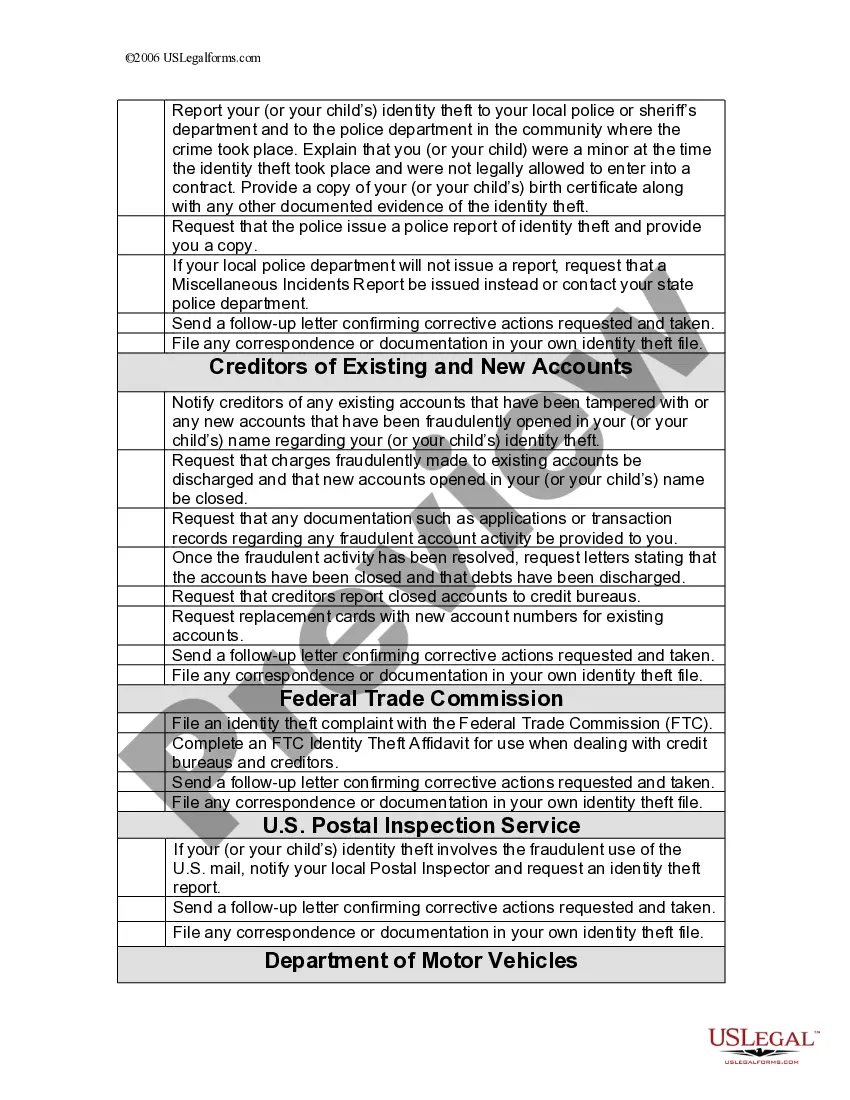

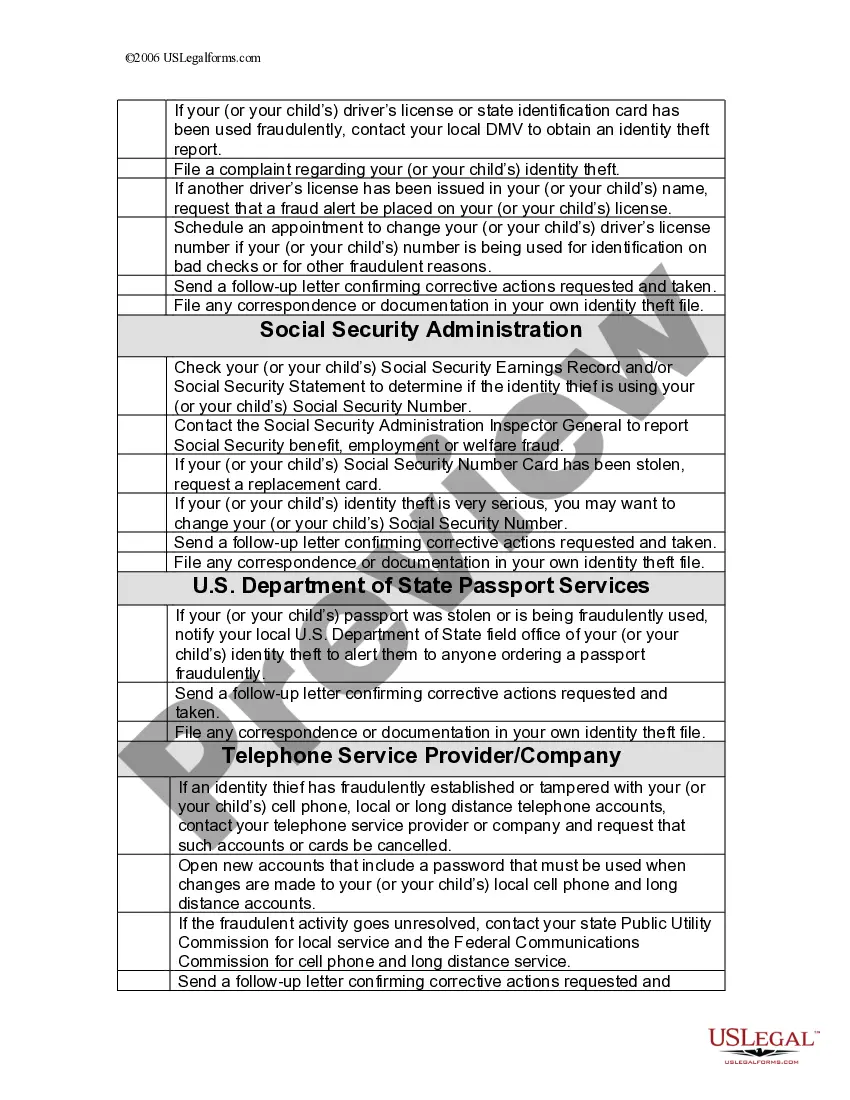

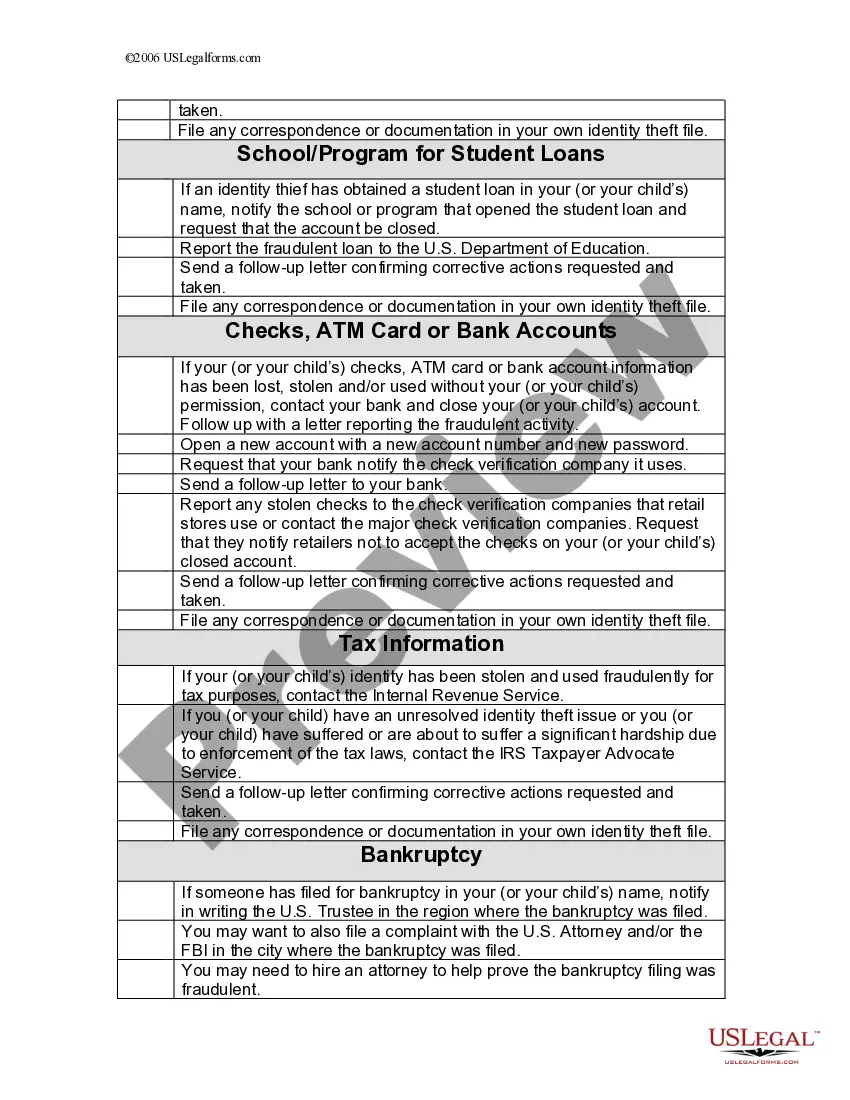

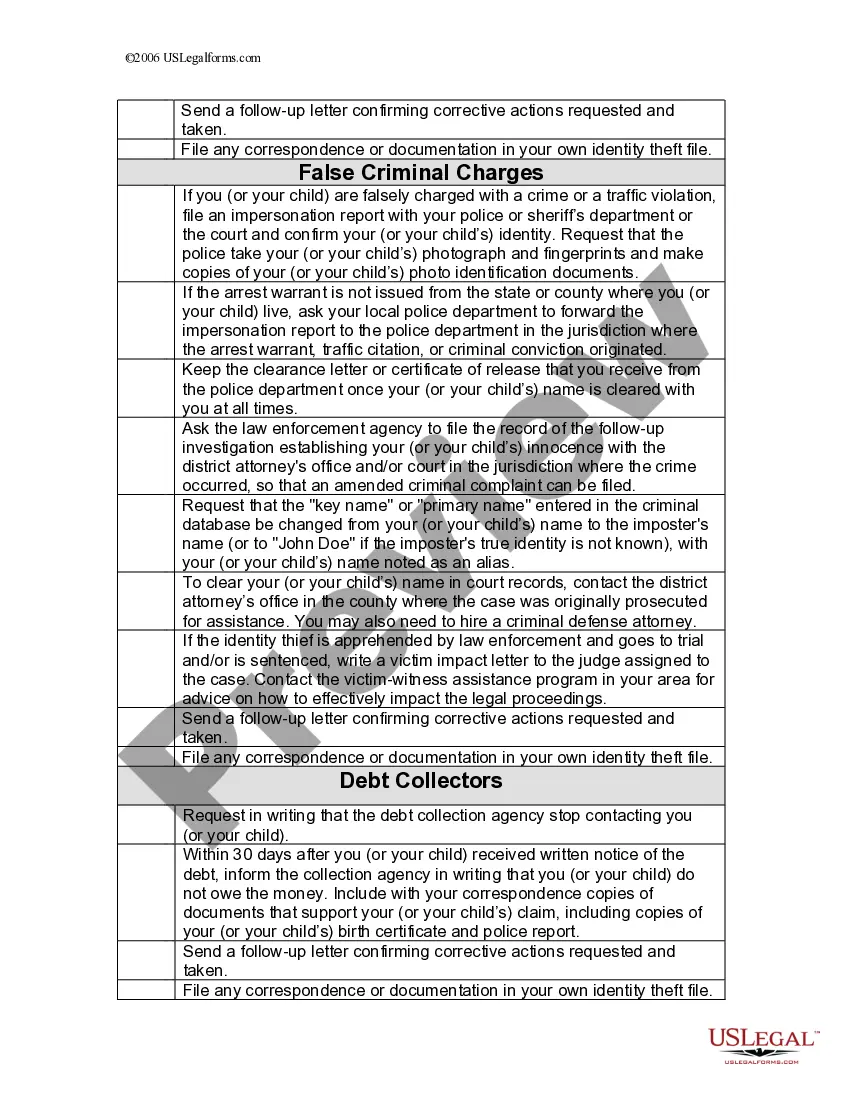

Guam Identity Theft Checklist for Minors

Description

How to fill out Identity Theft Checklist For Minors?

US Legal Forms - one of the largest collections of legal templates in the United States - provides a range of legal document formats that you can download or print.

By using the site, you can access thousands of forms for business and personal purposes, categorized by types, states, or keywords. You can find the latest versions of documents such as the Guam Identity Theft Checklist for Minors in just moments.

If you already have a subscription, Log In and download the Guam Identity Theft Checklist for Minors from the US Legal Forms library. The Download button will appear on every form you view. You can access all previously downloaded forms from the My documents section of your account.

Make adjustments. Fill out, modify, and print and sign the downloaded Guam Identity Theft Checklist for Minors.

