Georgia Proposed Amendment to create a class of Common Stock that has 1-20th vote per share

Description

How to fill out Proposed Amendment To Create A Class Of Common Stock That Has 1-20th Vote Per Share?

You may devote hours on the web searching for the legitimate papers template that fits the federal and state requirements you will need. US Legal Forms gives 1000s of legitimate varieties which can be reviewed by professionals. You can actually obtain or print the Georgia Proposed Amendment to create a class of Common Stock that has 1-20th vote per share from our services.

If you already have a US Legal Forms bank account, it is possible to log in and click on the Obtain key. After that, it is possible to complete, modify, print, or indicator the Georgia Proposed Amendment to create a class of Common Stock that has 1-20th vote per share. Each legitimate papers template you buy is your own forever. To obtain yet another backup of the purchased form, check out the My Forms tab and click on the corresponding key.

If you use the US Legal Forms web site for the first time, follow the simple directions below:

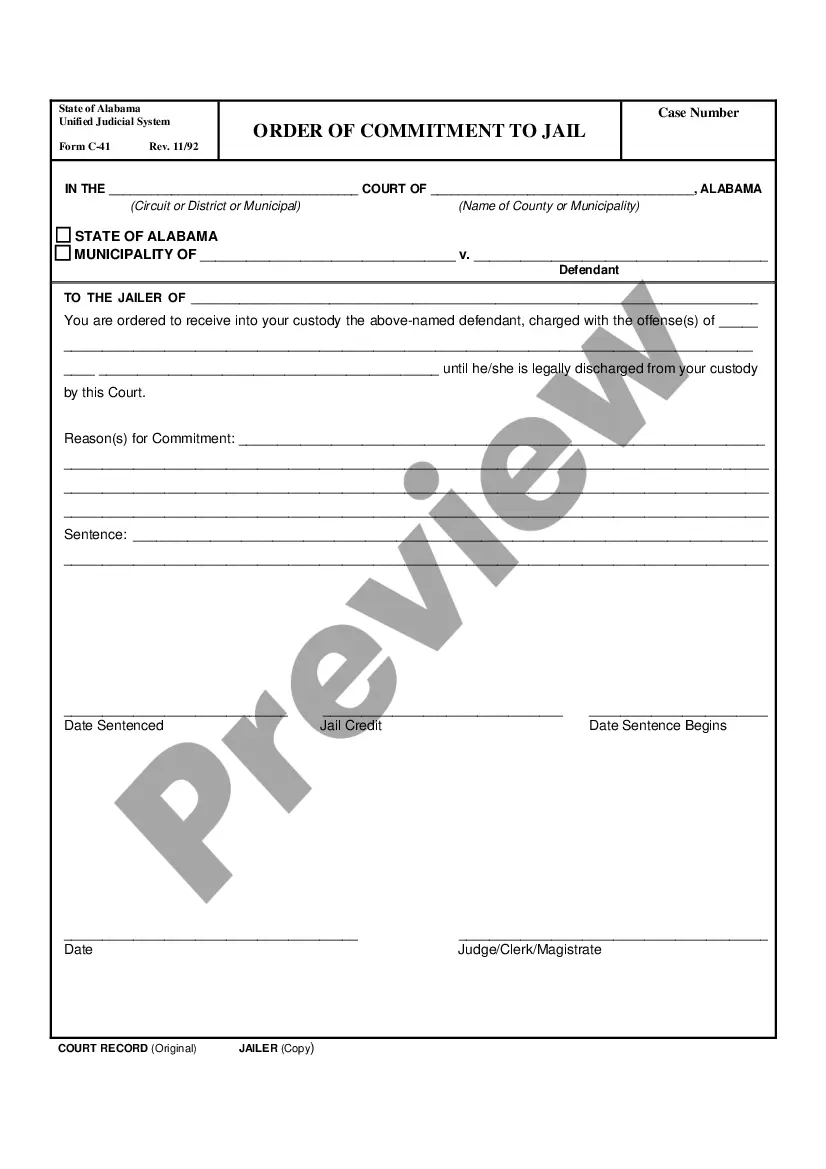

- First, ensure that you have selected the proper papers template for that county/area of your choice. Look at the form description to ensure you have chosen the right form. If available, utilize the Preview key to look from the papers template as well.

- In order to discover yet another version of your form, utilize the Search area to get the template that meets your needs and requirements.

- Once you have discovered the template you would like, simply click Get now to proceed.

- Find the costs prepare you would like, key in your qualifications, and register for a free account on US Legal Forms.

- Comprehensive the deal. You may use your Visa or Mastercard or PayPal bank account to cover the legitimate form.

- Find the structure of your papers and obtain it to your product.

- Make alterations to your papers if possible. You may complete, modify and indicator and print Georgia Proposed Amendment to create a class of Common Stock that has 1-20th vote per share.

Obtain and print 1000s of papers themes using the US Legal Forms site, which offers the most important assortment of legitimate varieties. Use professional and express-specific themes to tackle your company or specific requires.