Guam Exchange Addendum to Contract - Tax Free Exchange Section 1031

Description

How to fill out Exchange Addendum To Contract - Tax Free Exchange Section 1031?

You can dedicate several hours online searching for the legal form template that fulfills the local and national criteria you desire.

US Legal Forms offers an extensive variety of legal documents that can be reviewed by experts.

You can obtain or create the Guam Exchange Addendum to Contract - Tax Free Exchange Section 1031 through our service.

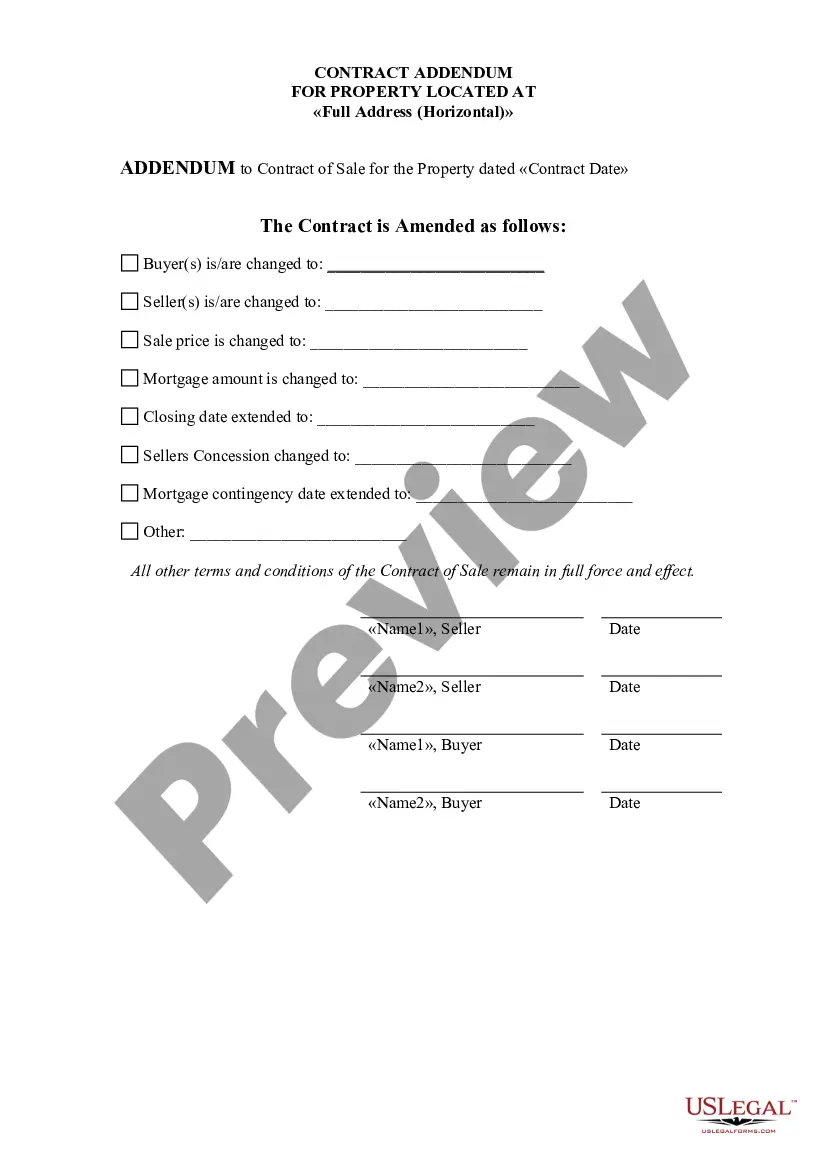

Review the form details to confirm that you have selected the proper template. If available, use the Preview button to view the document template as well.

- If you already possess a US Legal Forms account, you may Log In and click on the Download button.

- Subsequently, you can fill out, modify, create, or sign the Guam Exchange Addendum to Contract - Tax Free Exchange Section 1031.

