Guam Affidavit by an Attorney-in-Fact in the Capacity of an Executor of an Estate

Description

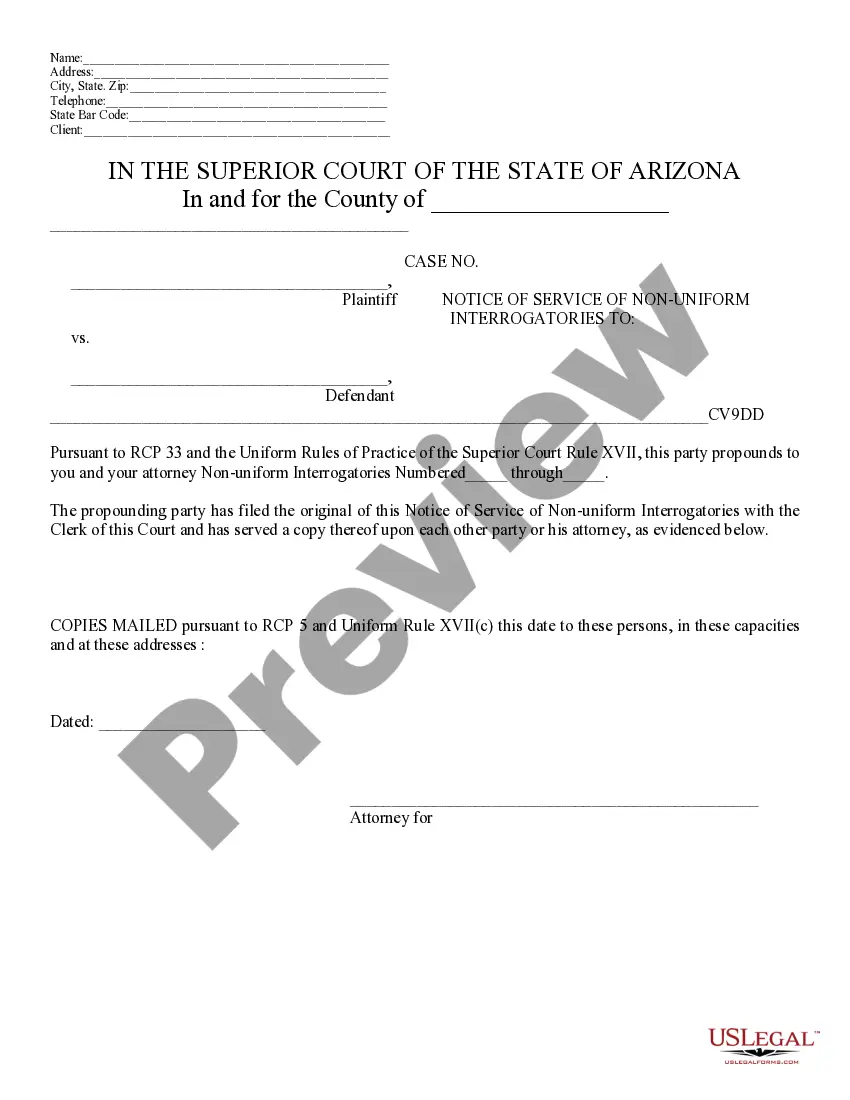

How to fill out Affidavit By An Attorney-in-Fact In The Capacity Of An Executor Of An Estate?

Selecting the optimal valid document template can be quite challenging. Obviously, there are numerous templates accessible online, but how can you find the valid type you need? Make use of the US Legal Forms website. The service provides a vast selection of templates, including the Guam Affidavit by an Attorney-in-Fact in the Role of an Executor of an Estate, which can serve both professional and personal purposes. Each of the forms is reviewed by experts and complies with state and federal regulations.

If you are already a member, Log In to your account and click the Download button to retrieve the Guam Affidavit by an Attorney-in-Fact in the Role of an Executor of an Estate. Use your account to browse through the legal forms you have previously acquired. Go to the My documents section of your account to obtain another copy of the document you need.

If you are a first-time user of US Legal Forms, here are straightforward instructions that you should follow: First, ensure you have selected the right form for your city/county. You can examine the form using the Review option and view the form summary to confirm it is suitable for your needs. If the form does not meet your requirements, utilize the Search feature to find the correct form. Once you are confident that the form is appropriate, click the Purchase now button to obtain the form. Choose the pricing plan you prefer and enter the necessary details. Create your account and place an order using your PayPal account or credit card. Select the file format and download the legal document template to your device. Complete, modify, print, and sign the acquired Guam Affidavit by an Attorney-in-Fact in the Role of an Executor of an Estate.

- US Legal Forms is the largest database of legal forms where you can find a variety of document templates.

- Utilize the service to obtain professionally crafted documents that comply with state regulations.

- You can easily navigate through the extensive collection of templates available.

- Ensure your selected form fits your specific needs before making a purchase.

- Follow the account creation and payment instructions for a smooth transaction.

- Access your previous forms anytime through your account dashboard.

Form popularity

FAQ

Generally it takes 6 to 8 weeks for grant of proabte in Ontario. At busy court location such as Toronto probate application process can take upto 5 months. In some cases, it took several months for a probate grant due to errors or motions and objections filed by parties. Therefore, it is not a concert timeline.

A grant of probate proves the validity of an individual's will and grants authority to the executor, while a Grant of Administration is necessary when no Will can be found and an executor must be appointed.

If you were named executor in the deceased's will, you can go to the Ontario Superior Court of Justice with the following documents: The original will; A death certificate; Court application forms. These include: Application (Form 74A) Affidavit of Service (Form 74B)

How to obtain a Certificate of Appointment without a Will in Ontario. In Ontario, the application is made to the Superior Court of Justice. The applicant must file the application in the office of the county or district where the deceased was living when they died.

A party wishing to contest the issuance of a grant of probate or administration may file a Notice to Dispute under Rule 25 (10) of the Supreme Court Rules. While a notice to dispute is in effect, the registrar must not issue an estate grant.

When a person dies without a will, the provincial government gets to decide who gets the money in your bank account. Provincial governments will often prioritize immediate family members or blood relatives of the deceased person, which can leave common-law partners with nothing.

Finally, an executor has the power to distribute what remains of the estate to the beneficiaries. However, the executor cannot independently decide how the estate is distributed. They must follow the instructions in the will or the succession laws of the relevant jurisdiction.

When a person dies without a will someone, usually a close relative must apply to the court to be appointed as the estate trustee without a will. If there is a dispute as to who should be appointed the matter must be referred to a judge to determine the most appropriate person to act as estate trustee.