Georgia Instructions for Completing IRS Form 4506-EZ

Description

How to fill out Instructions For Completing IRS Form 4506-EZ?

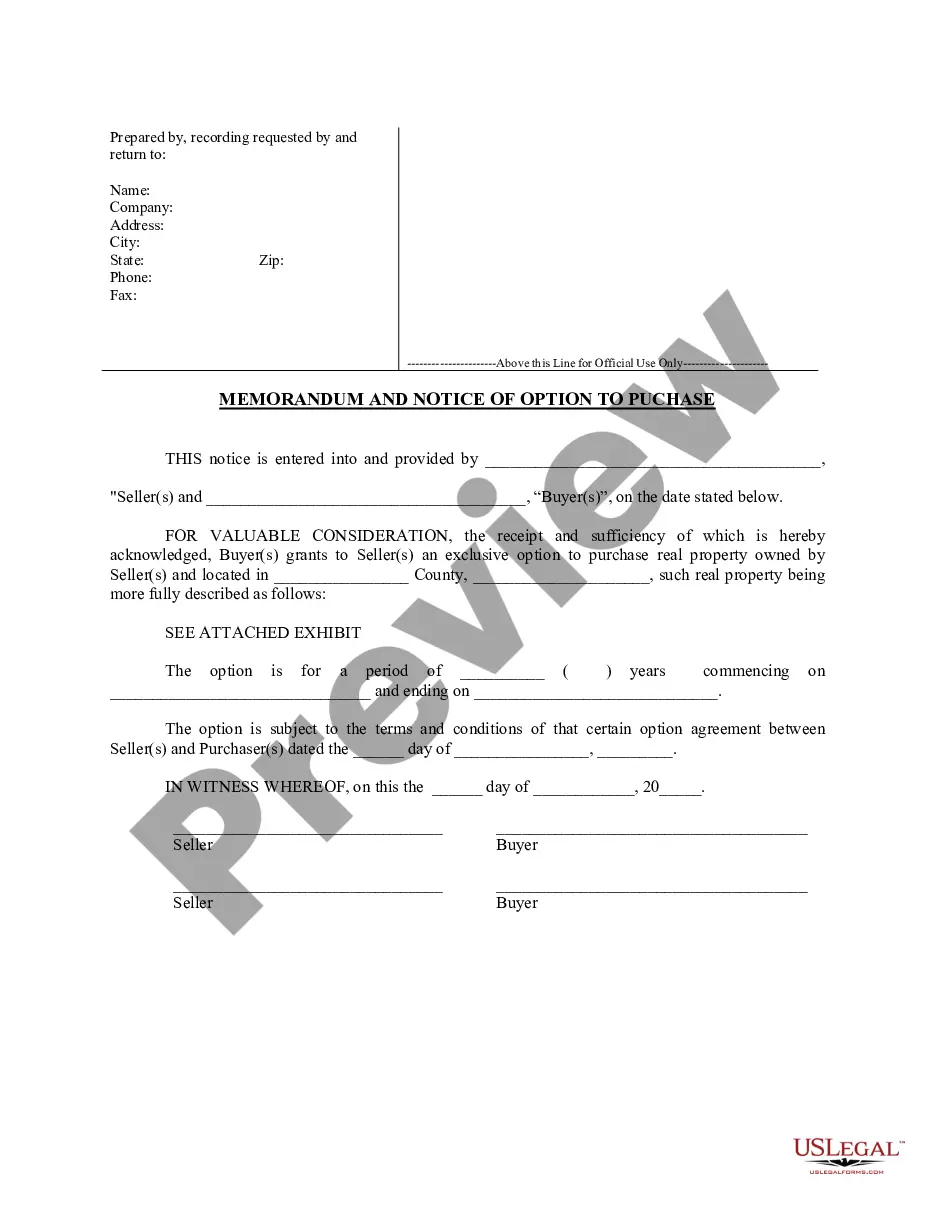

You may spend time on the web searching for the lawful document format that fits the federal and state specifications you will need. US Legal Forms supplies thousands of lawful varieties which are examined by specialists. You can easily down load or print out the Georgia Instructions for Completing IRS Form 4506-EZ from our services.

If you already have a US Legal Forms accounts, you can log in and then click the Down load option. After that, you can complete, change, print out, or indication the Georgia Instructions for Completing IRS Form 4506-EZ. Every single lawful document format you acquire is the one you have eternally. To get another copy of the bought develop, check out the My Forms tab and then click the corresponding option.

If you use the US Legal Forms internet site initially, keep to the simple guidelines listed below:

- First, be sure that you have chosen the correct document format for that state/area of your liking. See the develop outline to make sure you have picked out the appropriate develop. If readily available, use the Review option to search through the document format too.

- If you want to discover another edition of your develop, use the Search discipline to discover the format that fits your needs and specifications.

- After you have discovered the format you want, click Get now to proceed.

- Pick the prices plan you want, key in your credentials, and register for a merchant account on US Legal Forms.

- Total the financial transaction. You should use your Visa or Mastercard or PayPal accounts to pay for the lawful develop.

- Pick the file format of your document and down load it to the gadget.

- Make modifications to the document if needed. You may complete, change and indication and print out Georgia Instructions for Completing IRS Form 4506-EZ.

