Georgia Self-Employed Ceiling Installation Contract

Description

How to fill out Self-Employed Ceiling Installation Contract?

Selecting the appropriate legal document template can be a challenge. Certainly, there are numerous templates available online, but how do you find the legal form you require? Utilize the US Legal Forms website. The service offers thousands of templates, including the Georgia Self-Employed Ceiling Installation Contract, which can be used for both business and personal purposes. All forms are vetted by professionals and comply with federal and state regulations.

If you are already registered, Log In to your account and click the Download button to obtain the Georgia Self-Employed Ceiling Installation Contract. Use your account to browse the legal forms you have previously purchased. Navigate to the My documents section of your account and retrieve an additional copy of the documents you need.

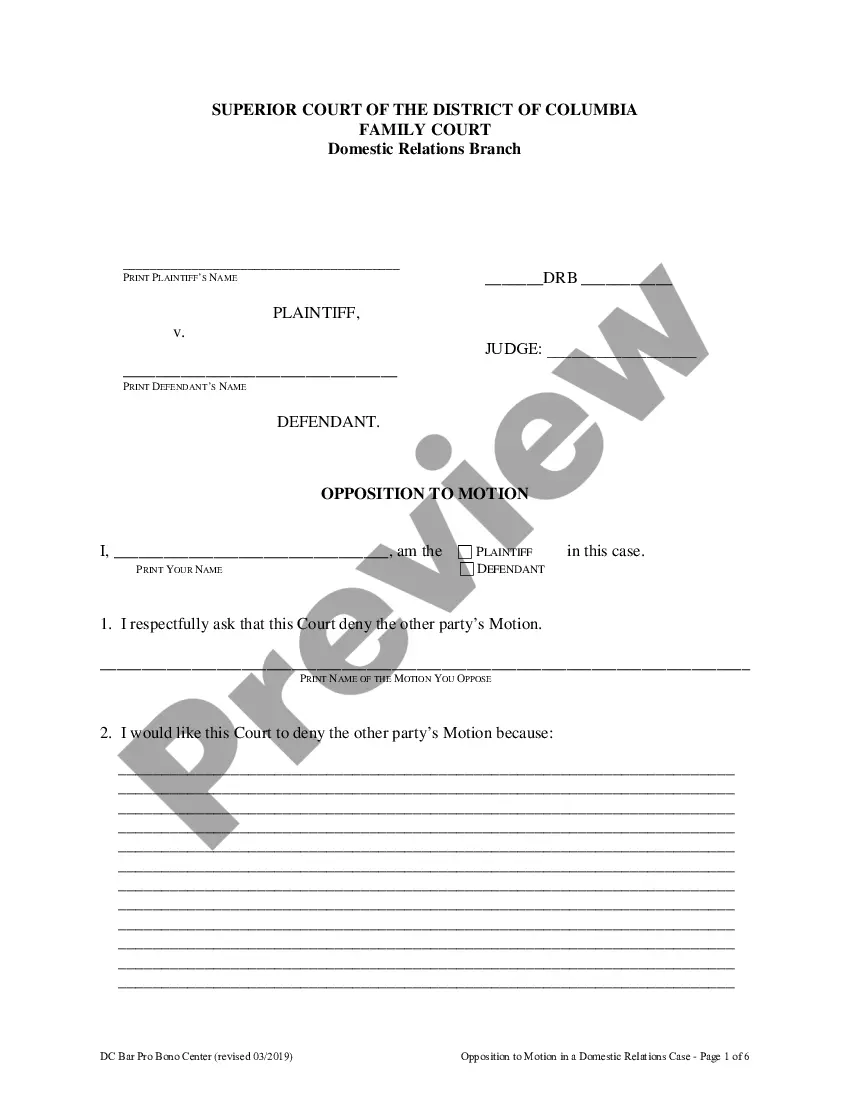

If you are a new user of US Legal Forms, here are simple steps you can follow: First, ensure you have selected the correct form for your city/region. You can review the form using the Preview button and read the form description to confirm it is indeed the right one for you. If the form does not meet your requirements, use the Search box to find the correct form. Once you are confident the form is accurate, click the Buy now button to acquire the form. Choose the pricing plan you desire and enter the necessary information. Create your account and pay for the order using your PayPal account or credit card. Select the format and download the legal document template to your device. Complete, modify, print, and sign the received Georgia Self-Employed Ceiling Installation Contract.

