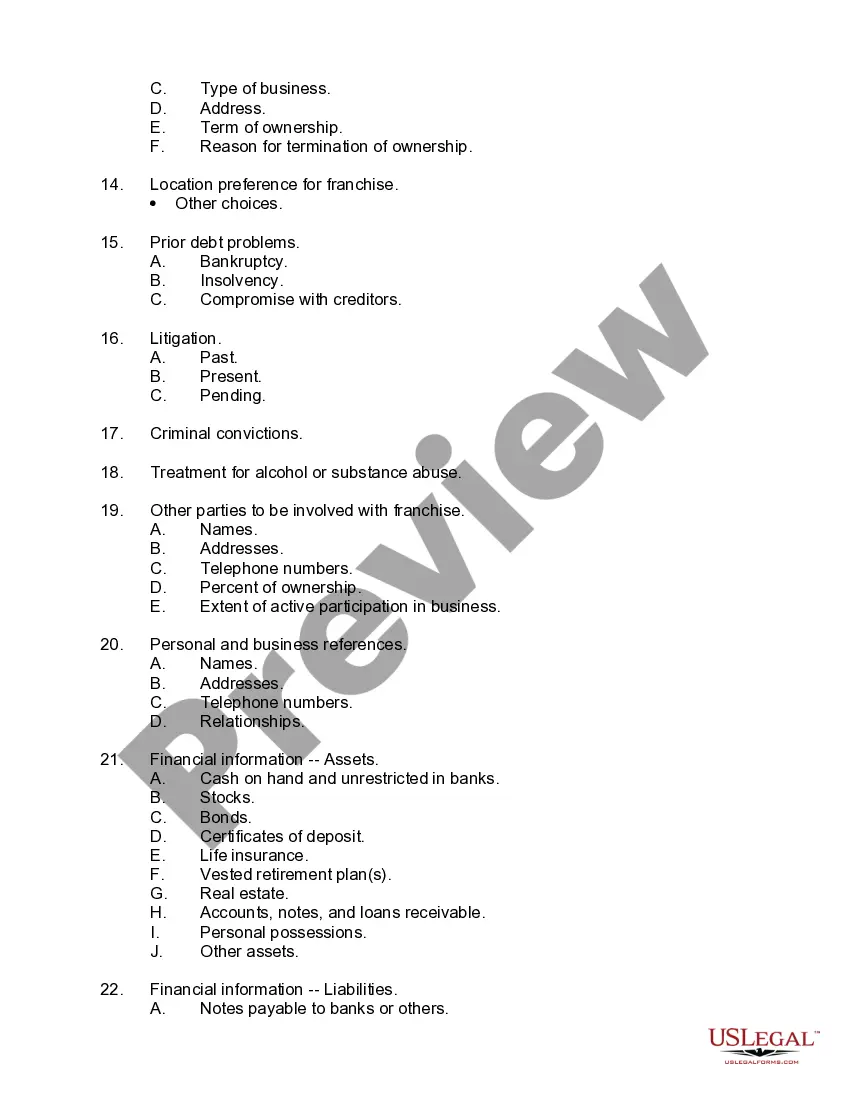

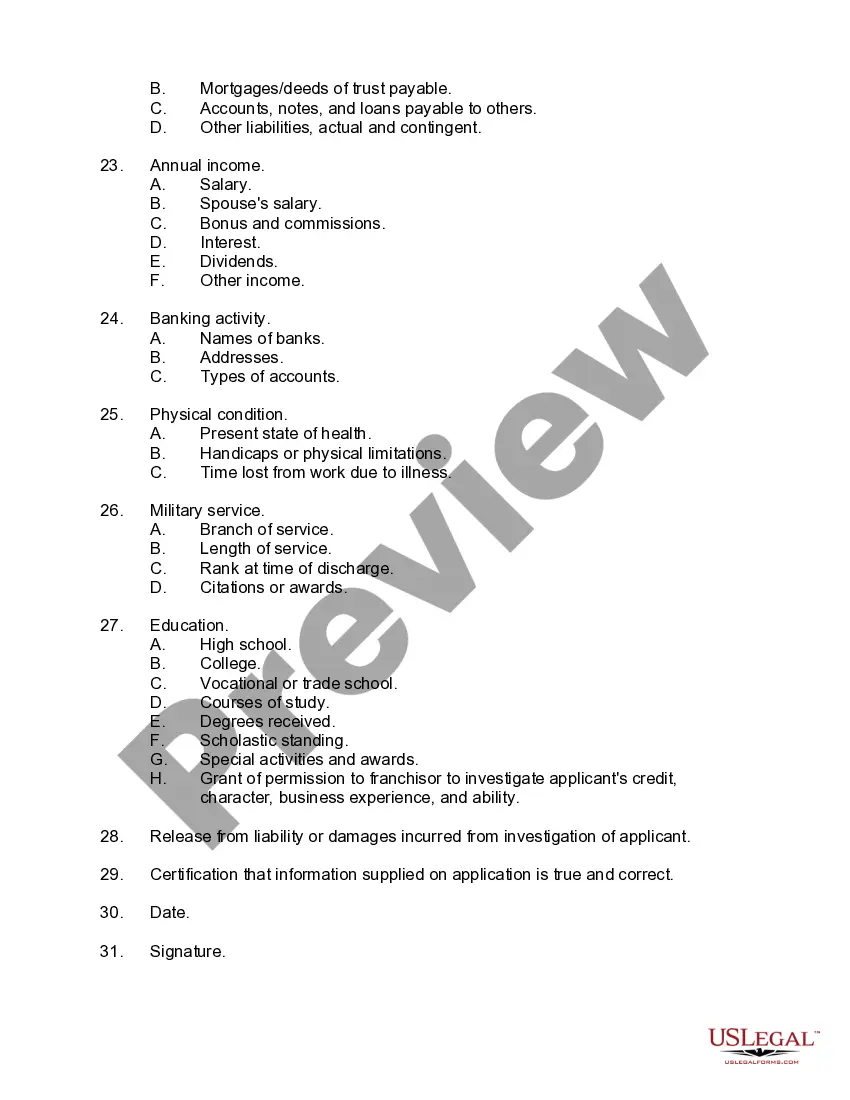

Missouri Checklist for Drafting a Franchise Application

Description

How to fill out Checklist For Drafting A Franchise Application?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a range of legal form templates you can download or print.

Using the website, you can access thousands of forms for business and personal use, categorized by types, states, or keywords.

You can quickly find the latest versions of forms like the Missouri Checklist for Drafting a Franchise Application in just minutes.

Review the form description to confirm that you have chosen the right one.

If the form does not suit your needs, utilize the Search box at the top of the screen to find one that does.

- If you already have an account, sign in and obtain the Missouri Checklist for Drafting a Franchise Application from your US Legal Forms library.

- The Download button will appear on every form you view.

- You can access all previously acquired forms in the My documents tab of your account.

- If you are using US Legal Forms for the first time, here are simple steps to help you get started.

- Ensure you have selected the correct form for your city/state.

- Click the Preview option to review the form's content.

Form popularity

FAQ

To determine if a place operates as a franchise, look for the presence of a trademarked name and consistent branding across multiple locations. Additionally, franchises often have a formal franchise agreement that outlines the relationship between the franchisor and franchisee. Using the Missouri Checklist for Drafting a Franchise Application can help clarify franchise definitions and legalities applicable to your specific case.

Franchise registration states require businesses to file their franchise applications before offering franchises. In the United States, key franchise registration states include California, New York, and Illinois. Understanding this is essential when using the Missouri Checklist for Drafting a Franchise Application to ensure compliance across different jurisdictions.

In Missouri, individuals can earn a certain amount without being required to file taxes, which can vary by filing status. It is important to stay informed about these limits, as they can change annually. For accurate and updated information, refer to a Missouri Checklist for Drafting a Franchise Application to help you monitor any changes and maintain compliance.

