Guam Accounts Receivable - Contract to Sale

Description

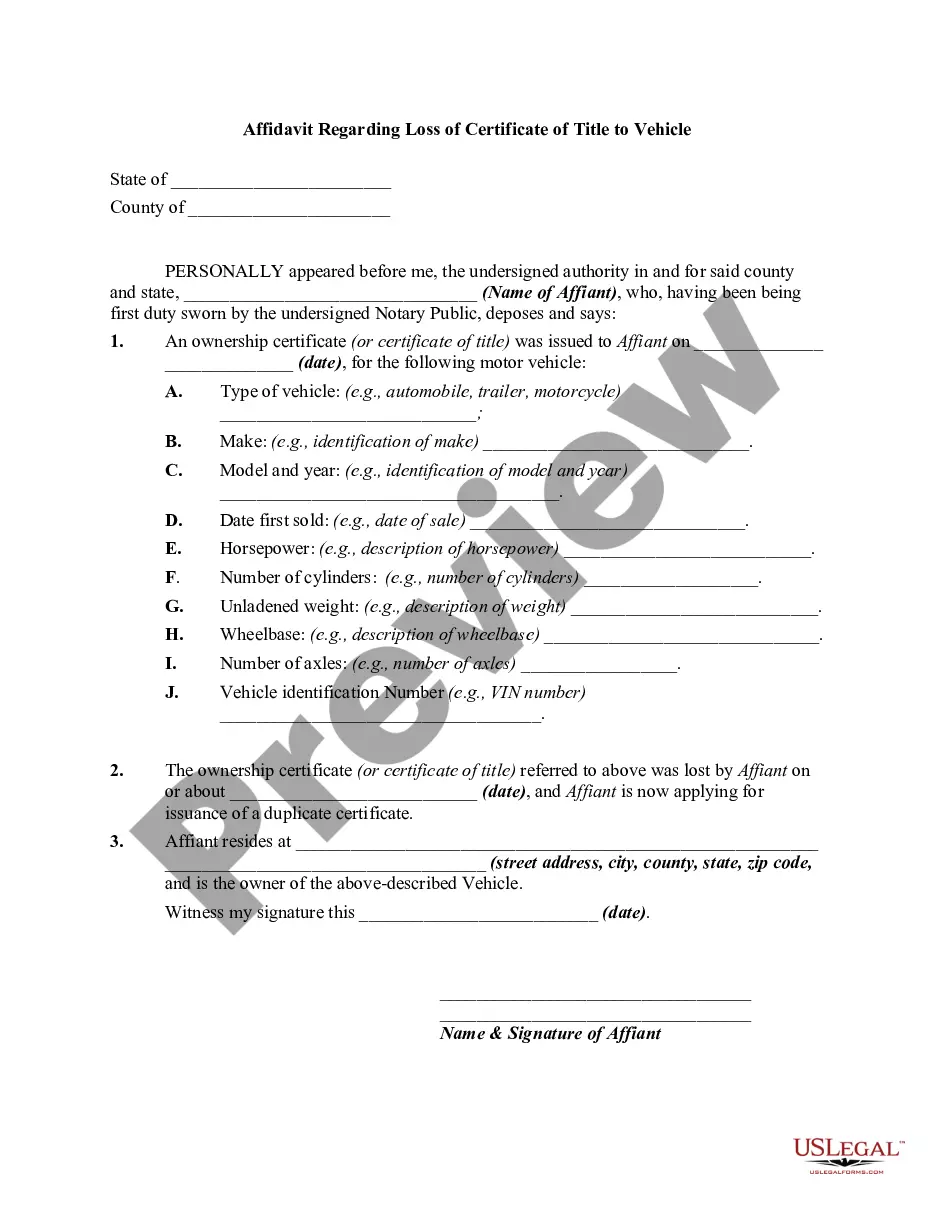

