Georgia Nonqualified Defined Benefit Deferred Compensation Agreement

Description

How to fill out Nonqualified Defined Benefit Deferred Compensation Agreement?

Selecting the appropriate legal document template can be challenging. Clearly, there are numerous online templates available, but how do you locate the legal form you need.

Utilize the US Legal Forms website. This platform offers thousands of templates, including the Georgia Nonqualified Defined Benefit Deferred Compensation Agreement, suitable for both business and personal use. All the forms are reviewed by experts and comply with federal and state regulations.

If you are already registered, Log In to your account and click the Download button to obtain the Georgia Nonqualified Defined Benefit Deferred Compensation Agreement. Use your account to access the legal forms you have previously acquired. Navigate to the My documents section of your account to retrieve another copy of the document you need.

US Legal Forms is the largest collection of legal templates where you can explore a variety of document templates. Take advantage of the service to obtain properly crafted paperwork that adheres to state regulations.

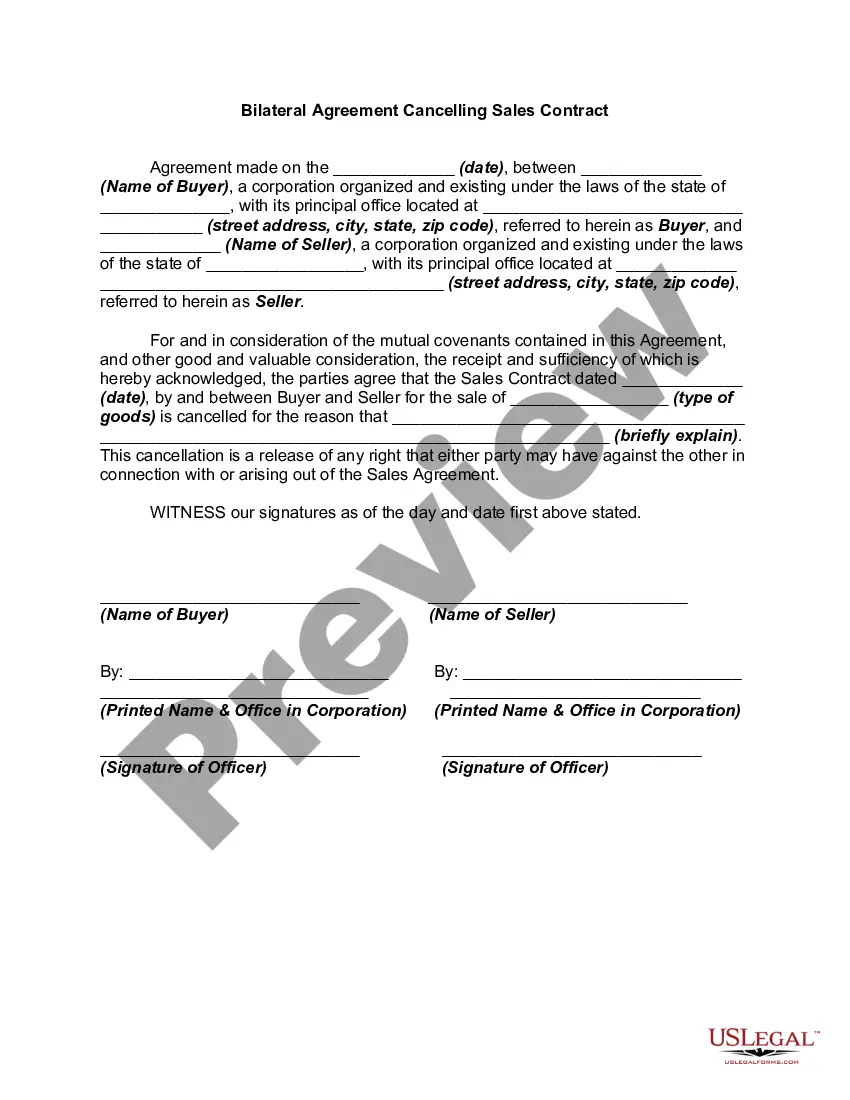

- First, make sure you have selected the correct form for your city/county. You can browse the form using the Review button and read the form description to confirm it is suitable for you.