Whether you are required to file a Missouri state tax return depends on your income and filing status. If your income exceeds Missouri's established filing thresholds, then yes, you are required to file. Rely on a Missouri Checklist for Drafting a Franchise Application to determine your specific obligations and ensure smooth navigation through the process.

Yes, LLCs in Missouri are required to file annual reports to maintain good standing with the Secretary of State. These reports typically include updated information about the business and its members. To simplify this process, consider consulting a Missouri Checklist for Drafting a Franchise Application, which outlines all necessary components and deadlines for compliance.

Filing requirements in Missouri vary based on filing status, income, and types of income earned. Generally, if you earn over a certain amount, you must file a state tax return. A Missouri Checklist for Drafting a Franchise Application can guide you through all applicable filing requirements, ensuring you adhere to state regulations effectively.

MO form 2643 is the Missouri Individual Income Tax Extension form. This document allows taxpayers to request an extension for filing their state income tax returns, ensuring they have additional time to prepare. When dealing with tax matters, especially related to franchises, having a Missouri Checklist for Drafting a Franchise Application can keep you organized and informed about crucial deadlines.

Seniors in Missouri may be required to file taxes based on their income level. If your income surpasses the state's established limits, you do need to file a return. For seniors looking for guidance, utilizing a Missouri Checklist for Drafting a Franchise Application can streamline the process and clarify any specific needs or exemptions.

In Missouri, the minimum requirements for filing taxes generally depend on your income level and filing status. For example, if your income exceeds a specific threshold, you must file a tax return. To ensure compliance, consult a Missouri Checklist for Drafting a Franchise Application, which can help clarify your obligations and guide you through the process.

Yes, Missouri imposes a franchise tax on certain businesses operating within the state. This tax is calculated based on the company’s net worth and certain other criteria. To navigate the specifics, refer to a Missouri Checklist for Drafting a Franchise Application, which lays out all necessary details. Understanding this tax can significantly influence the financial planning for your franchise.