- Each legal document template you purchase is yours indefinitely.

- To obtain another copy of any purchased form, navigate to the My documents section and click on the appropriate button.

- If you are visiting the US Legal Forms website for the first time, follow these simple instructions below.

- First, ensure that you have chosen the correct document template for the county/city of your choice.

Form popularity

FAQ

A 1031 addendum will normally clearly show intent to do a 1031 exchange, permit assignment, and advise the other party there will be no expense or liability as a result of the exchange. Sometimes there is cooperation language asserting that both parties to the contract will cooperate with a 1031 exchange.

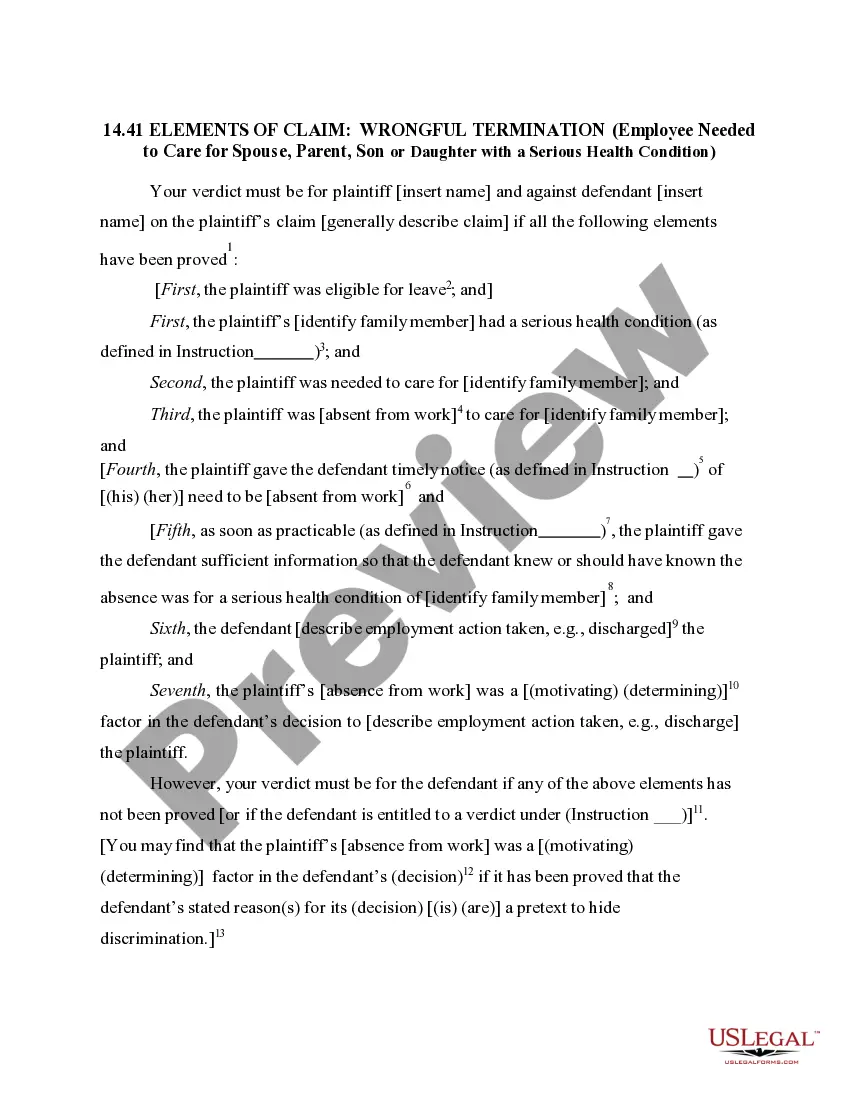

A 1031 exchange allows you to sell one investment or business property and buy another without incurring capital gains taxes as long as the exchange is completed according to IRS rules and the new property is of the same nature or character (like kind).