Down load and print out thousands of document web templates while using US Legal Forms website, which provides the greatest variety of lawful varieties. Use professional and express-particular web templates to tackle your company or person demands.

Form popularity

FAQ

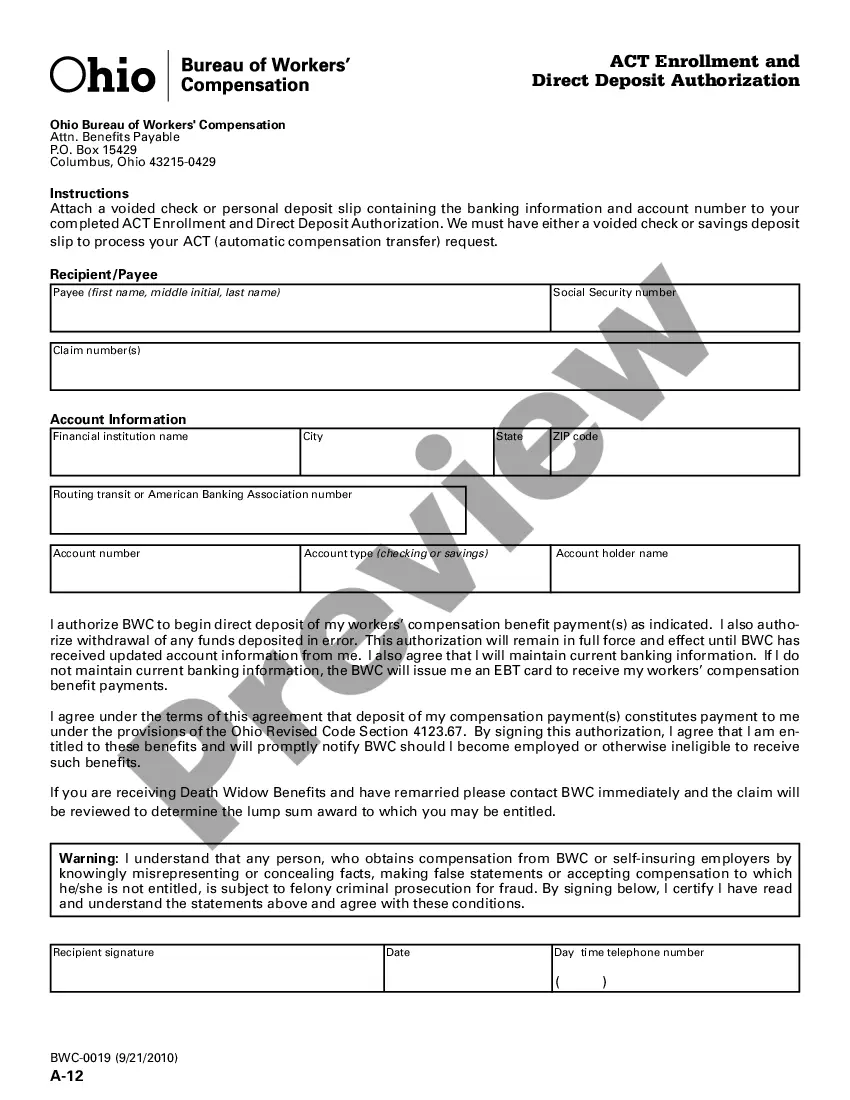

Individuals can use Form 4506T-EZ to request a tax return transcript for the current and the prior three years that includes most lines of the original tax return. The tax return transcript will not show payments, penalty assessments, or adjustments made to the originally filed return.

I, (full name), certify that I did not file a tax return in 20YY. I am unable to provide an IRS Verification of Non-filing Letter because I do not have a Social Security Number, Individual Taxpayer Identification Number, or Employer Identification Number. I did not work or earn any wages in 20YY.

Use Form 4506-T to request any of the transcripts: tax return, tax account, wage and income, record of account and verification of non-filling. The transcript format better protects taxpayer data by partially masking personally identifiable information.

If you and/or your parents have never filed taxes with the IRS, the IRS Verification of Non-Filing Letter must be requested by mail using the paper version of the IRS Form 4506-T available at .irs.gov/pub/irs-pdf/f4506t.pdf You will need to print, complete, sign and send the form by mail or fax to the IRS.

1. Complete the form. Line 1a: Enter your name as it's shown on your tax returns. Line 1b: Enter your Social Security number. Line 2a: Enter your spouse's name if you filed a joint return. Line 2b: Enter your spouse's Social Security number, if you filed a joint return. Line 3: Enter your current address.

Complete these lines on the form: Line 1a: Enter your name as it's shown on your tax returns. Line 1b: Enter your Social Security number. Line 2a: Enter your spouse's name if you filed a joint return. Line 2b: Enter your spouse's Social Security number, if you filed a joint return. Line 3: Enter your current address.

Fill out the type of tax information, tax form number, the years or periods, and the specific matter of the tax information you are authorizing in form 8821. You may enter multiple years or a series of periods such as ?2015 thru 2017,? but you may not make blanket statements such as ?all years.?

Paper Request Form ? IRS Form 4506-T Complete lines 1 ? 4, following the instructions on page 2 of the form. Line 3: enter the non-filer's street address and zip or postal code. ... Line 5 provides non-filers with the option to have their IRS Verification of Non-filing Letter mailed directly to a third party by the IRS.