Guam Sample Letter for Offer of Assistance with Continued Education - Business to Employee

Description

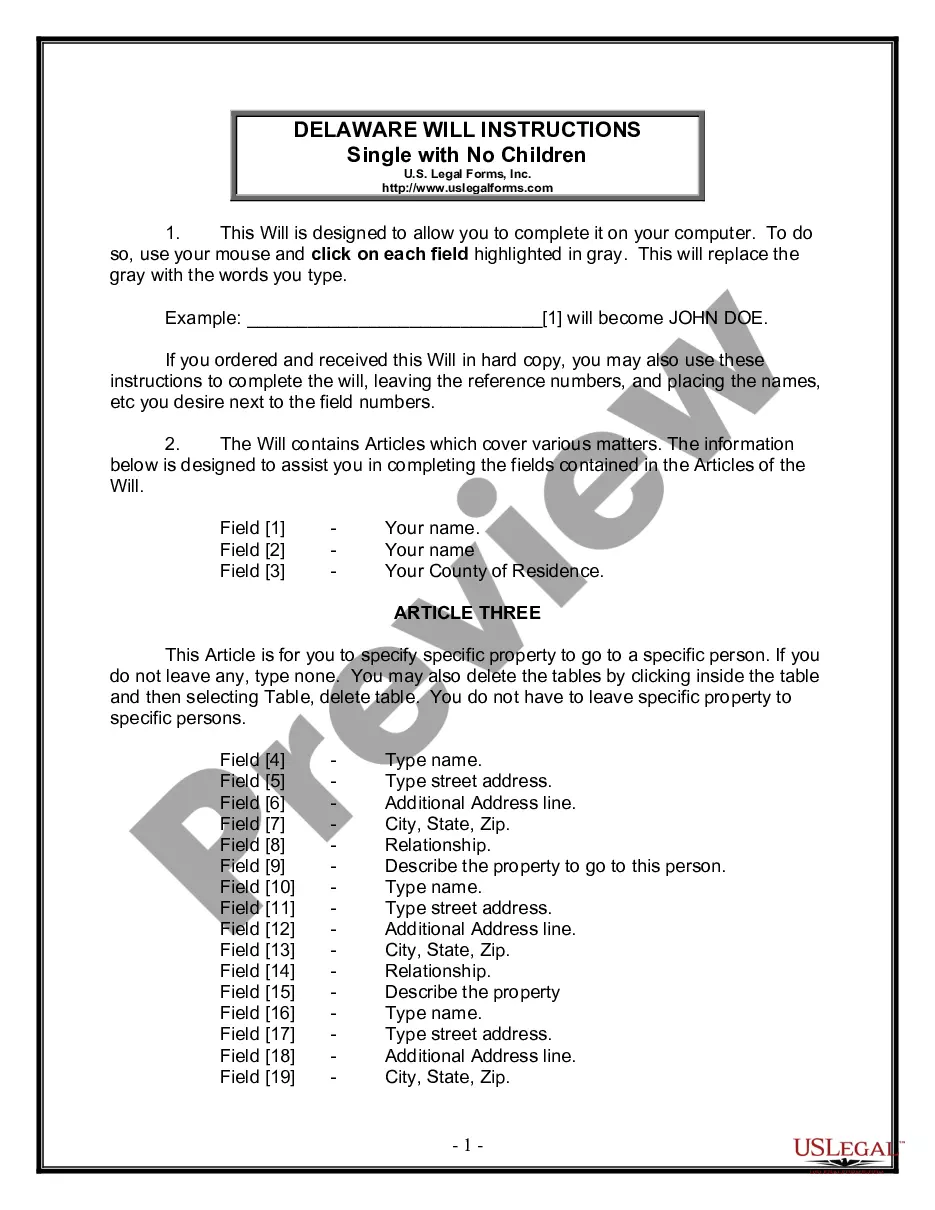

How to fill out Sample Letter For Offer Of Assistance With Continued Education - Business To Employee?

Have you found yourself in a situation where you require paperwork for either corporate or personal reasons almost every workday.

