as the Guam Receipt Template for Small Business, tailored to meet federal and state regulations.

If you locate the right form, click Get now.

Choose the payment plan you want, fill in the required details to create your account, and pay for the order using your PayPal or Visa or Mastercard.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Guam Receipt Template for Small Business template.

- If you do not have an account and wish to start using US Legal Forms, follow these instructions.

- Select the form you need and confirm it is for the correct region/county.

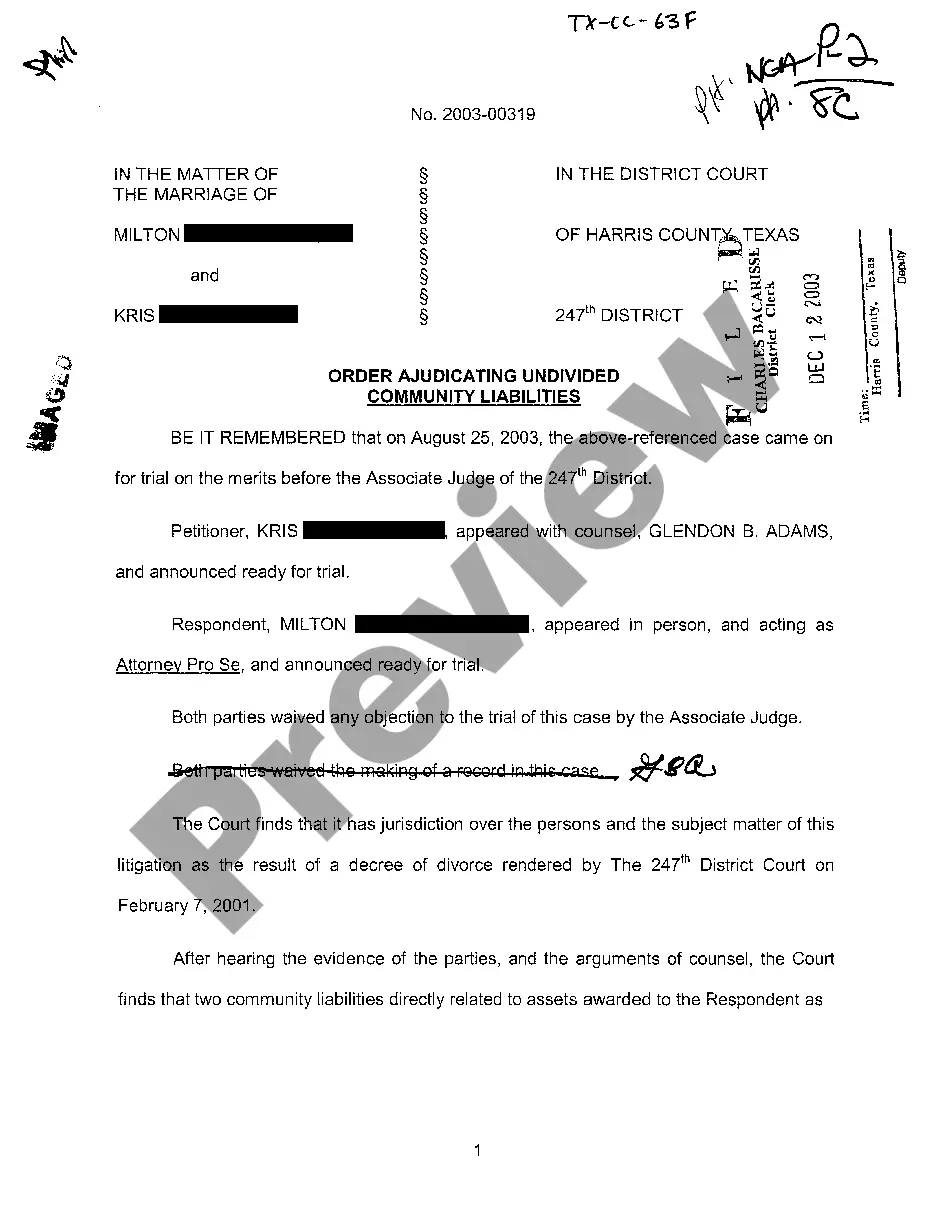

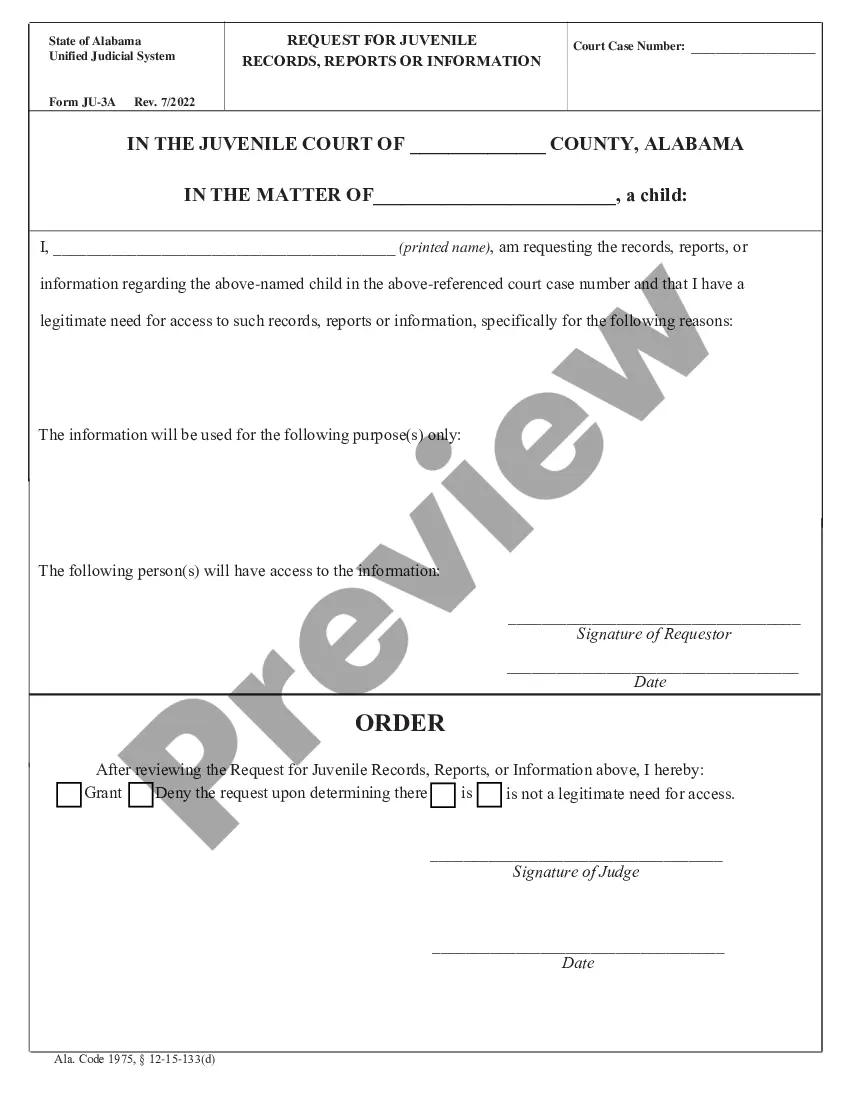

- Utilize the Review option to examine the form.

- Read the description to ensure that you have chosen the correct form.

- If the form is not what you are looking for, use the Search field to find the form that matches your needs.

Form popularity

FAQ

Starting a small business on Guam requires careful planning and adherence to local regulations. First, develop a solid business plan outlining your goals and strategies. Next, register your business and obtain the necessary licenses. Using a Guam Receipt Template for Small Business can help you manage transactions efficiently, ensuring compliance with local requirements while providing a professional impression to your customers.

Starting an LLC in Guam involves several steps. You will need to choose a unique name for your business and file the Articles of Organization with the Guam Department of Revenue and Taxation. After approval, obtain any necessary business licenses and permits, and consider using a Guam Receipt Template for Small Business for your invoicing needs. This template ensures professional transactions from the outset.

Writing a receipt for a small business involves several key components. Start with your business name, address, and contact details, followed by a unique receipt number. List the items sold or services provided with their respective prices, and include the total amount, any applicable taxes, and payment method. A Guam Receipt Template for Small Business can help you ensure that all necessary information is included and presented professionally.