- If the form does not fulfill your requirements, use the Search field to find the appropriate form.

- When you are confident the form is correct, click the Purchase now button to obtain the form.

- Choose the payment plan you desire and enter the required details. Create your account and pay for the order using your PayPal account or Visa or Mastercard.

- Select the file format and download the legal document template to your device.

- Complete, edit, print, and sign the downloaded Georgia Nonqualified Defined Benefit Deferred Compensation Agreement.

Form popularity

FAQ

To set up a NQDC plan, start by determining the eligibility criteria and contribution limits for your organization. Next, work with financial advisors to create a customized agreement that meets your needs and adheres to IRS regulations. With UsLegalForms, you can access templates and resources to help you effectively implement your Georgia Nonqualified Defined Benefit Deferred Compensation Agreement.

Setting up a non-qualified deferred compensation plan involves several steps, including designing the plan, drafting the agreement, and communicating the benefits to employees. It is vital to consult with legal and financial professionals to ensure compliance with relevant regulations. Platforms like UsLegalForms can help streamline this process, making it easier to establish your Georgia Nonqualified Defined Benefit Deferred Compensation Agreement.

A NQDC, or Nonqualified Deferred Compensation, appears on your paystub as a way to indicate your deferred earnings. This amount represents the portion of your income that you have chosen to delay receiving. These contributions are often reported separately to provide transparency in your compensation package, particularly when considering your Georgia Nonqualified Defined Benefit Deferred Compensation Agreement.

Eligibility for a Georgia Nonqualified Defined Benefit Deferred Compensation Agreement typically extends to high-level employees such as executives and key personnel within an organization. These plans are designed to provide supplemental retirement income that exceeds the limits of qualified plans. To participate, individuals often need to meet specific criteria set by their employer, including performance objectives and tenure with the company. By partnering with uslegalforms, you can easily navigate the complexities of forming these agreements and ensure compliance with state regulations.

Nonqualified deferred compensation is generally not considered earned income until it is distributed to you. At that point, it becomes taxable and can significantly impact your income during retirement. Knowing the specifics of the Georgia Nonqualified Defined Benefit Deferred Compensation Agreement can help you manage your financial planning effectively.

One significant disadvantage of a nonqualified deferred compensation plan is the lack of federal protection for your funds, which means your employer can decide to eliminate the plan. Additionally, if your employer goes bankrupt, you may lose the deferred amounts. Thus, understanding the implications of the Georgia Nonqualified Defined Benefit Deferred Compensation Agreement is essential for making informed decisions.

Participating in a nonqualified deferred compensation plan can be beneficial, especially if you expect to be in a higher tax bracket in retirement. This strategy helps you reduce taxable income now, while potentially allowing for increased growth in your retirement savings. The Georgia Nonqualified Defined Benefit Deferred Compensation Agreement can provide structured benefits tailored to your financial needs.

The main difference between a 401k and a deferred compensation plan lies in how they are treated under tax law. A 401k is a qualified retirement plan that offers tax advantages when certain IRS rules are followed, while a deferred compensation plan is generally nonqualified, allowing for greater flexibility but with fewer protections. Understanding the Georgia Nonqualified Defined Benefit Deferred Compensation Agreement can help you appreciate these differences.

qualified deferred compensation arrangement is a financial tool that enables employees to postpone earning taxes on a portion of their compensation until a later date. This can help with tax planning and improve retirement savings. The Georgia Nonqualified Defined Benefit Deferred Compensation Agreement exemplifies this type of arrangement.

A nonqualified deferred compensation arrangement allows employees to defer a portion of their income to a future date, typically for retirement purposes. Unlike qualified plans, these arrangements do not need to meet strict regulatory requirements. The Georgia Nonqualified Defined Benefit Deferred Compensation Agreement is one such example, providing flexibility in how and when employees receive their income.