Every document you upload to your account does not expire and is yours indefinitely. So, if you wish to download or print another copy, simply go to the My documents section and click on the form you want. Access the Guam Identity Theft Checklist for Minors with US Legal Forms, one of the most extensive libraries of legal document formats. Utilize thousands of professional and state-specific templates that meet your business or personal needs and requirements.

- If you are using US Legal Forms for the first time, here are some simple steps to get started.

- Ensure you have selected the correct form for your city/county. Click on the Review button to examine the document's details. Check the form summary to confirm you have chosen the right one.

- If the form does not meet your needs, use the Search field at the top of the page to find one that does.

- Once you are satisfied with the document, confirm your selection by clicking the Download now button. Then, choose your payment plan and provide your information to register for an account.

- Process the payment. Use your credit card or PayPal account to complete the transaction.

- Choose the format and download the document to your device.

Form popularity

FAQ

What does identity theft insurance not cover? It's important to note that these insurance policies typically don't cover stolen money or direct financial losses from fraudulent purchases and other unauthorized use of credit accounts. They typically reimburse you only for the costs of the reporting and recovery process.

Identity theft happens when someone takes your name and personal information (like your social security number) and uses it without your permission to do things like open new accounts, use your existing accounts, or obtain medical services.

The four types of identity theft include medical, criminal, financial and child identity theft. Medical identity theft occurs when individuals identify themselves as another to procure free medical care.

Identity theft happens when someone uses your personal or financial information without your permission. It can damage your credit status and cost you time and money.

Some clear indicators of identity theft include bills for items that you didn't buy; these can be seen on your credit card or received via email or other means, calls from debt collectors regarding accounts that you didn't open, and your loan applications being denied when you believed your credit is in good standing.