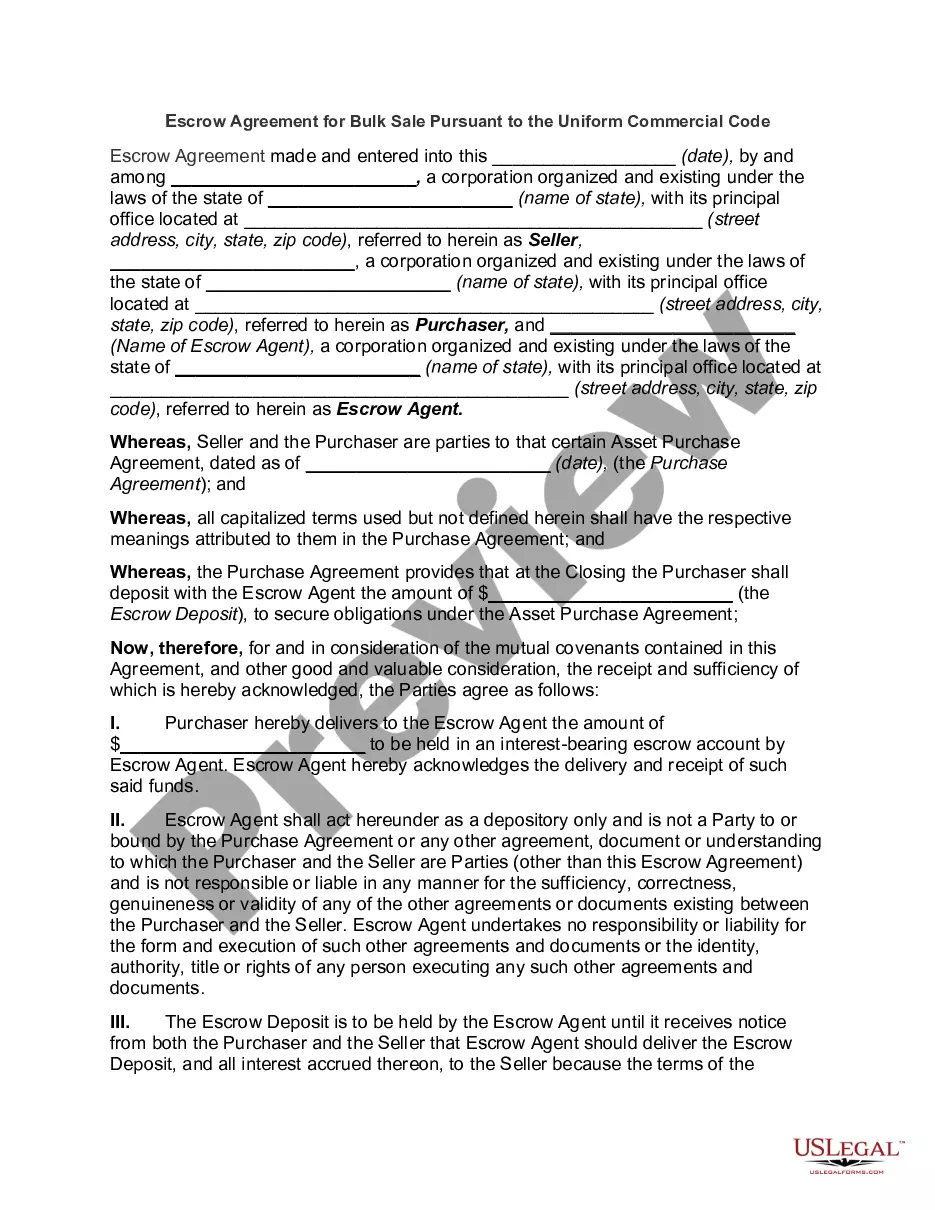

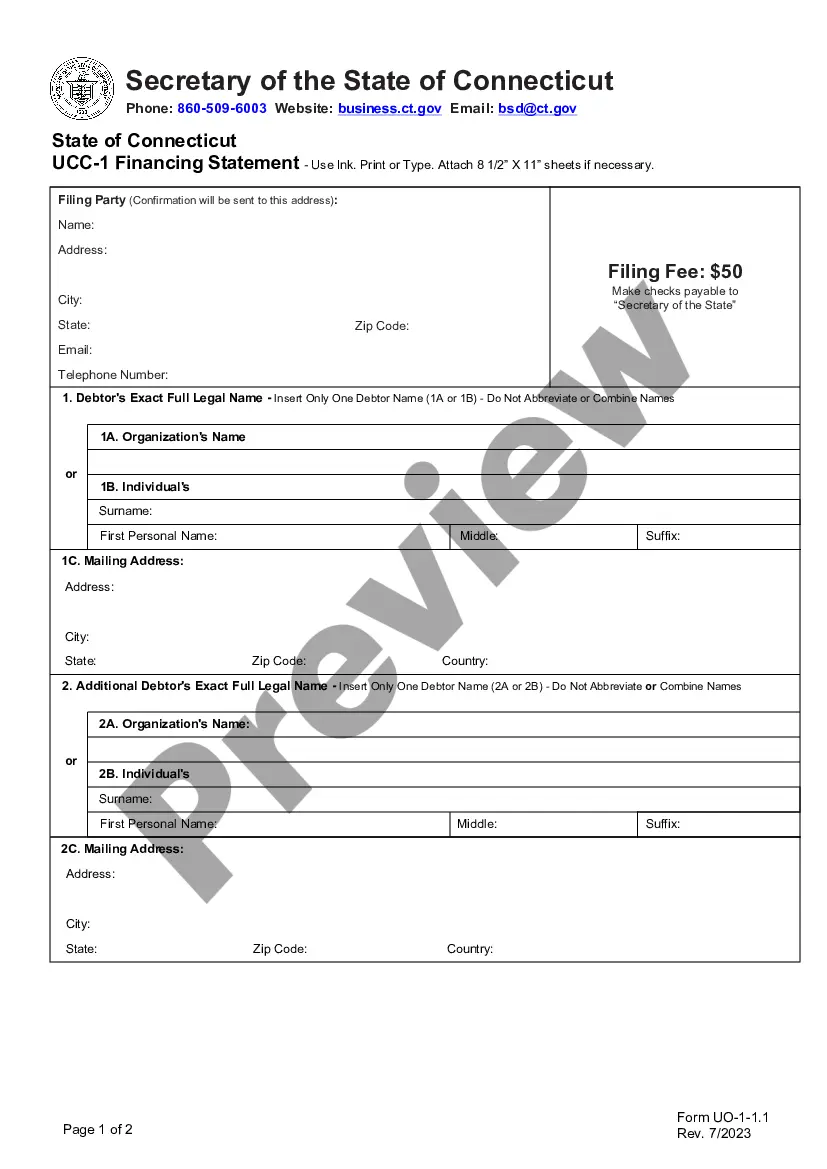

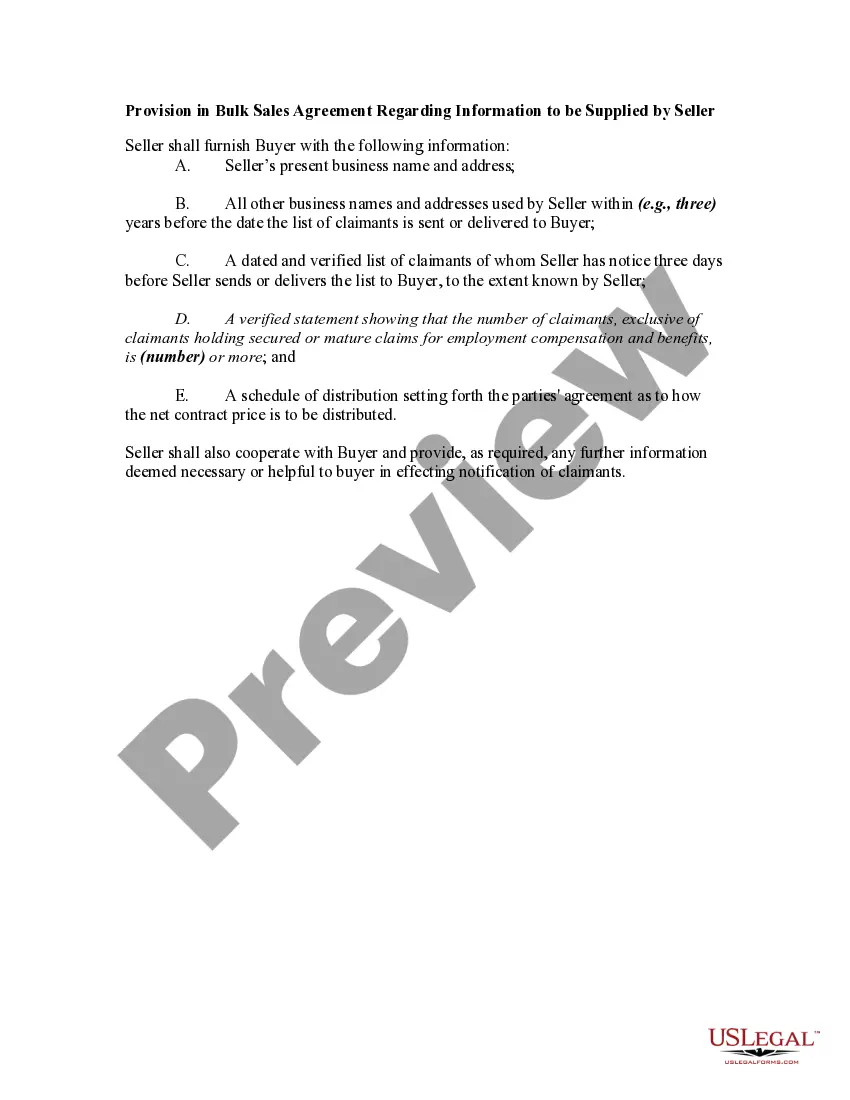

A bulk sale is a sale of goods by a business which engages in selling items out of inventory, often in liquidating or selling a business, and is governed by Article 6 of the Uniform Commercial Code (UCC) which deals with bulk sales. Article 6 has been adopted at least in part in all states. If the parties do not comply with the notification process for a bulk sale, creditors of the seller may obtain a declaration that the sale was invalid against the creditors and the creditors may take possession of the goods or obtain judgment for any proceeds the buyer received from a subsequent sale.

UCC Section 6-104 specifies the duties of the bulk sales buyer, including determining the identity of the seller, and preparation of a list of claimants and a schedule of distribution. These duties are imposed on the buyer in order to give claimants the opportunity to learn of the bulk sale before the seller has been paid and disappeared with the money.