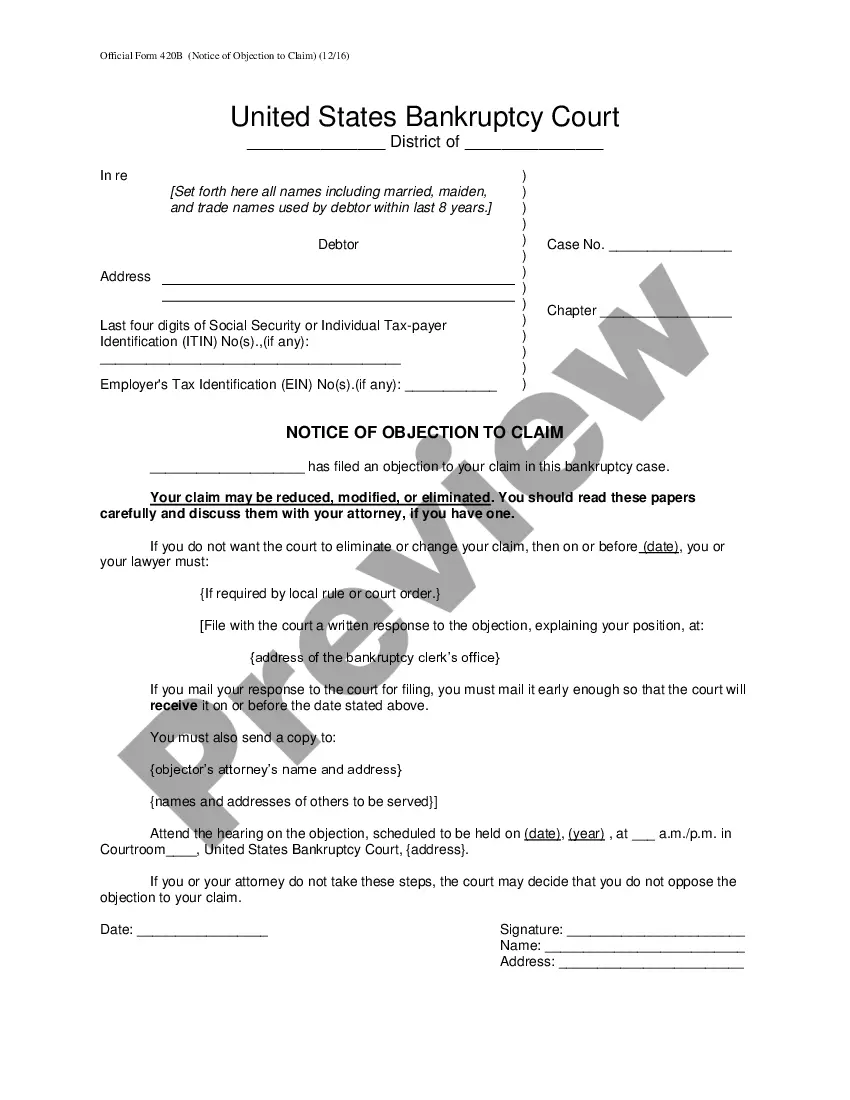

How to Avoid Boot in a 1031 ExchangeTrade up in real estate value with one or more replacement properties.Reinvest all of your 1031 exchange proceeds from the relinquished property into the replacement property.Maintain or increase the amount of debt on the replacement property.More items...?

In real estate, a 1031 exchange is a swap of one investment property for another that allows capital gains taxes to be deferred.

Although many taxpayers include language in their purchase and sale agreements establishing their intent to perform an exchange, it is not required by the Internal Revenue Code in a Section 1031 exchange. It is important, however, that the purchase and sale agreements for both properties be assignable.