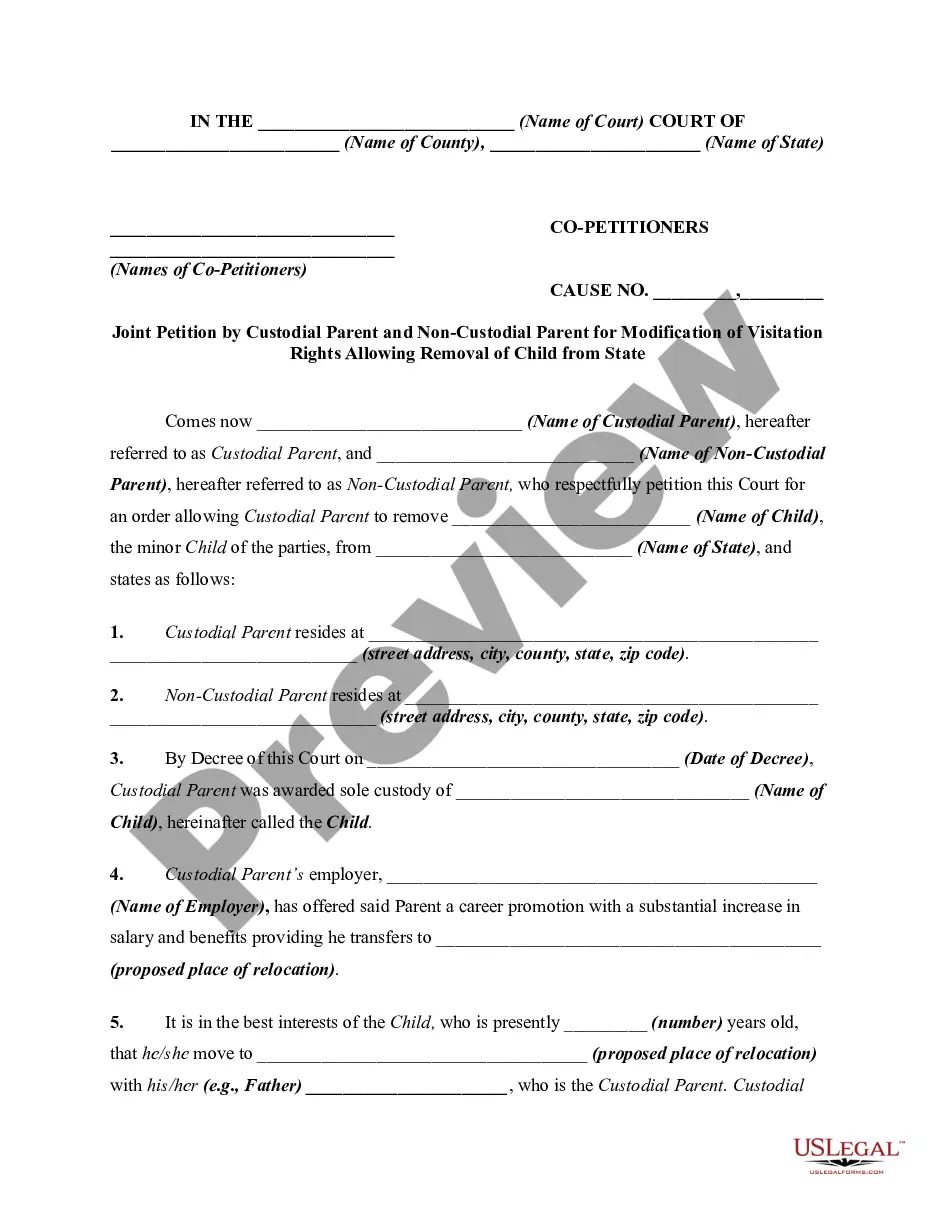

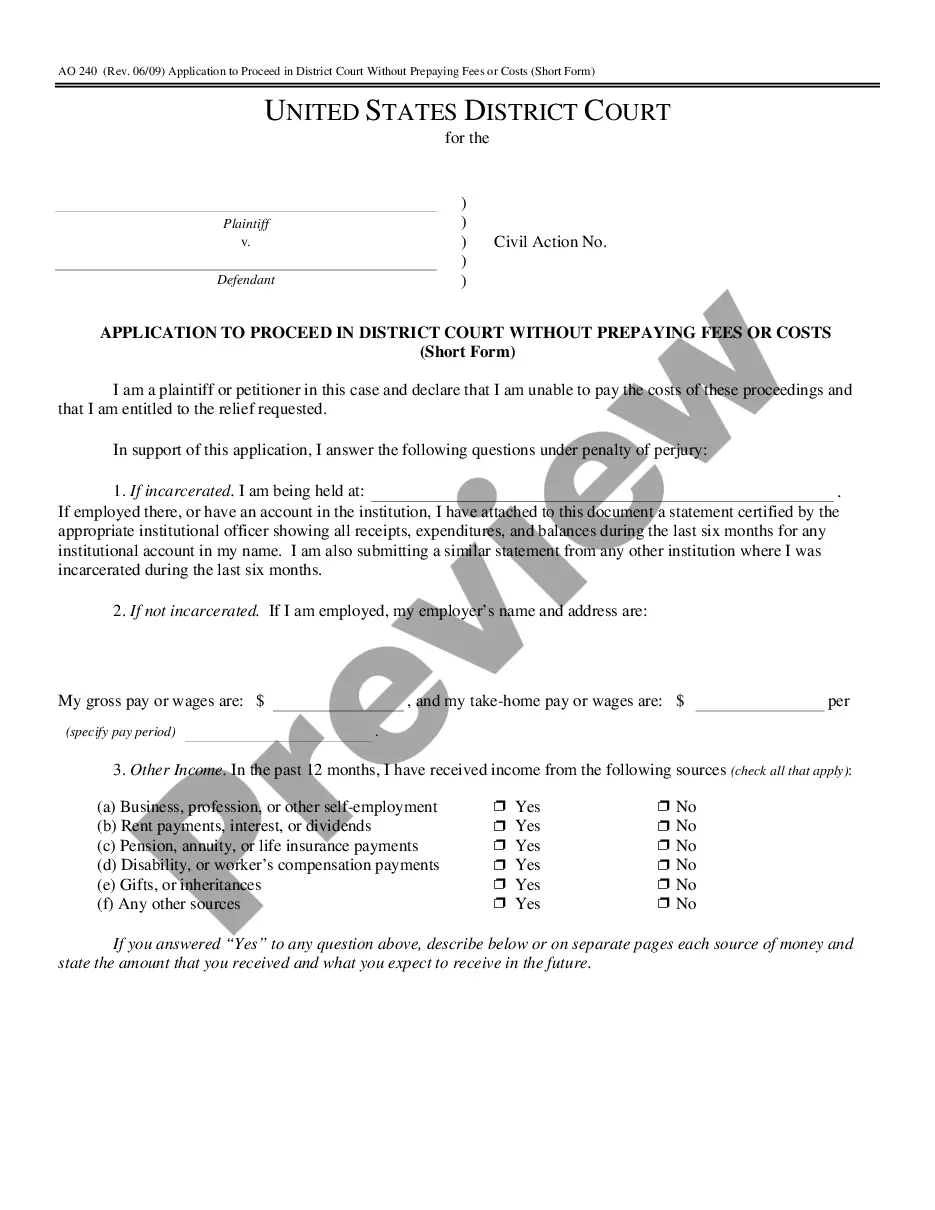

