In a charitable lead trust, the lifetime payments go to the charity and the remainder returns to the donor or to the donor's estate or other beneficiaries. A donor transfers property to the lead trust, which pays a percentage of the value of the trust assets, usually for a term of years, to the charity. Unlike a charitable remainder trust, a charitable lead annuity trust creates no income tax deduction to the donor, but the income earned in the trust is not attributed to donor. The trust itself is taxed according to trust rates. The trust receives an income tax deduction for the income paid to charity.

Guam Charitable Inter Vivos Lead Annuity Trust

Description

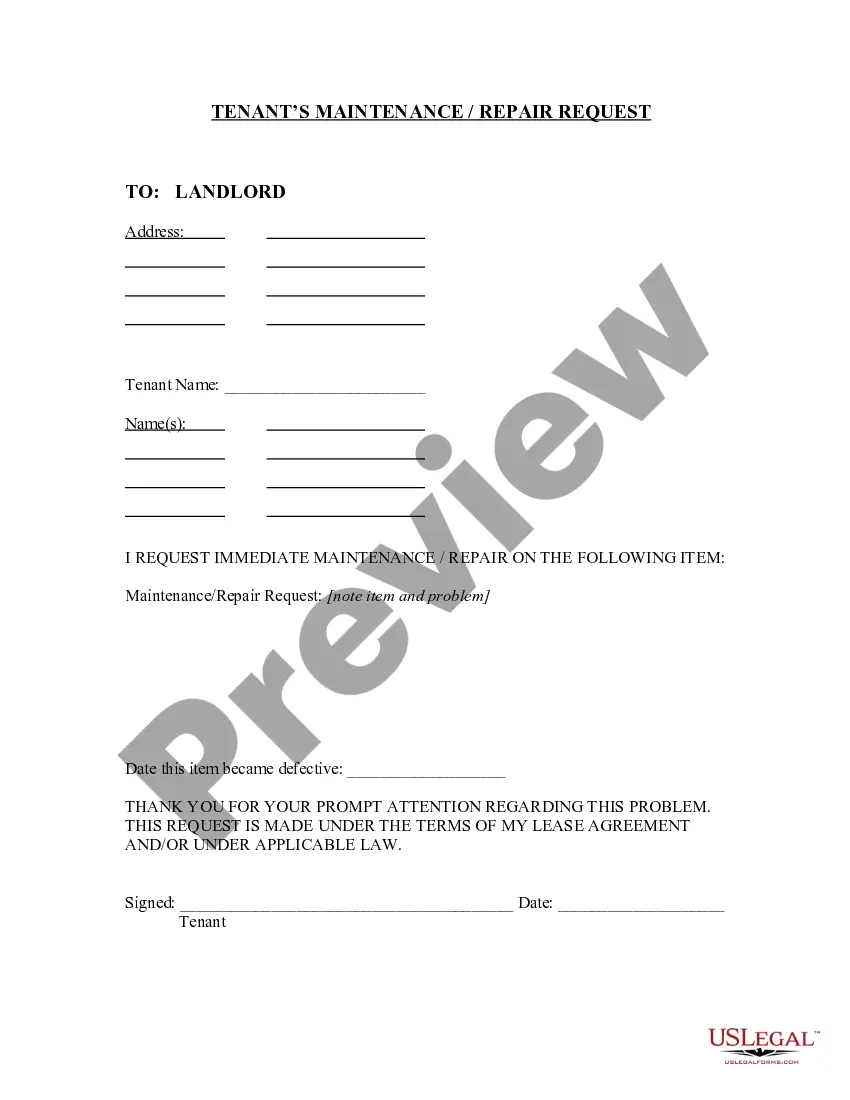

How to fill out Charitable Inter Vivos Lead Annuity Trust?

US Legal Forms - one of the most substantial collections of legal templates in the United States - offers a variety of legal document formats that you can download or print.

While utilizing the website, you can access thousands of forms for business and personal purposes, categorized by types, states, or keywords. You can find the latest versions of forms such as the Guam Charitable Inter Vivos Lead Annuity Trust in moments.

If you already have an account, Log In to obtain the Guam Charitable Inter Vivos Lead Annuity Trust from the US Legal Forms collection. The Download button will appear on every form you view. You have access to all previously saved forms in the My documents section of your account.

Make edits. Complete, modify, print, and sign the saved Guam Charitable Inter Vivos Lead Annuity Trust.

