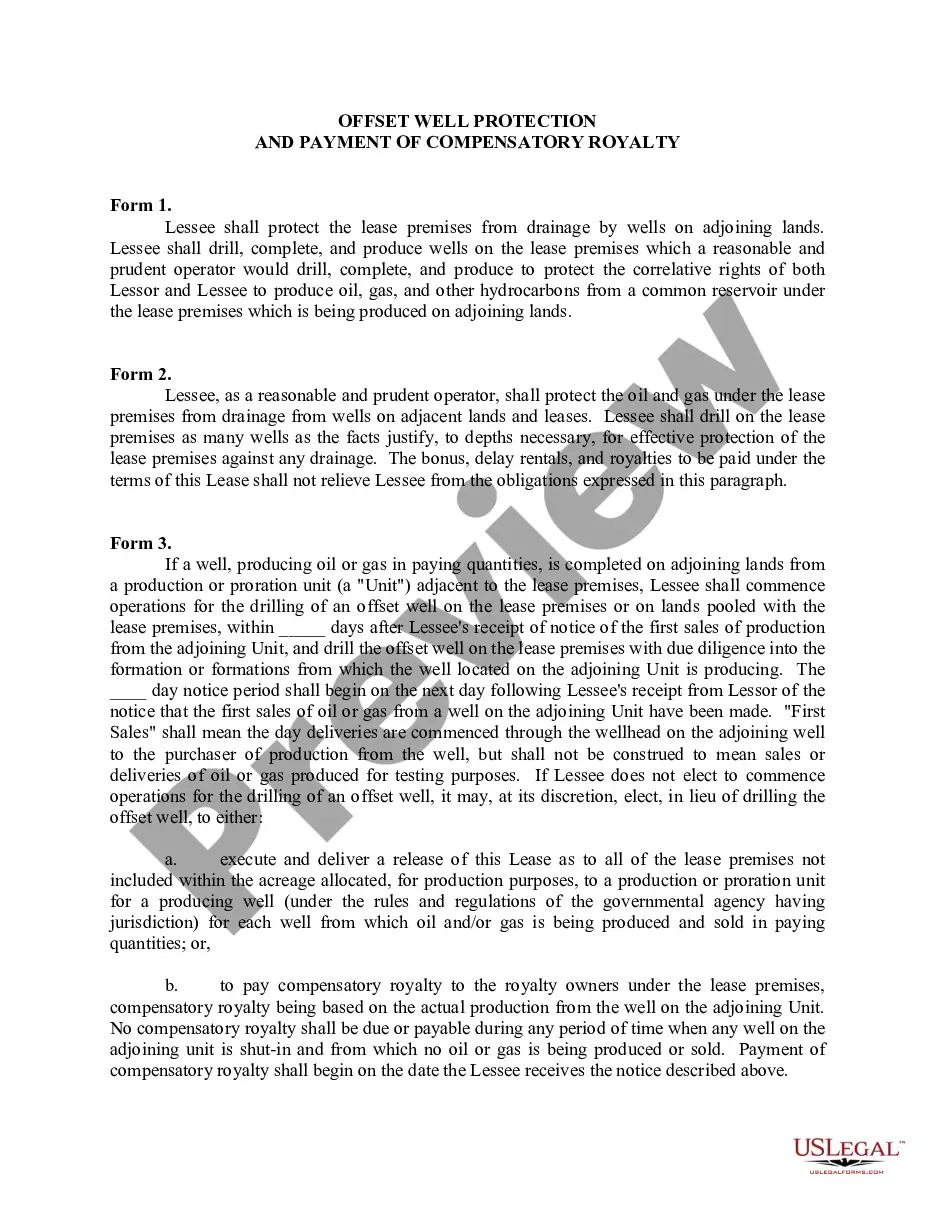

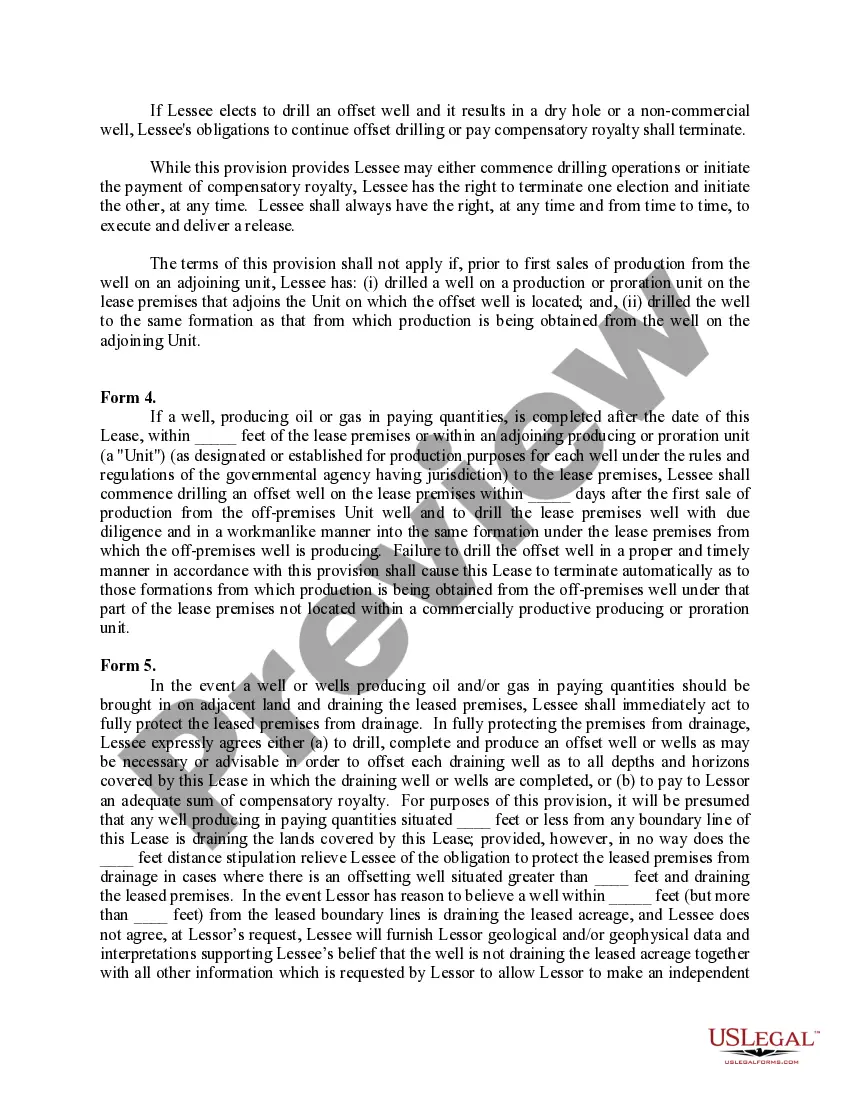

This lease rider form may be used when you are involved in a lease transaction, and have made the decision to utilize the form of Oil and Gas Lease presented to you by the Lessee, and you want to include additional provisions to that Lease form to address specific concerns you may have, or place limitations on the rights granted the Lessee in the “standard” lease form.

Georgia Offset Well Protection and Payment of Compensatory Royalty

Description

How to fill out Offset Well Protection And Payment Of Compensatory Royalty?

If you need to full, download, or print legitimate document web templates, use US Legal Forms, the greatest selection of legitimate types, which can be found on-line. Make use of the site`s easy and hassle-free research to obtain the files you will need. A variety of web templates for company and individual uses are sorted by categories and says, or key phrases. Use US Legal Forms to obtain the Georgia Offset Well Protection and Payment of Compensatory Royalty in just a couple of clicks.

In case you are previously a US Legal Forms client, log in in your accounts and click on the Download switch to get the Georgia Offset Well Protection and Payment of Compensatory Royalty. You may also access types you in the past downloaded from the My Forms tab of your own accounts.

If you are using US Legal Forms initially, refer to the instructions under:

- Step 1. Make sure you have chosen the form to the proper metropolis/land.

- Step 2. Use the Review solution to look over the form`s content material. Don`t overlook to see the outline.

- Step 3. In case you are unsatisfied with all the form, make use of the Look for area at the top of the monitor to discover other versions from the legitimate form template.

- Step 4. Once you have located the form you will need, click the Acquire now switch. Choose the pricing program you favor and include your references to sign up for an accounts.

