Are you in a position in which you will need papers for sometimes enterprise or personal uses virtually every time? There are a lot of lawful papers templates available on the Internet, but finding versions you can depend on isn`t easy. US Legal Forms provides thousands of type templates, much like the Guam Agreement Between Heirs and Third Party Claimant as to Division of Estate, which are composed to meet state and federal needs.

Should you be presently familiar with US Legal Forms internet site and get a free account, just log in. Next, you may obtain the Guam Agreement Between Heirs and Third Party Claimant as to Division of Estate design.

Unless you come with an account and want to begin to use US Legal Forms, abide by these steps:

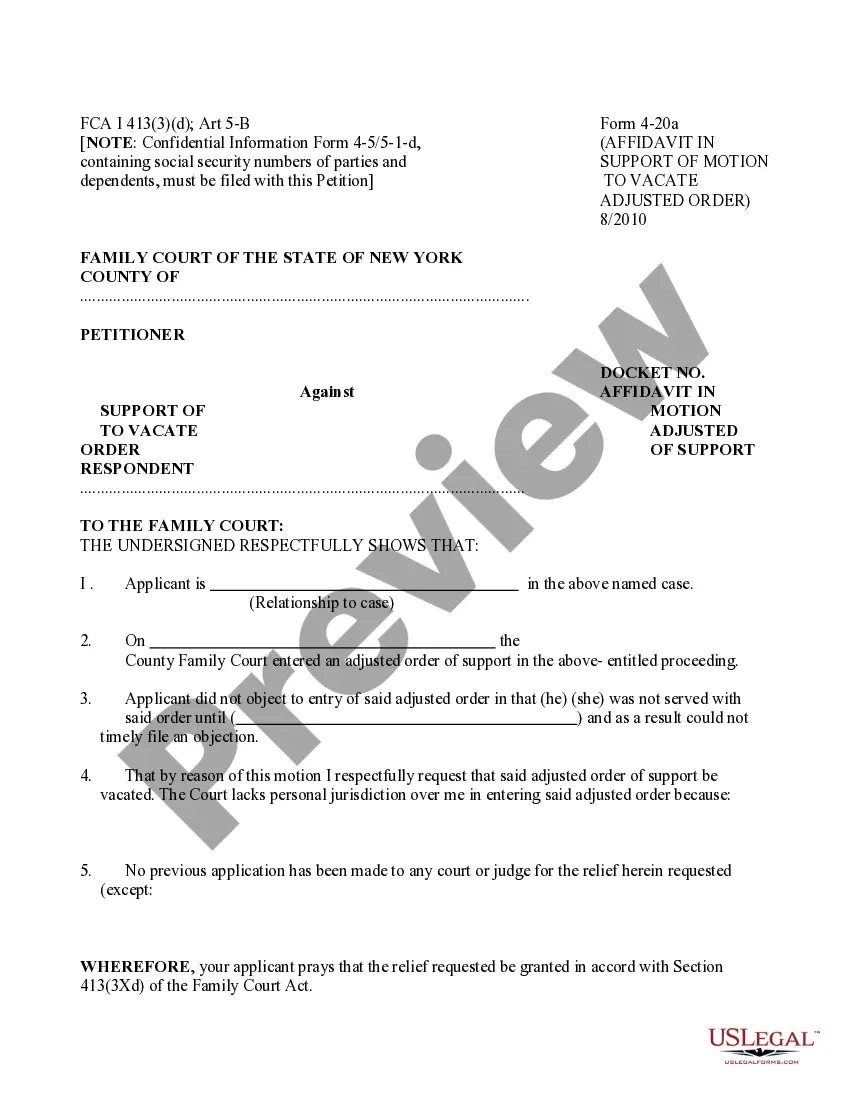

- Discover the type you want and ensure it is for that appropriate city/state.

- Take advantage of the Preview option to analyze the shape.

- See the description to actually have chosen the proper type.

- In case the type isn`t what you`re seeking, make use of the Research discipline to obtain the type that meets your requirements and needs.

- Once you obtain the appropriate type, click on Get now.

- Select the pricing plan you need, submit the necessary information to produce your account, and purchase the transaction making use of your PayPal or Visa or Mastercard.

- Pick a hassle-free data file format and obtain your copy.

Locate each of the papers templates you possess purchased in the My Forms menu. You may get a more copy of Guam Agreement Between Heirs and Third Party Claimant as to Division of Estate whenever, if required. Just select the required type to obtain or print out the papers design.

Use US Legal Forms, probably the most extensive selection of lawful varieties, to save lots of time as well as prevent errors. The assistance provides expertly made lawful papers templates that can be used for a range of uses. Generate a free account on US Legal Forms and start making your daily life a little easier.