Georgia Performance Evaluation for Nonexempt Employees

Description

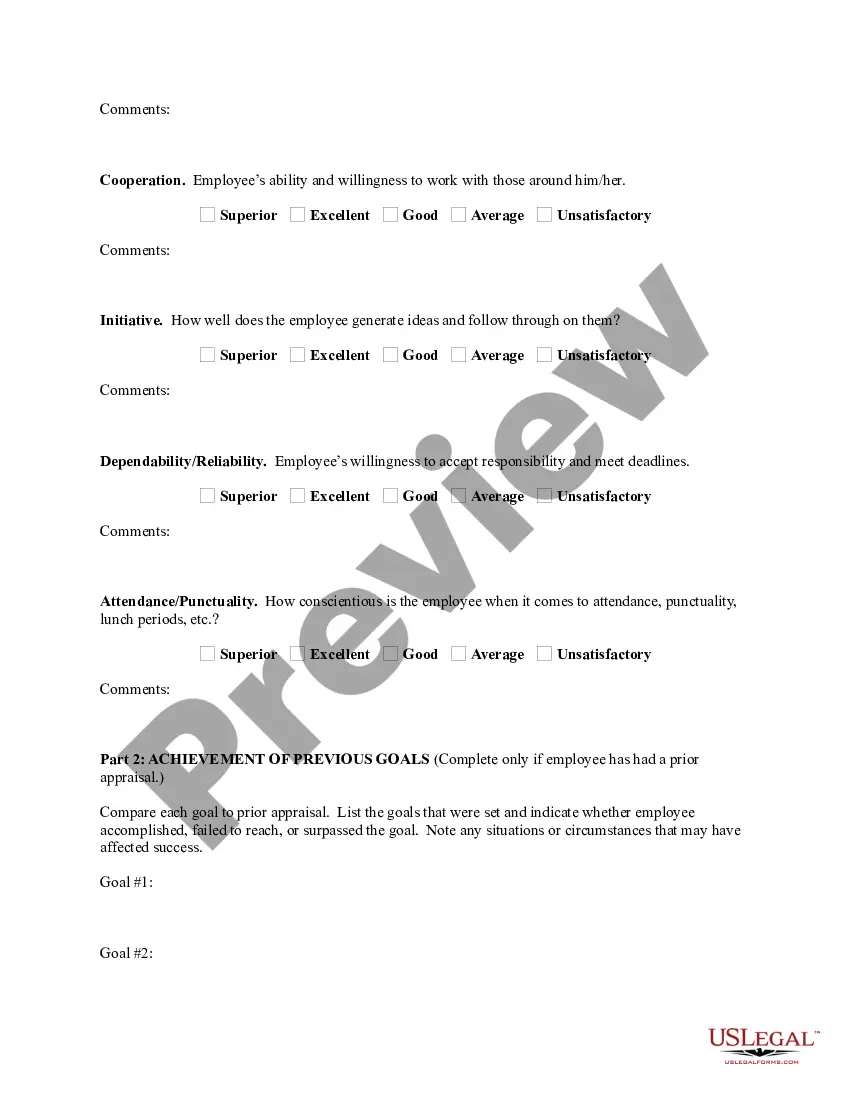

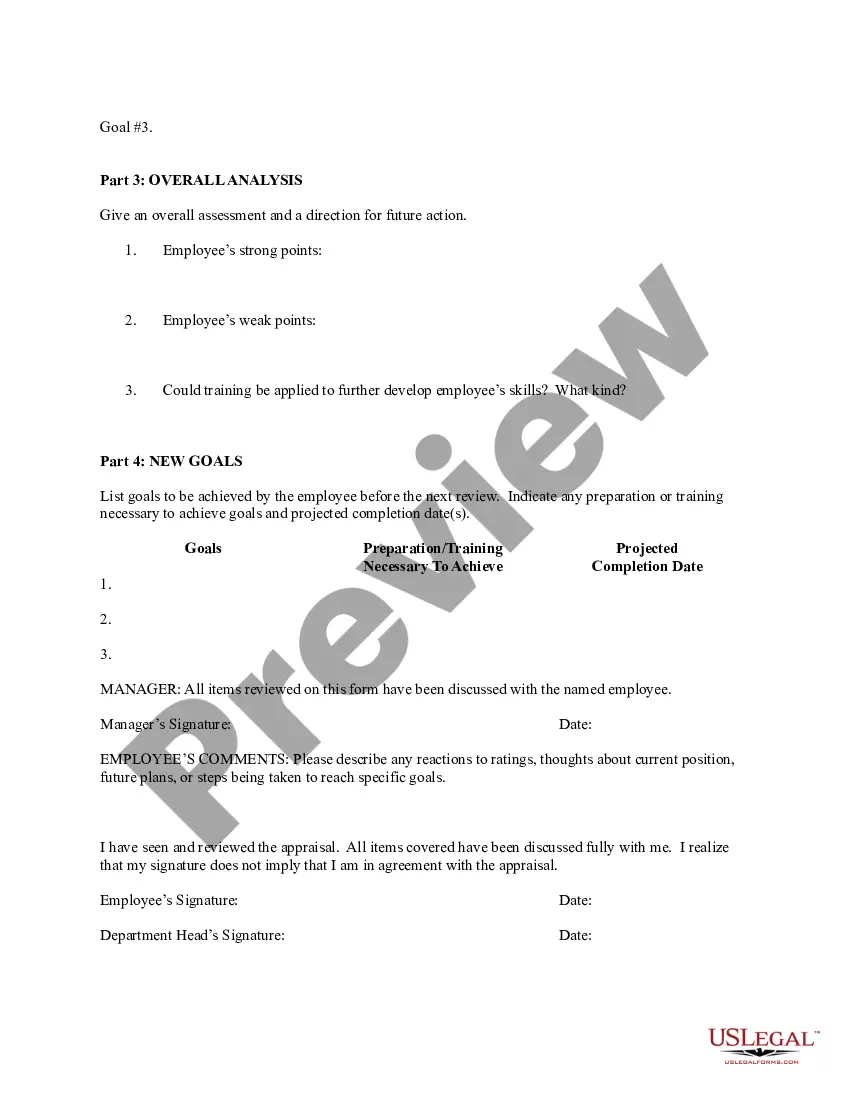

How to fill out Performance Evaluation For Nonexempt Employees?

US Legal Forms - one of the most prominent collections of legal templates in the United States - offers a broad selection of legal document formats that you can obtain or create.

By utilizing the website, you can discover thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can access the latest versions of forms like the Georgia Performance Evaluation for Nonexempt Employees in just a few minutes.

If you possess a membership, Log In to download the Georgia Performance Evaluation for Nonexempt Employees from the US Legal Forms library. The Download button will appear on each form you view. You can access all previously saved forms in the My documents section of your account.

Complete the purchase. Use your credit card or PayPal account to finalize the transaction.

Select the format and download the form to your device. Make changes. Fill out, edit, print, and sign the saved Georgia Performance Evaluation for Nonexempt Employees. Each design you upload to your account has no expiration date and belongs to you permanently. Therefore, if you wish to obtain or print another copy, simply navigate to the My documents section and click on the form you need. Access the Georgia Performance Evaluation for Nonexempt Employees with US Legal Forms, one of the most comprehensive libraries of legal document formats. Utilize a vast array of professional and state-specific templates that cater to your business or personal needs and requirements.

- Make sure to select the correct form for your city/state.

- Click on the Review button to check the form's details.

- Read the form description to ensure you have chosen the right form.

- If the form does not meet your requirements, use the Search field at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your choice by clicking the Purchase now button.

- Then, choose your preferred pricing plan and provide your information to register for an account.

Form popularity

FAQ

Employees may be considered exempt if they are paid a salary, earn at least $684 per week or $35,568 annually, and perform the job duties of one of the exempt professions (administrative, executive, etc.). Highly compensated employees who make $107,432 or more per year are also not required to be paid overtime.

