Georgia Stock Option and Long Term Incentive Plan of Golf Technology Holding, Inc.

Description

How to fill out Stock Option And Long Term Incentive Plan Of Golf Technology Holding, Inc.?

Have you been inside a place that you require paperwork for possibly organization or specific uses virtually every time? There are a variety of lawful record web templates available on the Internet, but locating kinds you can trust isn`t effortless. US Legal Forms gives a large number of kind web templates, like the Georgia Stock Option and Long Term Incentive Plan of Golf Technology Holding, Inc., which can be written in order to meet federal and state requirements.

When you are already informed about US Legal Forms web site and have an account, just log in. Following that, it is possible to download the Georgia Stock Option and Long Term Incentive Plan of Golf Technology Holding, Inc. design.

Unless you offer an accounts and need to begin using US Legal Forms, abide by these steps:

- Obtain the kind you require and ensure it is for your proper city/region.

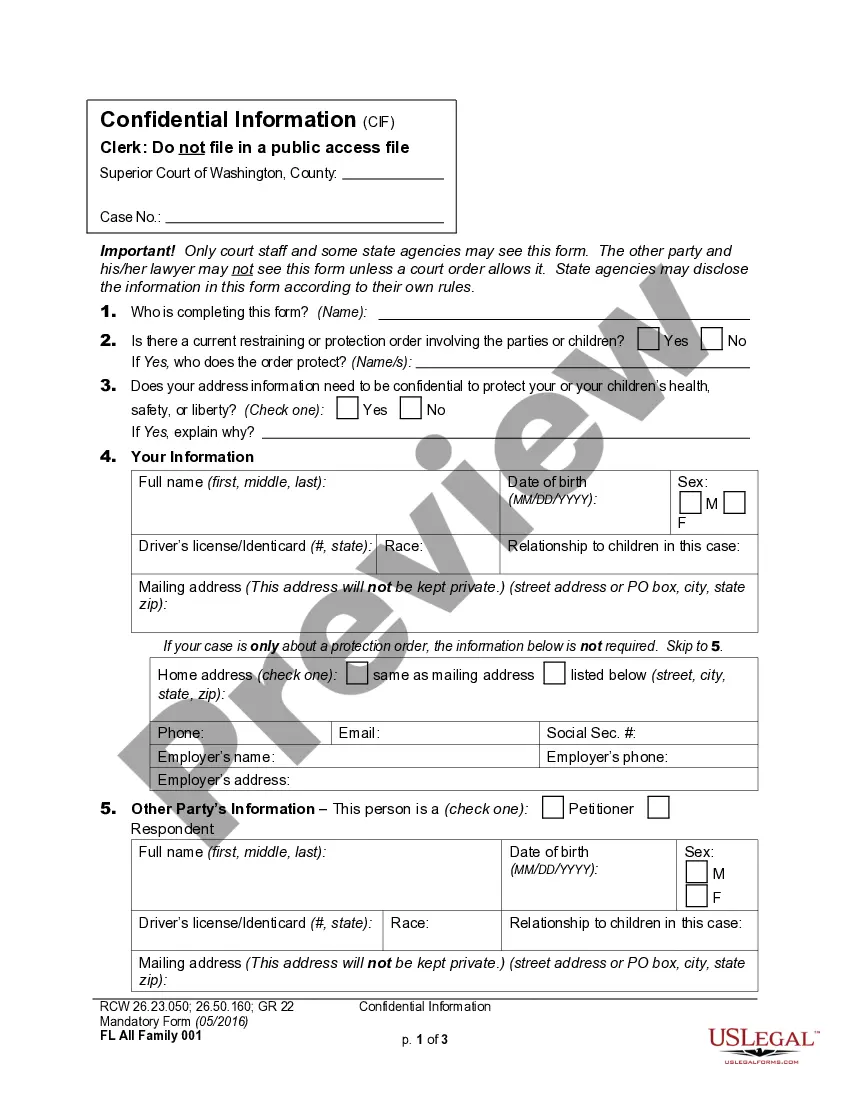

- Make use of the Preview switch to check the shape.

- See the explanation to actually have chosen the appropriate kind.

- If the kind isn`t what you are seeking, utilize the Look for discipline to get the kind that suits you and requirements.

- Once you find the proper kind, click on Purchase now.

- Opt for the costs plan you desire, fill out the specified info to make your money, and purchase the transaction with your PayPal or credit card.

- Select a practical file formatting and download your version.

Discover all the record web templates you might have bought in the My Forms food list. You can get a more version of Georgia Stock Option and Long Term Incentive Plan of Golf Technology Holding, Inc. any time, if required. Just select the essential kind to download or printing the record design.

Use US Legal Forms, by far the most substantial assortment of lawful varieties, to save time as well as prevent blunders. The service gives expertly manufactured lawful record web templates that can be used for a range of uses. Produce an account on US Legal Forms and commence producing your way of life easier.

Form popularity

FAQ

ESOs are a form of equity compensation granted by companies to their employees and executives. Like a regular call option, an ESO gives the holder the right to purchase the underlying asset?the company's stock?at a specified price for a finite period of time.

An LTIP works by rewarding employees (usually senior employees) with cash or shares of company stock for meeting specific goals. The goals are usually long-term, running for 3-5 years to stimulate ongoing progress rather than a-few-months objectives.

Long-term incentives are earned based on the achievement of goals over a longer period of time. The goals may be based on stock price or business performance. It's important to take a holistic approach to compensation ? if it's short- or long-term, cash vs. bonds, the kinds of vehicles you're using, and so forth.

LTI are typically granted with what is known as a vesting period. What this means is that grantees are conditionally granted equity, but they do not actually own it until the vesting period expires.

This incentive is paid out on top of the executive's base salary and can often come in the form of a cash incentive. Both private companies and publicly traded firms implement discretionary incentive programs for their employees based on performance metrics.