Guam Sample Letter for Motion to Dismiss in Referenced Bankruptcy

Description

How to fill out Sample Letter For Motion To Dismiss In Referenced Bankruptcy?

Have you been inside a place that you need to have documents for either company or person functions nearly every day time? There are plenty of lawful file themes available on the net, but discovering types you can rely on is not effortless. US Legal Forms gives thousands of form themes, just like the Guam Sample Letter for Motion to Dismiss in Referenced Bankruptcy, that are published in order to meet federal and state requirements.

If you are currently acquainted with US Legal Forms web site and also have a merchant account, basically log in. Afterward, you may obtain the Guam Sample Letter for Motion to Dismiss in Referenced Bankruptcy web template.

If you do not have an accounts and would like to begin using US Legal Forms, follow these steps:

- Discover the form you want and make sure it is to the right town/region.

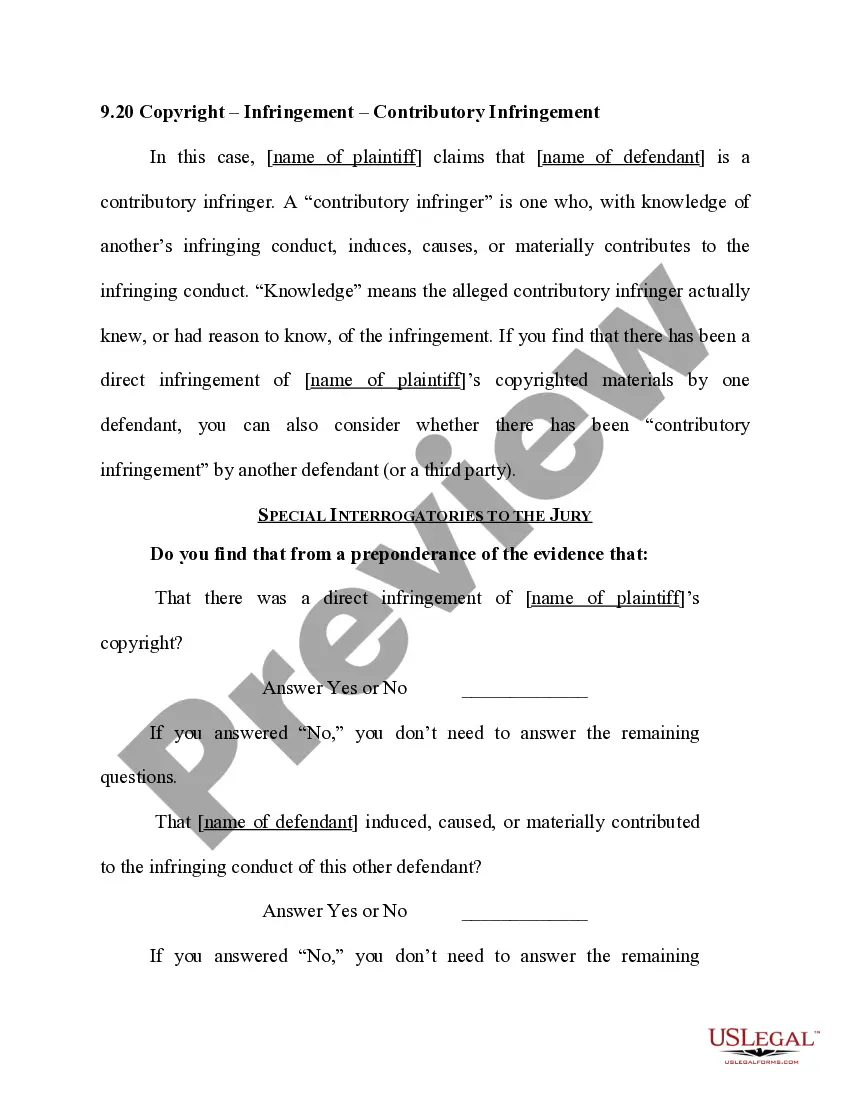

- Take advantage of the Preview button to analyze the form.

- Look at the information to actually have selected the proper form.

- In the event the form is not what you`re looking for, make use of the Search industry to obtain the form that meets your needs and requirements.

- Once you get the right form, just click Acquire now.

- Select the rates plan you want, complete the desired details to produce your money, and pay money for the order using your PayPal or Visa or Mastercard.

- Choose a handy paper formatting and obtain your backup.

Locate each of the file themes you may have bought in the My Forms menus. You can get a further backup of Guam Sample Letter for Motion to Dismiss in Referenced Bankruptcy any time, if necessary. Just select the needed form to obtain or print the file web template.

Use US Legal Forms, one of the most substantial assortment of lawful varieties, to conserve time as well as avoid mistakes. The service gives skillfully manufactured lawful file themes which you can use for an array of functions. Make a merchant account on US Legal Forms and initiate producing your life a little easier.

Form popularity

FAQ

The Chapter 13 Trustee communicates by mail with Chapter 13 debtors. The Trustee sends out financial information, notices and legal pleadings using the debtor's mailing address maintained in the Bankruptcy Court records.

Dismissal of a Bankruptcy Case ? Dismissal ordinarily means that the court stopped all proceedings in the main bankruptcy case AND in all adversary proceedings, and a discharge order was not entered. Dismissal can occur because a debtor requested the dismissal and qualifies for voluntary dismissal.

A Chapter 13 petition for bankruptcy will likely necessitate a $500 to $600 monthly payment, especially for debtors paying at least one automobile through the payment plan. However, since the bankruptcy court will consider a large number of factors, this estimate could vary greatly.

At the meeting, the Chapter 13 trustee will ask you questions, under oath, about what you owe, what you own, your income, and your Chapter 13 Plan.

Case Closure at Trustee's Office After receiving all required payments under the plan (including any tax refunds owed) and completing an audit to determine that all amounts owed were received, the Chapter 13 Trustee will file a Certificate of Final Payment with the Bankruptcy Court.

Key Elements to Include in the Letter It should include the name and contact information of the debtor, the date of the filing, the court where the bankruptcy was filed, the case number, and the type of bankruptcy filed. It should also provide information about the bankruptcy trustee and the meeting of creditors.