There are numerous legal document templates available online, but finding reliable ones can be challenging.

US Legal Forms offers a plethora of form templates, like the Guam Sample Letter for Offer of Assistance with Continued Education - Business to Employee, which are crafted to satisfy federal and state regulations.

Once you've found the appropriate form, click Purchase now.

Select the pricing plan you prefer, enter the required information to create your account, and complete the transaction using your PayPal or Visa or Mastercard. Choose a suitable document format and download your copy.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- After that, you can download the Guam Sample Letter for Offer of Assistance with Continued Education - Business to Employee template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and verify it is for your correct city/state.

- Utilize the Preview button to examine the form.

- Read the description to ensure you have chosen the right form.

- If the form does not meet your requirements, use the Search field to locate the form that fits your needs.

Form popularity

FAQ

Writing a letter to request assistance is straightforward. Start with a professional greeting, then clearly outline your request for help with continuing education. Include the elements of a Guam Sample Letter for Offer of Assistance with Continued Education - Business to Employee, emphasizing how this opportunity aligns with your career goals. Conclude with gratitude for their consideration and an invitation for any further discussion.

To ask for tuition assistance, write a clear and concise request to your employer or HR department. State your intentions, mention how further education will enhance your skills, and express your interest in the Guam Sample Letter for Offer of Assistance with Continued Education - Business to Employee. By doing this, you demonstrate initiative and highlight mutual benefits, which can increase the likelihood of support.

When you need to ask about tuition fees, be respectful and direct. You can frame your request by saying you are researching educational benefits offered by the company. For clarity, mention that you are specifically looking for information on the Guam Sample Letter for Offer of Assistance with Continued Education - Business to Employee to formalize your request for financial aid.

To ask for a tuition assistance sample, start by identifying the right contact within your organization, typically someone in Human Resources or management. Clearly express your interest in educational support and mention that you are looking for a Guam Sample Letter for Offer of Assistance with Continued Education - Business to Employee. Additionally, be polite and concise, stating how this assistance will benefit both you and the company.

Yes, you can file your Guam taxes online using the Guam Department of Revenue and Taxation's online portal. This option offers an easy way to ensure your filings are timely and accurate. Follow the given instructions carefully to avoid any discrepancies. Using resources such as the Guam Sample Letter for Offer of Assistance with Continued Education - Business to Employee can also provide clarity on this process.

In Guam, the business privilege tax is imposed on gross income received from business activities. The rate can vary depending on the type of goods or services provided. This tax aims to generate revenue while supporting the local economy. For a comprehensive understanding of how this tax affects your business, refer to the Guam Sample Letter for Offer of Assistance with Continued Education - Business to Employee for guidance.

The general tax rate in Guam is currently at 4% on gross receipts. Different categories, such as businesses and services, may have specific rates. Staying informed about these rates is crucial for compliance and financial planning. Knowing how these taxes work might be important, so consider the Guam Sample Letter for Offer of Assistance with Continued Education - Business to Employee when preparing for your obligations.

To obtain a Guam Gross Receipts Tax (GRT) account number, visit the Guam Department of Revenue and Taxation's website. You will fill out the required forms, which you can also do online. This account number is necessary for businesses operating within Guam to manage their tax obligations efficiently. For further assistance, check out the Guam Sample Letter for Offer of Assistance with Continued Education - Business to Employee for insight into managing business needs.

The average property tax rate in Guam typically ranges between 0.10% to 0.25% of the property value. This low rate helps attract residents and businesses. It's essential to keep updated with any changes in these rates. Additionally, if you seek to better understand taxation in Guam, reviewing the Guam Sample Letter for Offer of Assistance with Continued Education - Business to Employee could be beneficial.

Yes, you can renew your Guam ID online through the official Guam government website. This process offers convenience and saves time by allowing you to complete the renewal from home. Make sure to have your current ID and supporting documents ready to streamline the process. Consider using resources like the Guam Sample Letter for Offer of Assistance with Continued Education - Business to Employee to gather necessary information.