Guam Privacy and Confidentiality of Credit Card Purchases

Description

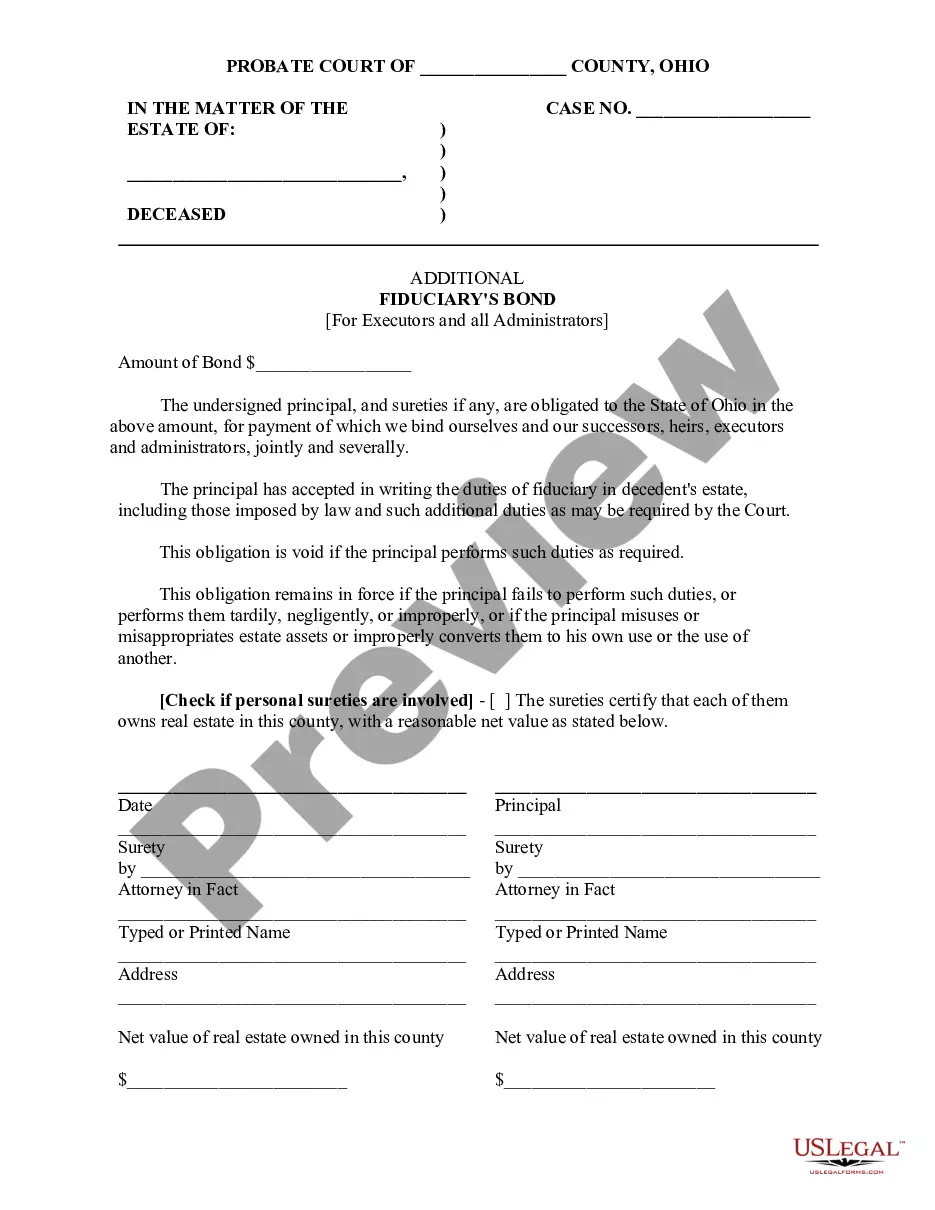

The following form seeks to give such assurance.

How to fill out Privacy And Confidentiality Of Credit Card Purchases?

You can spend numerous hours on the internet attempting to locate the authentic document format that satisfies the federal and state criteria required. US Legal Forms provides thousands of valid forms that have been assessed by professionals.

You can obtain or print the Guam Privacy and Confidentiality of Credit Card Purchases through this service.