To make a legit receipt, focus on providing accurate and comprehensive transaction details. Include your business name, the buyer’s information, a description of items or services, and payment information. Utilizing a Guam Receipt Template for Small Business can help ensure your receipt meets all legitimacy requirements.

Yes, Google Docs offers various templates, including those for receipts. You can customize these templates to suit your business needs. For a more specific option, you might consider using a Guam Receipt Template for Small Business available on uslegalforms, which offers additional features tailored for small businesses.

Creating a contractor receipt involves documenting the services rendered comprehensively. Start with your business name, detail the specific work completed, and include applicable rates. A Guam Receipt Template for Small Business makes this process simple and helps you maintain professionalism.

To make a valid receipt, ensure you input clear details that reflect the transaction accurately. Include your business information, a unique receipt number, the date, and a list of purchased items or services. You can use a Guam Receipt Template for Small Business to create an efficient and valid receipt every time.

You can generate a receipt for your small business by using receipt templates available online. Many platforms, like uslegalforms, offer customizable Guam Receipt Templates for Small Business tailored to your needs. Simply fill in the details, and you can print or send receipts easily.

Yes, if you conduct business in Guam, you are required to file a Guam tax return. This process includes reporting your gross receipts, expenses, and any applicable taxes. To streamline your filing process, consider utilizing a Guam Receipt Template for Small Business, which can help you gather and organize the necessary documentation for your tax return.

Customs taxes in Guam are applicable to imported goods and are similar to tariffs. These taxes contribute to the territory's revenue and vary based on the type of goods imported. When managing your imports, a Guam Receipt Template for Small Business can help track expenses and ensure that you account for any potential customs taxes appropriately.