Nonexempt: An individual who is not exempt from the overtime provisions of the FLSA and is therefore entitled to overtime pay for all hours worked beyond 40 in a workweek (as well as any state overtime provisions). Nonexempt employees may be paid on a salary, hourly or other basis.

Federal Exemptions from Overtime: To be considered "exempt," these employees must generally satisfy three tests: Salary-level test. Effective January 1, 2020, employers must pay employees a salary of at least $684 per week. The FLSA's minimum salary requirement is set to remain the same in 2022.

Salary level test. Employees who are paid less than $23,600 per year ($455 per week) are nonexempt. (Employees who earn more than $100,000 per year are almost certainly exempt.)

Employees who are paid less than $23,600 per year ($455 per week) are nonexempt. (Employees who earn more than $100,000 per year are almost certainly exempt.)

In Georgia, most workers are usually regarded as employees "at will." This means that the employee works at the will of the employer and the employer can fire the worker at any time, for any reason (just about), and without any notice.

1, 2016. The minimum salary threshold required for an employee to be exempt from overtime was raised from $23,660 annually to $47,476 annually. Decisions for an employee to be exempt or non-exempt were based on DOL salary and duties tests and USG policies and guidelines.

Generally the FLSA exempts executive, administrative, professional, and outside sales employees from overtime requirements provided they meet certain tests regarding job duties and are compensated "on a salary basis."

Employees earning less than $23,600 per year or $455 per week, are nonexempt. Employees who earn more than $100,000 per year are almost certainly exempt under current law, however this is set to go up in 2016 too.

Georgia Minimum Wage for 2021, 2022. Georgia's state minimum wage rate is $7.25 per hour. This is the same as the current Federal Minimum Wage rate. The minimum wage applies to most employees in Georgia, with limited exceptions including tipped employees, some student workers, and other exempt occupations.