Georgia Worksheet Analyzing a Self-Employed Independent Contractor

Description

How to fill out Worksheet Analyzing A Self-Employed Independent Contractor?

Are you in a scenario where you will require documents for business or particular reasons almost daily.

There are numerous legitimate document templates available on the internet, but finding ones you can rely on is challenging.

US Legal Forms provides a vast selection of form templates, such as the Georgia Worksheet Analyzing a Self-Employed Independent Contractor, designed to comply with both state and federal regulations.

When you find the correct form, click on Purchase now.

Choose the payment plan you need, complete the required information to set up your payment, and pay for your order using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have your account, simply Log In.

- Next, you can download the Georgia Worksheet Analyzing a Self-Employed Independent Contractor template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/county.

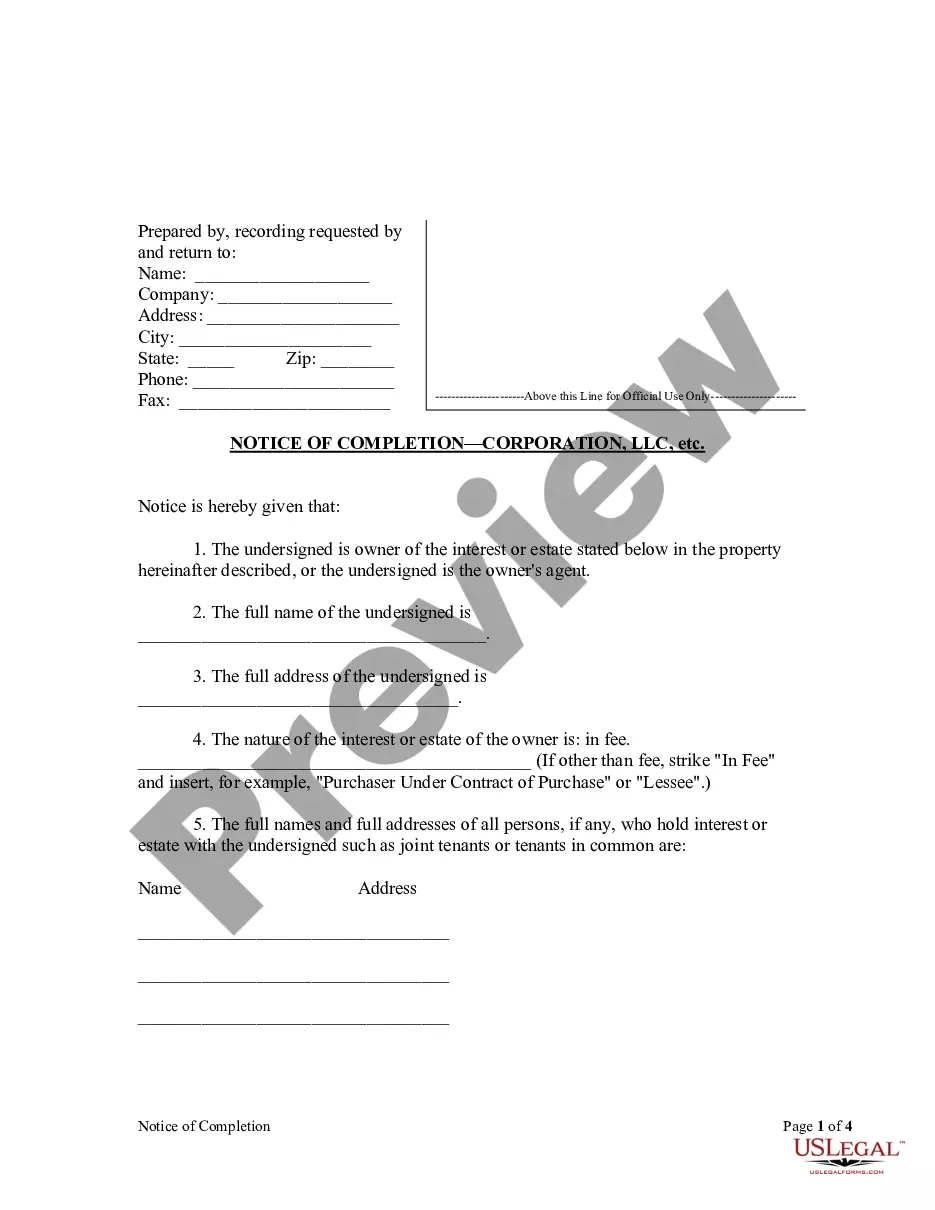

- Use the Preview option to check the form.

- Review the details to confirm you have selected the appropriate form.

- If the form is not what you are looking for, use the Search box to locate the form that meets your needs.

Form popularity

FAQ

The three types of self-employed individuals include:Independent contractors. Independent contractors are individuals hired to perform specific jobs for clients, meaning that they are only paid for their jobs.Sole proprietors.Partnerships.

Independent contractors generally report their earnings to the IRS quarterly using Form 1040-ES, Estimated Tax for Individuals. This covers both their federal income tax and self-employment tax liabilities. They may also have to pay state and local taxes according to their state and local government guidelines.

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.

Independent contractors are self-employed workers who provide services for an organisation under a contract for services. Independent contractors are not employees and are typically highly skilled, providing their clients with specialist skills or additional capacity on an as needed basis.

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

If you are an independent contractor, then you are self-employed. The earnings of a person who is working as an independent contractor are subject to self-employment tax. To find out what your tax obligations are, visit the Self-Employed Individuals Tax Center.

The general rule is that you will be: An employee if you work for someone and do not have the risks of running a business. Self-employed if you have a trade, profession or vocation, are in business on your own account and are responsible for the success or failure of that business.

Accrual Method Accounting When you operate a business providing services as an independent contractor, you have the option of using the accrual method of accounting for your contractor earnings and expenses while reporting your personal income and deductions using the cash method.

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.

Here is a list of some of the things you can write off on your 1099 if you are self-employed:Mileage and Car Expenses.Home Office Deductions.Internet and Phone Bills.Health Insurance.Travel Expenses.Meals.Interest on Loans.Subscriptions.More items...?