If you possess a US Legal Forms account, you can Log In and click the Acquire button. Afterwards, you can complete, edit, print, or sign the Guam Privacy and Confidentiality of Credit Card Purchases. Every legitimate document format you obtain is yours indefinitely.

Select the format of your document and download it to your device. Make adjustments to your document if possible. You can complete, edit, sign, and print the Guam Privacy and Confidentiality of Credit Card Purchases. Access and print thousands of document templates using the US Legal Forms Website, which offers the largest range of valid forms. Utilize professional and state-specific templates to address your business or personal needs.

- To obtain an additional copy of a purchased form, navigate to the My documents section and click the appropriate button.

- If this is your first time using the US Legal Forms website, follow the simple instructions below.

- First, confirm that you have selected the correct document format for the county/city of your choice. Review the form description to ensure you have selected the right form.

- If available, use the Preview button to review the document format as well.

- If you wish to find another version of your form, use the Lookup field to locate the format that suits your needs and specifications.

- Once you have identified the format you want, click Buy now to continue.

- Select the pricing plan you desire, enter your details, and create an account on US Legal Forms.

- Complete the transaction. You can use your credit card or PayPal account to purchase the valid form.

Form popularity

FAQ

Absolutely, organizations can face legal consequences if they are found negligent in their data protection practices. This includes potential lawsuits and regulatory penalties, especially regarding the Guam Privacy and Confidentiality of Credit Card Purchases. Companies are encouraged to invest in comprehensive security measures to mitigate risks. By choosing solutions like US Legal Forms, businesses can ensure better compliance and protection.

Yes, organizations can face significant fines for failing to protect consumer information adequately. Under various state and federal laws, including those related to the Guam Privacy and Confidentiality of Credit Card Purchases, penalties can escalate based on the severity of the breach. Companies must prioritize compliance to avoid financial repercussions. Understanding these risks can empower you to take proactive measures.

Liability for a data breach typically falls on the organization that fails to protect sensitive information. In the case of Guam Privacy and Confidentiality of Credit Card Purchases, businesses must ensure robust security measures are in place to prevent breaches. If a breach occurs, affected individuals may hold the entity responsible for damages. It’s essential to know your rights and the organization’s responsibilities.

Guam is governed by its own set of local laws, and it follows a combination of federal law and its territorial statutes. Specifically, Guam provides for regulations regarding privacy and data security. As such, the principles underlying the Guam Privacy and Confidentiality of Credit Card Purchases are crucial for both consumers and businesses. Understanding these laws can help you navigate compliance effectively.

Not all 50 states enforce the same data breach laws. However, every state has some form of legislation addressing data breaches, which emphasizes the importance of safeguarding personal information. Understanding these laws can provide insights into the Guam Privacy and Confidentiality of Credit Card Purchases. Staying informed about local regulations can help you better protect your financial data.

The protection of personal privacy refers to the measures and regulations that safeguard personal data from unauthorized access or breaches. In the context of Guam Privacy and Confidentiality of Credit Card Purchases, this includes ensuring that financial institutions adhere to strict guidelines while handling your sensitive information. By staying informed about these protections, you can better understand your rights as a consumer.

Yes, Guam has enacted data breach laws that require organizations to notify consumers if their personal information is compromised. These laws aim to protect residents from the consequences of data breaches, including identity theft and financial fraud. By understanding the Guam Privacy and Confidentiality of Credit Card Purchases, you can take proactive steps to safeguard your information.

Protecting your personal banking and credit card information is essential to prevent unauthorized access and identity theft. Insecure transactions can lead to financial loss and damage to your credit score. The Guam Privacy and Confidentiality of Credit Card Purchases emphasizes the importance of safeguarding your information, which ultimately promotes trust in the financial system.

Under the Guam Privacy and Confidentiality of Credit Card Purchases, personal information that requires protection includes names, addresses, Social Security numbers, and credit card details. It is vital that this information is kept confidential to prevent identity theft and fraud. Both banks and credit card companies are responsible for ensuring that this sensitive data is adequately safeguarded.

Banks employ multiple layers of security to safeguard the personal information of their customers. These measures include secure servers, robust firewall systems, and routine audits of their data protection strategies. By adhering to the Guam Privacy and Confidentiality of Credit Card Purchases regulations, banks strive to maintain your trust while protecting your financial information.