Every template you add to your account has no expiration date and belongs to you permanently. Therefore, if you wish to download or print another copy, simply go to the My documents section and click on the form you need. Access the Guam Charitable Inter Vivos Lead Annuity Trust with US Legal Forms, one of the most extensive collections of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal needs.

- If you are using US Legal Forms for the first time, here are simple instructions to get started.

- Make sure you have selected the appropriate form for your city/region. Click the Review button to examine the document’s content. Check the form description to confirm you have chosen the correct one.

- If the form does not meet your needs, take advantage of the Search box at the top of the page to find one that does.

- If you are satisfied with the form, confirm your selection by clicking the Buy now button. Then, choose your preferred pricing plan and provide your information to create an account.

- Process the transaction. Utilize a credit card or PayPal account to complete the purchase.

- Select the format and download the document to your device.

Form popularity

FAQ

A charitable lead refers to the income or payments provided to a charity from a trust or annuity over a designated period. This arrangement, exemplified by the Guam Charitable Inter Vivos Lead Annuity Trust, allows you to fulfill your philanthropic goals while also enjoying certain tax benefits. Understanding what a charitable lead entails can enhance your ability to make meaningful contributions to causes that matter to you.

A charitable remainder unitrust (CRUT) typically files Form 5227, which is the Split-Interest Trust Information Return. This form provides detailed information about the trust's income, expenses, and distributions, ensuring compliance with IRS regulations. If managing a Guam Charitable Inter Vivos Lead Annuity Trust, keeping accurate records is essential for both tax reporting and transparency.

A charitable lead annuity trust (CLAT) distributes fixed payments to a charity over a specified term. After that term, the remaining assets go to your beneficiaries. The Guam Charitable Inter Vivos Lead Annuity Trust combines the benefits of charitable planning with tax advantages, allowing you to support your chosen charity while also protecting your estate for your heirs.

A charitable remainder trust allows you to receive income during your lifetime, with the remainder going to charity upon your passing. In contrast, a charitable lead trust, such as the Guam Charitable Inter Vivos Lead Annuity Trust, pays income to a charity for a set period, after which the remaining assets are transferred back to you or your heirs. Recognizing these differences is crucial for effective estate planning.

A charitable gift annuity offers a guaranteed income for your lifetime in exchange for a gift to a charity, while a charitable remainder annuity trust provides income to you or your beneficiaries for a specified period, after which the remaining assets go to a charity. The Guam Charitable Inter Vivos Lead Annuity Trust focuses on making payments to a charity for a set time, which is a key distinction. Understanding these differences can help you choose the best option for your financial and philanthropic goals.

A trust is a legal arrangement where one party holds property for the benefit of another. An inter vivos trust, specifically the Guam Charitable Inter Vivos Lead Annuity Trust, is established during a person's lifetime, allowing them to manage their assets while alive. Unlike other trusts, it provides charitable benefits and generates annuity payments to the donor. This type of trust can offer significant tax advantages, making it an appealing option for many individuals.

The distinction between a charitable lead trust and a charitable remainder trust is straightforward yet significant. A charitable lead trust directs payments to a charity for an initial period, while a remainder trust offers payouts to you or your heirs first, with the charity receiving what remains afterward. Understanding these differences can help you select the best strategy for philanthropy and estate planning, like utilizing a Guam Charitable Inter Vivos Lead Annuity Trust.

Advised Fund (DAF) allows you to manage your charitable donations over time, whereas a Charitable Remainder Trust (CRT) provides income during your lifetime with the remainder going to charity. While both offer tax benefits, choosing between them depends on your desire for ongoing control or immediate benefits. A Guam Charitable Inter Vivos Lead Annuity Trust may also align with your charitable vision.

The primary difference between a Charitable Remainder Trust (CRT) and a Charitable Lead Trust (CLT) lies in the flow of payments. A CRT pays you or your beneficiaries during your lifetime, while a CLT pays a charity first, with any leftover assets going to your heirs. Depending on your goals, a Guam Charitable Inter Vivos Lead Annuity Trust might fit your needs as part of this strategy.

While a Guam Charitable Inter Vivos Lead Annuity Trust can offer tax benefits, it also has disadvantages. For instance, once assets are placed in the trust, you generally cannot reclaim them. Additionally, if the trust doesn't perform well, the final distribution to your heirs may be lower than expected. It's essential to weigh these risks against the potential benefits.