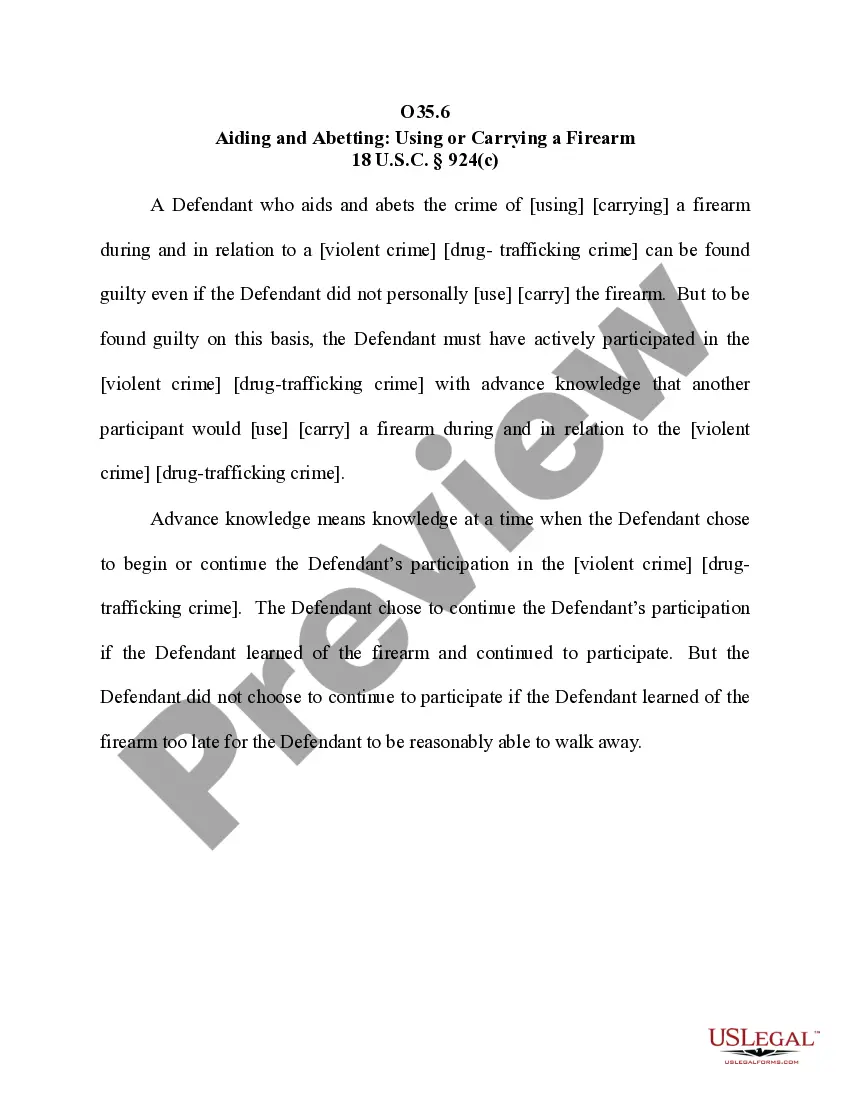

How to fill out Accounts Receivable - Contract To Sale?