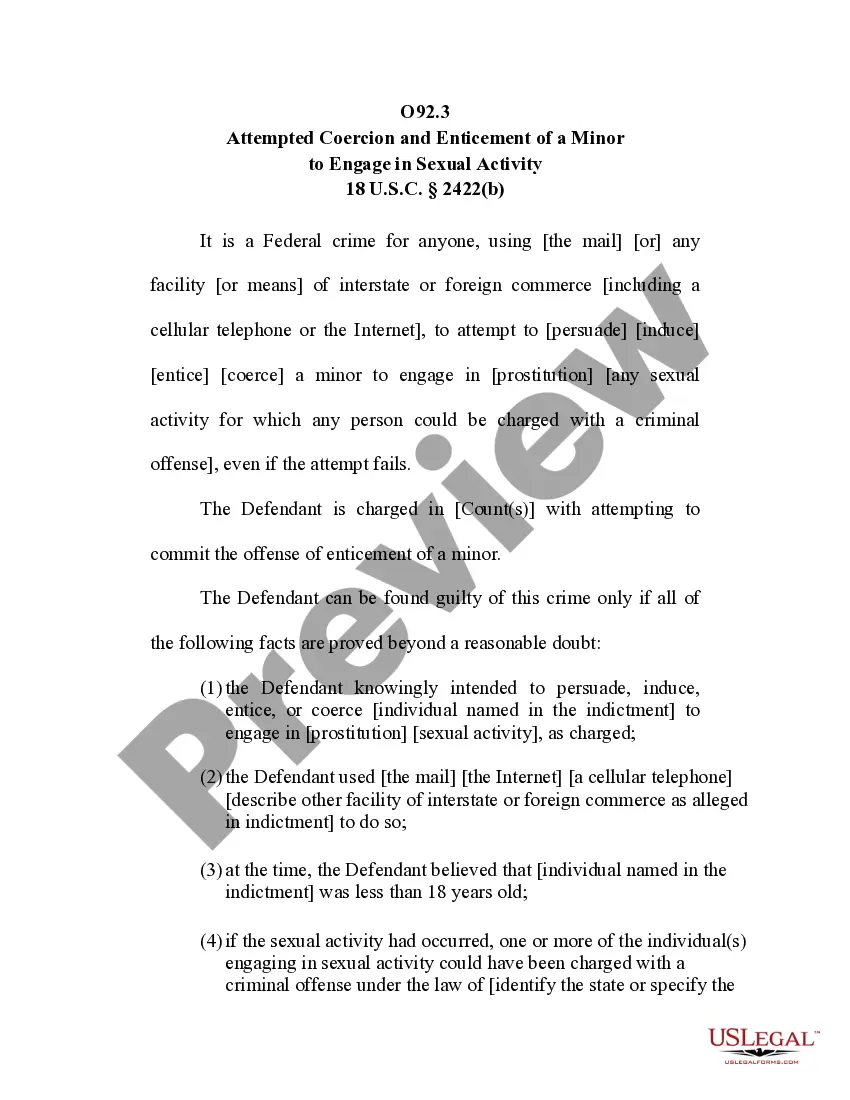

For instance, when an installment sale includes seller financing for which the seller wishes to complete a 1031 exchange but will be receiving some or all of the buyer's installment payments beyond the 180 day window for concluding the exchange.

For a Section 1031 exchange, it is imperative that the purchase and sale contracts for both parties be assignable.

Notes and the 1031 ExchangeThough a contract sale can be incorporated in an exchange, it may not be possible to accomplish this goal all the time. In order for a note to be used in an exchange, you, the Exchangor, must not have actual or constructive receipt of the note.

Another reason someone would not want to do a 1031 exchange is if they have a loss, since there will be no capital gains to pay taxes on. Or if someone is in the 10% or 12% ordinary income tax bracket, they would not need to do a 1031 exchange because, in that case, they will be taxed at 0% on capital gains.

Gain deferred in a like-kind exchange under IRC Section 1031 is tax-deferred, but it is not tax-free. The exchange can include like-kind property exclusively or it can include like-kind property along with cash, liabilities and property that are not like-kind.