Full text of legislative history behind the Insurers Rehabilitation and Liquidation Model Act.

Georgia Insurers Rehabilitation and Liquidation Model Act Legislative History

Description

How to fill out Insurers Rehabilitation And Liquidation Model Act Legislative History?

Are you within a place the place you need to have files for possibly business or specific reasons nearly every day? There are plenty of authorized document themes accessible on the Internet, but getting types you can depend on isn`t simple. US Legal Forms delivers a large number of develop themes, such as the Georgia Insurers Rehabilitation and Liquidation Model Act Legislative History, which are written to meet federal and state requirements.

If you are currently knowledgeable about US Legal Forms site and possess a free account, simply log in. Following that, it is possible to download the Georgia Insurers Rehabilitation and Liquidation Model Act Legislative History web template.

If you do not provide an profile and wish to start using US Legal Forms, adopt these measures:

- Discover the develop you need and make sure it is to the proper city/area.

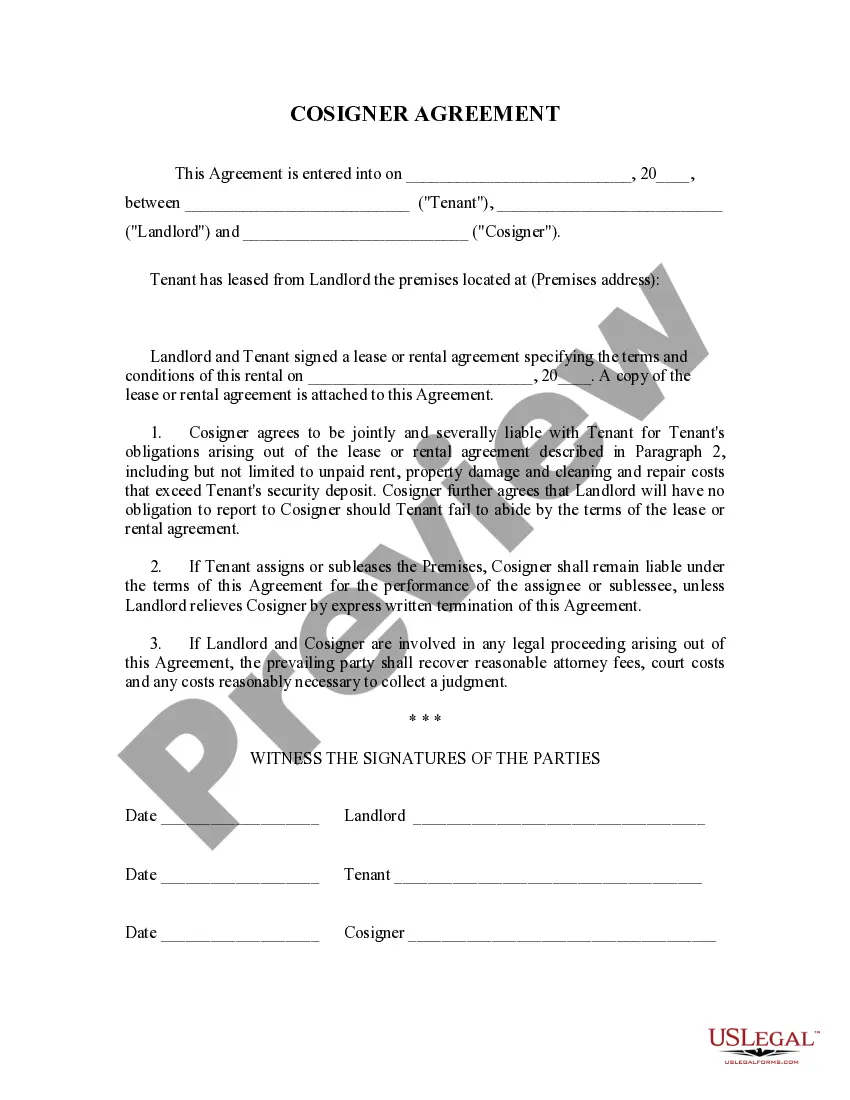

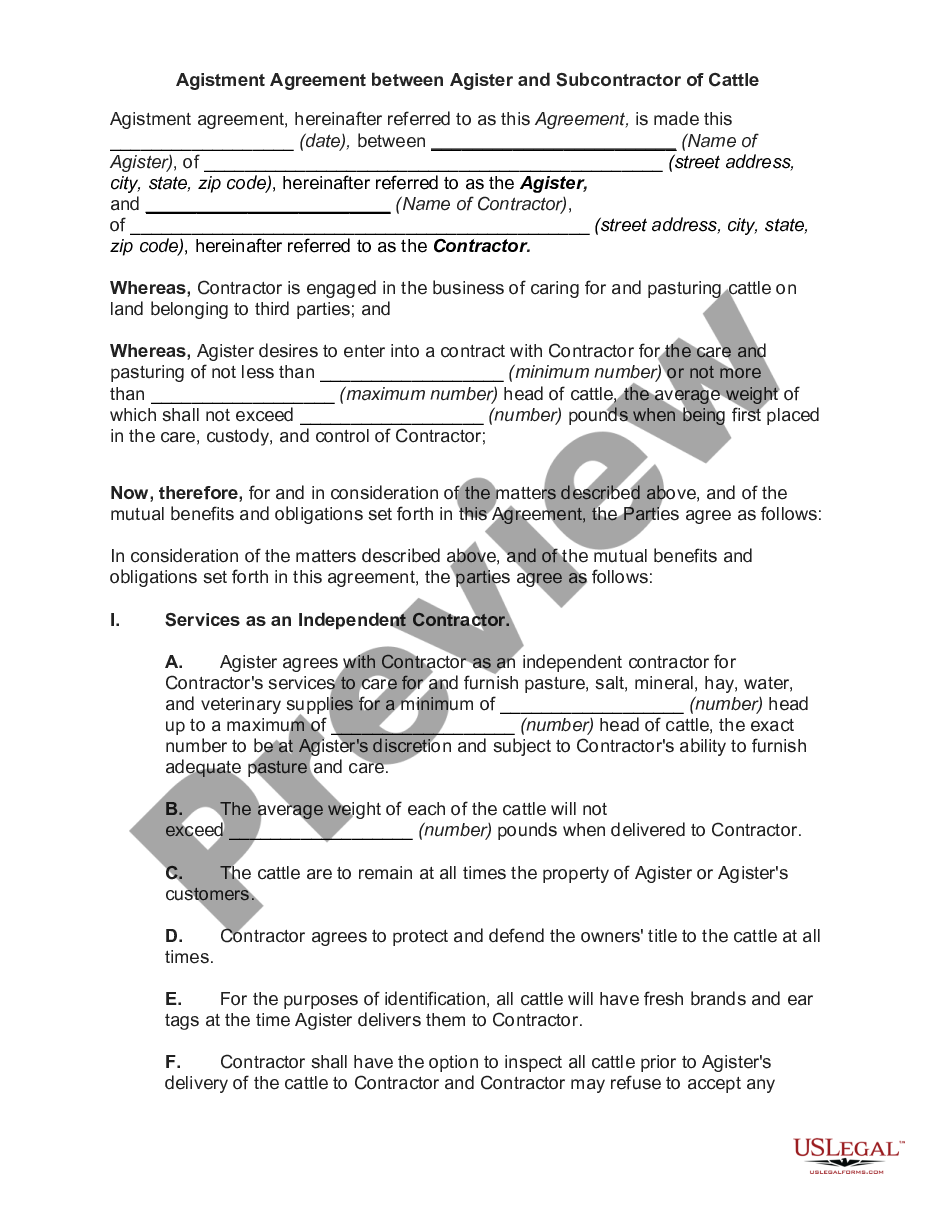

- Use the Preview option to check the form.

- Look at the outline to ensure that you have selected the proper develop.

- When the develop isn`t what you`re searching for, use the Lookup area to obtain the develop that meets your needs and requirements.

- If you find the proper develop, just click Purchase now.

- Pick the pricing program you desire, submit the necessary information to generate your bank account, and pay money for your order with your PayPal or credit card.

- Choose a handy file formatting and download your copy.

Locate every one of the document themes you may have purchased in the My Forms menus. You can obtain a extra copy of Georgia Insurers Rehabilitation and Liquidation Model Act Legislative History any time, if required. Just click on the required develop to download or produce the document web template.

