Georgia Notice to Debt Collector - Posing Lengthy Series of Questions or Comments

Description

Section 806 of the Fair Debt Collection Practices Act says a debt collector may not harass, oppress, or abuse any person in connection with the collection of a debt. This includes posing a lengthy series of questions or comments to the consumer without giving the consumer a chance to reply.

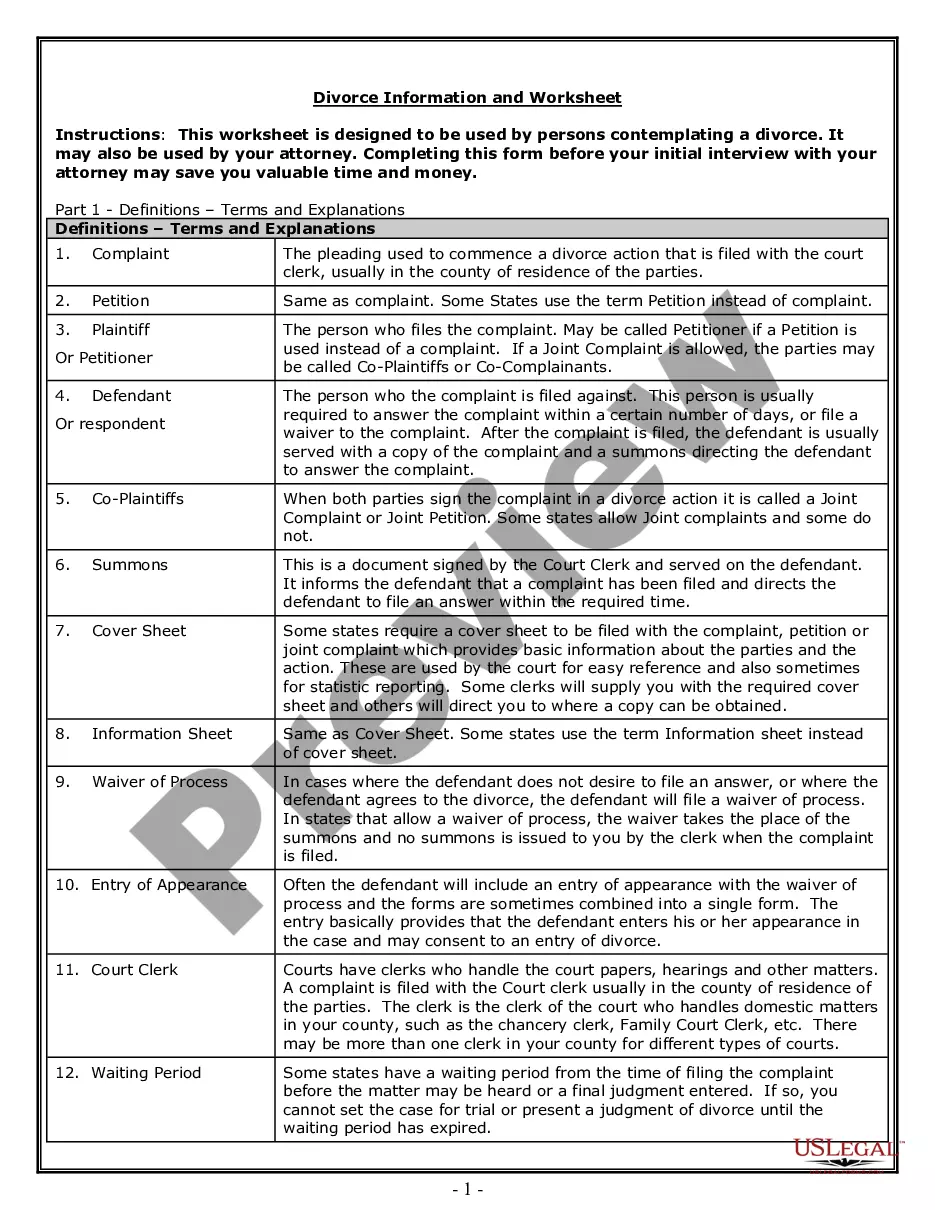

How to fill out Notice To Debt Collector - Posing Lengthy Series Of Questions Or Comments?

Are you presently in a situation where you need documents for various business or personal activities almost every workday? There are countless legal document templates accessible online, but finding reliable ones can be challenging.

US Legal Forms offers a vast collection of document templates, including the Georgia Notice to Debt Collector - Asking Lengthy Series of Questions or Comments, which are designed to comply with federal and state regulations.

If you are already familiar with the US Legal Forms website and have an account, simply Log In. Then, you can download the Georgia Notice to Debt Collector - Asking Lengthy Series of Questions or Comments template.

Access all the document templates you have acquired in the My documents section. You can obtain another copy of the Georgia Notice to Debt Collector - Asking Lengthy Series of Questions or Comments whenever needed. Just navigate to the appropriate form to download or print the document template.

Utilize US Legal Forms, the most extensive collection of legal templates, to save time and avoid mistakes. The service offers professionally crafted legal document templates that can be used for a variety of purposes. Create an account on US Legal Forms and start making your life a little easier.

- Obtain the document you need and ensure it is for the appropriate city/area.

- Use the Preview button to review the form.

- Read the description to confirm you have selected the right document.

- If the document isn't what you're looking for, use the Search field to find the form that suits your requirements.

- Once you find the correct document, click Get now.

- Choose the pricing plan you want, fill in the necessary information to create your account, and complete the purchase with your PayPal or credit card.

- Select a convenient file format and download your copy.

Form popularity

FAQ

The Fair Debt Collection Practices Act (FDCPA) The FDCPA prohibits debt collection companies from using abusive, unfair or deceptive practices to collect debts from you.

Debt collectors cannot harass or abuse you. They cannot swear, threaten to illegally harm you or your property, threaten you with illegal actions, or falsely threaten you with actions they do not intend to take. They also cannot make repeated calls over a short period to annoy or harass you.

You are not obliged let a debt collector into your home and they don't have the right to take goods away. It's very important to understand that a debt collector is not the same as an enforcement agent or bailiff. Debt collectors have no special legal powers.

Among the insider tips, Ulzheimer shared with the audience was this: if you are being pursued by debt collectors, you can stop them from calling you ever again by telling them '11-word phrase'. This simple idea was later advertised as an '11-word phrase to stop debt collectors'.

Debt collectors must be truthful The Fair Debt Collection Practices Act states that debt collectors cannot use any false, deceptive or misleading representation to collect the debt. Along with other restrictions, debt collectors cannot misrepresent: The amount of the debt. Whether it's past the statute of limitations.

Repeated calls. Threats of violence. Publishing information about you. Abusive or obscene language.

3 Things You Should NEVER Say To A Debt CollectorAdditional Phone Numbers (other than what they already have)Email Addresses.Mailing Address (unless you intend on coming to a payment agreement)Employer or Past Employers.Family Information (ex.Bank Account Information.Credit Card Number.Social Security Number.

The FDCPA forbids harassing, oppressive, and abusive conductno matter what kind of communication media the debt collector uses. So, this prohibition applies to in-person interactions, telephone calls, audio recordings, paper documents, mail, email, text messages, social media, and other electronic media.

Don't be surprised if debt collectors slide into your DMs. A new rule allows debt collectors to contact you on social media, text or email not just by phone. The rule, which was approved last year by the Consumer Financial Protection Bureau's former president Kathleen L. Kraninger, took effect Tuesday, Nov.

In Georgia, the statute of limitations on credit card debt is generally six years. After six years of non-payment on the debt, it becomes time-barred, meaning a collector or creditor cannot sue you to collect the debt.