By using US Legal Forms, you can simplify the process of finding and obtaining the legal documents necessary for your needs.

- US Legal Forms is the largest repository of legal documents where you can find various paper templates.

- Leverage the service to download professionally crafted documents that adhere to state regulations.

- Access a wide range of templates for different legal needs.

- Ensure compliance with both federal and state guidelines.

- Easily manage your downloaded forms through your account.

- Get expert assistance and support when needed.

Form popularity

FAQ

Acting as your own general contractor means you take on the role of managing your construction project from start to finish. This involves overseeing subcontractors, purchasing materials, and ensuring the work meets all regulations and standards. While it offers you greater control and potential savings, it also requires significant time and effort to coordinate everything effectively, especially with a Georgia Self-Employed Ceiling Installation Contract.

In Georgia, you can perform certain contracting tasks without a license, but this varies by the type of work. For example, small jobs may not require a license, but larger projects, like a Georgia Self-Employed Ceiling Installation Contract, typically do. It is essential to determine the scope of your work and local regulations to ensure you are operating legally.

In Georgia, whether an independent contractor needs a business license can depend on the specific county or city regulations. Many areas require you to obtain a business license, especially if you are working on projects like a Georgia Self-Employed Ceiling Installation Contract. It's advisable to check with your local government to ensure compliance with all necessary licensing requirements.

Yes, you can be your own general contractor in Georgia, provided you follow the state's regulations. You will need to familiarize yourself with local building codes and permit requirements. By taking this route, you can manage your own projects, like a Georgia Self-Employed Ceiling Installation Contract, while enjoying greater control over the process.

To write an independent contractor agreement, start by identifying the parties and describing the services to be provided. Include payment terms, project timelines, and any confidentiality clauses. It’s important to clarify the independent nature of the relationship. For a Georgia Self-Employed Ceiling Installation Contract, consider accessing templates from USLegalForms to ensure all legal requirements are met.

Writing a self-employment contract involves stating the nature of the work, terms of payment, and the duration of the agreement. Clearly define what is expected from both parties and include any relevant legal protections. For a more organized approach, utilizing a Georgia Self-Employed Ceiling Installation Contract template from USLegalForms can help ensure that you cover all necessary aspects.

When writing a contract for a 1099 employee, outline the relationship clearly, emphasizing that they are an independent contractor and not an employee. Include details about payment terms, work responsibilities, and deadlines. It’s also wise to add clauses regarding liability and confidentiality. Using a Georgia Self-Employed Ceiling Installation Contract template from USLegalForms can streamline this process.

To write a self-employed contract, start by clearly stating the agreement between the parties involved. Specify the scope of work, payment details, and deadlines. Additionally, include terms regarding ownership of work and confidentiality. For a Georgia Self-Employed Ceiling Installation Contract, consider using resources from USLegalForms to get a comprehensive template that meets legal standards.

Yes, you can write your own legally binding contract as long as it meets certain requirements, such as mutual consent, clear terms, and legal purpose. Ensure that both parties review the contract thoroughly before signing. For creating a Georgia Self-Employed Ceiling Installation Contract, using a template from USLegalForms can help ensure that you include all necessary elements for legal validity.

In Georgia, you can perform up to $2,500 worth of work without needing a contractor license. This includes various small projects, but it’s essential to know that larger jobs require proper licensing to ensure compliance and protection. If you're working on a Georgia Self-Employed Ceiling Installation Contract, be mindful of these regulations to avoid legal issues.