Use US Legal Forms, one of the most substantial collection of authorized types, to conserve time as well as steer clear of blunders. The assistance delivers professionally manufactured authorized document themes which can be used for an array of reasons. Create a free account on US Legal Forms and start creating your life a little easier.

Form popularity

FAQ

If an insurance company is declared insolvent, expect the state guaranty association and guaranty fund to swing into action. The association will transfer the insurer's policies to another insurance company or continue providing coverage itself for policyholders.

Role of the Insurance Commissioner The commissioner also has the responsibility to determine when an insurance company domiciled in the state should be declared insolvent and to seek authority from the state court to seize its assets and operate the company pending rehabilitation or liquidation.

It may be possible to insure against the risk of counterparty insolvency. Credit risk insurance provides cover against non-payment by customers or borrowers. To trigger cover, it is usually necessary for the non-payment to be due to a specified cause, such as commencement of insolvency proceedings.

The Insolvency Pool needs money to operate. The law creating the Pool makes insurance companies pay into the Pool to makes sure there are funds available when an insurance company goes insolvent.

Insurance guaranty associations provide protection to insurance policyholders and beneficiaries of policies issued by an insurance company that has become insolvent and is no longer able to meet its obligations. All states, the District of Columbia, and Puerto Rico have insurance guaranty associations.

An insolvency clause is a clause holding a reinsurer liable for its share of loss assumed under a treaty, even though the primary company has become insolvent.