- Step 5. Procedure the purchase. You may use your Мisa or Ьastercard or PayPal accounts to finish the purchase.

- Step 6. Find the file format from the legitimate form and download it on your gadget.

- Step 7. Total, modify and print or indicator the Georgia Offset Well Protection and Payment of Compensatory Royalty.

Each legitimate document template you purchase is your own property forever. You might have acces to each and every form you downloaded with your acccount. Click the My Forms portion and pick a form to print or download yet again.

Be competitive and download, and print the Georgia Offset Well Protection and Payment of Compensatory Royalty with US Legal Forms. There are millions of expert and state-certain types you can utilize for the company or individual needs.

Form popularity

FAQ

Royalty interest in the oil and gas industry refers to ownership of a portion of a resource or the revenue it produces. A company or person that owns a royalty interest does not bear any operational costs needed to produce the resource, yet they still own a portion of the resource or revenue it produces.

Compensatory royalty A royalty paid in lieu of drilling a well that would otherwise be required under the covenants of a lease, express or implied. compensatory royalty agreement An agreement developed for unleased Federal or Indian land being drained by a well located on adjacent land.

What is the difference between working interest and royalty interest? Working interests are oil and gas investments that give owners the right to exploit the resources on a property. Royalty interests are the rights belonging to the landowner who leased out the property to the working interest owner.

Royalties are an important source of income for landowners who have mineral rights. They can provide a steady stream of income over many years, as oil and gas production can last for decades.

An overriding royalty interest (ORRI) is an interest carved out of a working interest. It is: A percentage of gross production that is not charged with any expenses of exploring, developing, producing, and operating a well.