Georgia Stipulation of Ownership of Mineral Interest of Mineral Ownership in Specific Lands

Description

How to fill out Stipulation Of Ownership Of Mineral Interest Of Mineral Ownership In Specific Lands?

Choosing the right authorized papers web template might be a battle. Obviously, there are tons of web templates available online, but how do you get the authorized develop you need? Use the US Legal Forms site. The service provides a huge number of web templates, like the Georgia Stipulation of Ownership of Mineral Interest of Mineral Ownership in Specific Lands, which you can use for enterprise and private needs. Each of the types are checked out by specialists and satisfy state and federal requirements.

Should you be previously signed up, log in to the bank account and click the Acquire button to have the Georgia Stipulation of Ownership of Mineral Interest of Mineral Ownership in Specific Lands. Make use of bank account to check with the authorized types you might have purchased in the past. Go to the My Forms tab of your bank account and obtain another copy of the papers you need.

Should you be a new customer of US Legal Forms, listed below are straightforward directions so that you can adhere to:

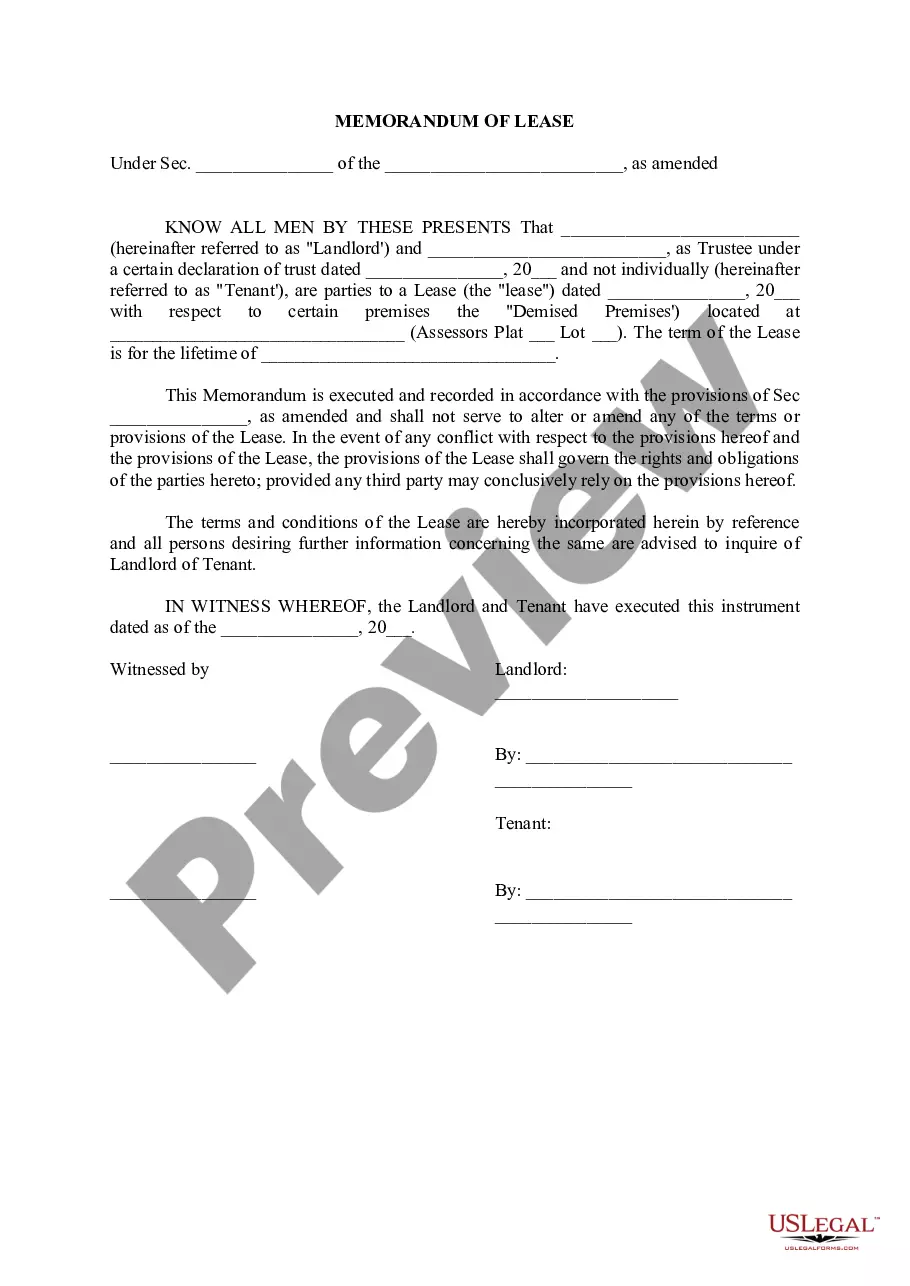

- Very first, make certain you have chosen the appropriate develop for your personal town/area. You are able to check out the shape using the Review button and read the shape outline to make sure it will be the best for you.

- When the develop does not satisfy your expectations, use the Seach area to obtain the appropriate develop.

- Once you are positive that the shape would work, click on the Acquire now button to have the develop.

- Opt for the rates plan you desire and type in the needed info. Design your bank account and buy the order making use of your PayPal bank account or Visa or Mastercard.

- Pick the data file format and obtain the authorized papers web template to the product.

- Full, revise and print and sign the received Georgia Stipulation of Ownership of Mineral Interest of Mineral Ownership in Specific Lands.

US Legal Forms is definitely the most significant local library of authorized types for which you can discover numerous papers web templates. Use the company to obtain appropriately-created papers that adhere to state requirements.

Form popularity

FAQ

In the United States, landowners possess both surface and mineral rights unless they choose to sell the mineral rights to someone else. Once mineral rights have been sold, the original owner retains only the rights to the land surface, while the second party may exploit the underground resources in any way they choose.

The ownership of rights to minerals, including oil and gas, contained in a tract of land. A mineral right is a real property interest and can be conveyed independently of the surface estate.

Mineral ownership, or mineral rights, are understood to be the property rights to exploit an area for the minerals, gas, or oil it harbors. The four types of mineral ownership are: Mineral Interest ? interest generated after the production of oil and gas after the sale of a deed or a lease.

(a) Whenever mineral rights are conveyed or whenever real property is conveyed in fee simple but the mineral rights to such property are reserved by the grantor, the owner of the real property in fee simple or his heirs or assigns may gain title to such mineral rights by adverse possession if the owner of the mineral ...

Mineral rights are ownership rights that allow the owner the right to exploit minerals from underneath a property. The rights refer to solid and liquid minerals, such as gold and oil. Mineral rights can be separate from surface rights and are not always possessed by the property owner.

Mineral rights are ownership rights that allow the owner the right to exploit minerals from underneath a property. The rights refer to solid and liquid minerals, such as gold and oil. Mineral rights can be separate from surface rights and are not always possessed by the property owner.

Mining assets include mineral rights which are considered tangible assets under ASC 930-805.

However, since mineral rights are a severed portion of the land rights themselves (they're separated from the land's "surface rights" and sold separately by deed, just like the land itself), they are usually considered real property.