US Legal Forms - one of the largest collections of legal documents in the USA - offers a variety of legal form templates that you can download or print. By using the website, you can find thousands of forms for both business and personal purposes, categorized by types, states, or keywords.

You can access the most recent versions of forms such as the Guam Accounts Receivable - Contract to Sale in moments. If you already have a monthly subscription, Log In and retrieve the Guam Accounts Receivable - Contract to Sale from the US Legal Forms library. The Download button will appear on every form you view. You have access to all previously acquired forms in the My documents section of your account.

To use US Legal Forms for the first time, here are simple instructions to help you get started: Ensure you have selected the correct form for your city/county. Click the Review button to check the form's content. Read the form description to ensure you have chosen the right form. If the form does not meet your requirements, utilize the Search box at the top of the screen to find one that does. If you are satisfied with the form, confirm your selection by clicking the Get now button. Then, choose the pricing plan you prefer and provide your details to register for the account.

Utilize thousands of professional and state-specific templates that meet your business or personal needs and requirements.

- Process the payment. Use your credit card or PayPal account to complete the transaction.

- Select the format and download the form to your device.

- Make modifications. Fill out, edit, print, and sign the downloaded Guam Accounts Receivable - Contract to Sale.

- Every template you add to your account has no expiration date and is yours permanently.

- So, if you wish to download or print another copy, just visit the My documents section and click on the form you need.

- Access the Guam Accounts Receivable - Contract to Sale with US Legal Forms, the most extensive collection of legal document templates.

Form popularity

FAQ

In Guam, the statute of limitations for collecting consumer debt is generally six years. This means that creditors have six years from the date of default to initiate legal action to recover the debt. Understanding this timeline is crucial when engaging in Guam Accounts Receivable - Contract to Sale agreements. If you're unsure about your rights or need assistance, consider using USLegalForms to access the necessary legal documentation and guidance for your specific situation.

To sell accounts receivable, a business typically enters into a contract with a buyer, such as a factoring company. This process involves submitting the outstanding invoices and agreeing on a discount rate. For businesses in Guam, utilizing the Guam Accounts Receivable - Contract to Sale helps streamline this transaction, providing clarity and security. Additionally, platforms like uslegalforms can assist you in drafting the necessary contracts to ensure a smooth sale.

The Dave Santos exemption allows certain taxpayers in Guam to exclude specific amounts from their taxable income. This exemption can significantly reduce your tax liability if you qualify. Understanding this exemption is particularly helpful when navigating Guam Accounts Receivable - Contract to Sale, as it may impact how you report your income.

Certain accounts, such as 401(k)s, IRAs, and health savings accounts, generally avoid Capital Gains Tax until withdrawal. This can be advantageous for long-term financial planning. In the context of Guam Accounts Receivable - Contract to Sale, knowing which accounts qualify can provide insights into your overall tax strategy.

Transactions that result in a profit from the sale of investments or assets, such as stocks, real estate, and certain business assets, are subject to Capital Gains Tax. It’s vital to understand which transactions apply to your situation. If you are handling Guam Accounts Receivable - Contract to Sale, recognizing these transactions can aid in effective financial management.

The sale of accounts receivable is typically taxed as ordinary income. This means that any gain you realize from the sale will be subject to income tax rates. Therefore, when dealing with Guam Accounts Receivable - Contract to Sale, it’s important to account for potential tax implications to avoid surprises.

Certain assets, such as primary residences up to a specific limit and retirement accounts, may not be subject to Capital Gains Tax. Understanding which assets fall under this category helps in effective tax planning. If you’re dealing with Guam Accounts Receivable - Contract to Sale, recognizing these exemptions can significantly impact your financial strategy.

Failing to file Guam taxes can lead to penalties, interest on unpaid taxes, and potential legal actions. The Guam government takes tax compliance seriously, and non-filing can affect your business's reputation. To avoid these issues, consider using services like US Legal Forms to ensure accurate filing related to Guam Accounts Receivable - Contract to Sale.

Accounts receivable are generally taxed as ordinary income when they are collected. However, the specifics can vary based on the structure of your business and local regulations. It's crucial to consult with a tax professional to navigate the complexities of Guam Accounts Receivable - Contract to Sale to ensure compliance.

Yes, accounts receivable can be subject to built-in gains tax under certain conditions. If you sell your business or its assets, any unrealized gains on accounts receivable may be taxed. Understanding how this applies in the context of Guam Accounts Receivable - Contract to Sale is essential for proper tax planning.