Statutory Guidelines [Appendix A(6) Revenue Procedure 93-34] regarding rules under which a designated settlement fund described in section 468B(d)(2) of the Internal Revenue Code or a qualified settlement fund described in section 1.468B-1 of the Income Tax Regulations will be considered "a party to the suit or agreement" for purposes of section 130.

Georgia Revenue Procedure 93-34

Description

How to fill out Revenue Procedure 93-34?

Are you currently in a situation in which you need paperwork for both company or individual purposes virtually every time? There are tons of legitimate record templates available on the Internet, but finding ones you can rely is not effortless. US Legal Forms provides a large number of kind templates, like the Georgia Revenue Procedure 93-34, which are published to fulfill state and federal needs.

If you are presently familiar with US Legal Forms web site and get an account, just log in. After that, you are able to acquire the Georgia Revenue Procedure 93-34 template.

If you do not provide an bank account and wish to start using US Legal Forms, follow these steps:

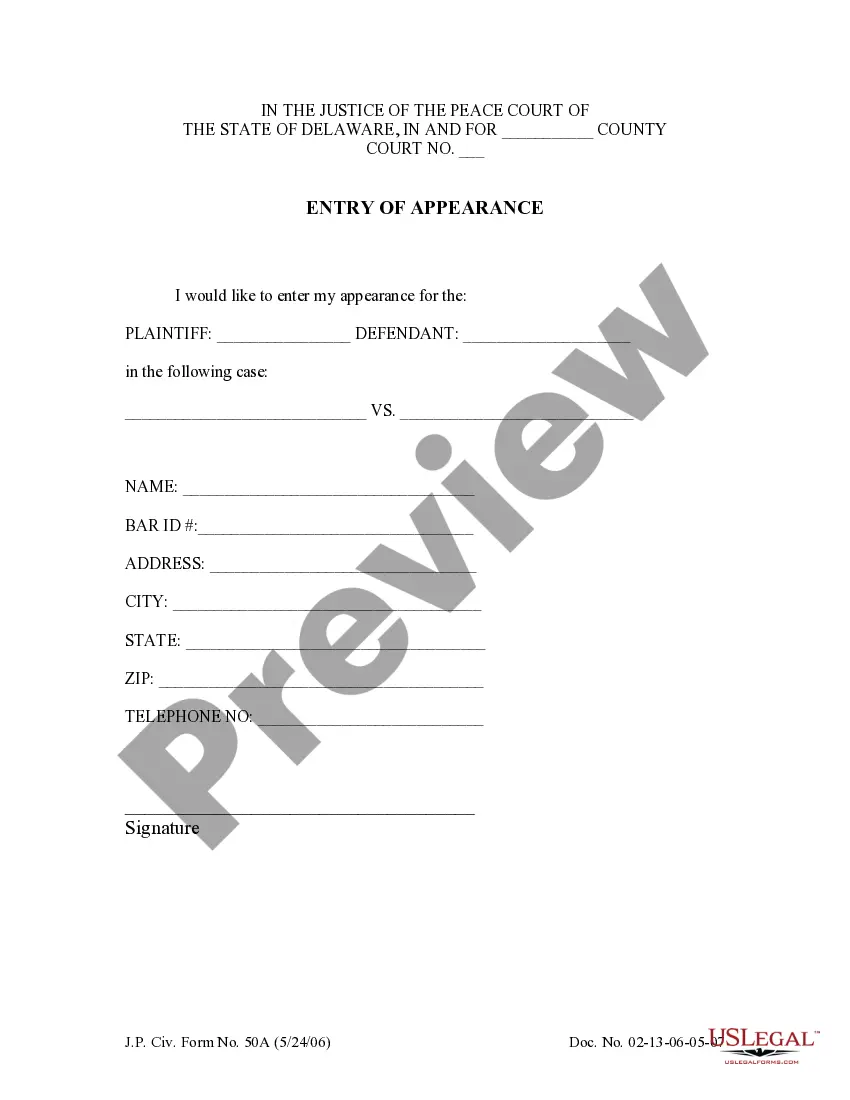

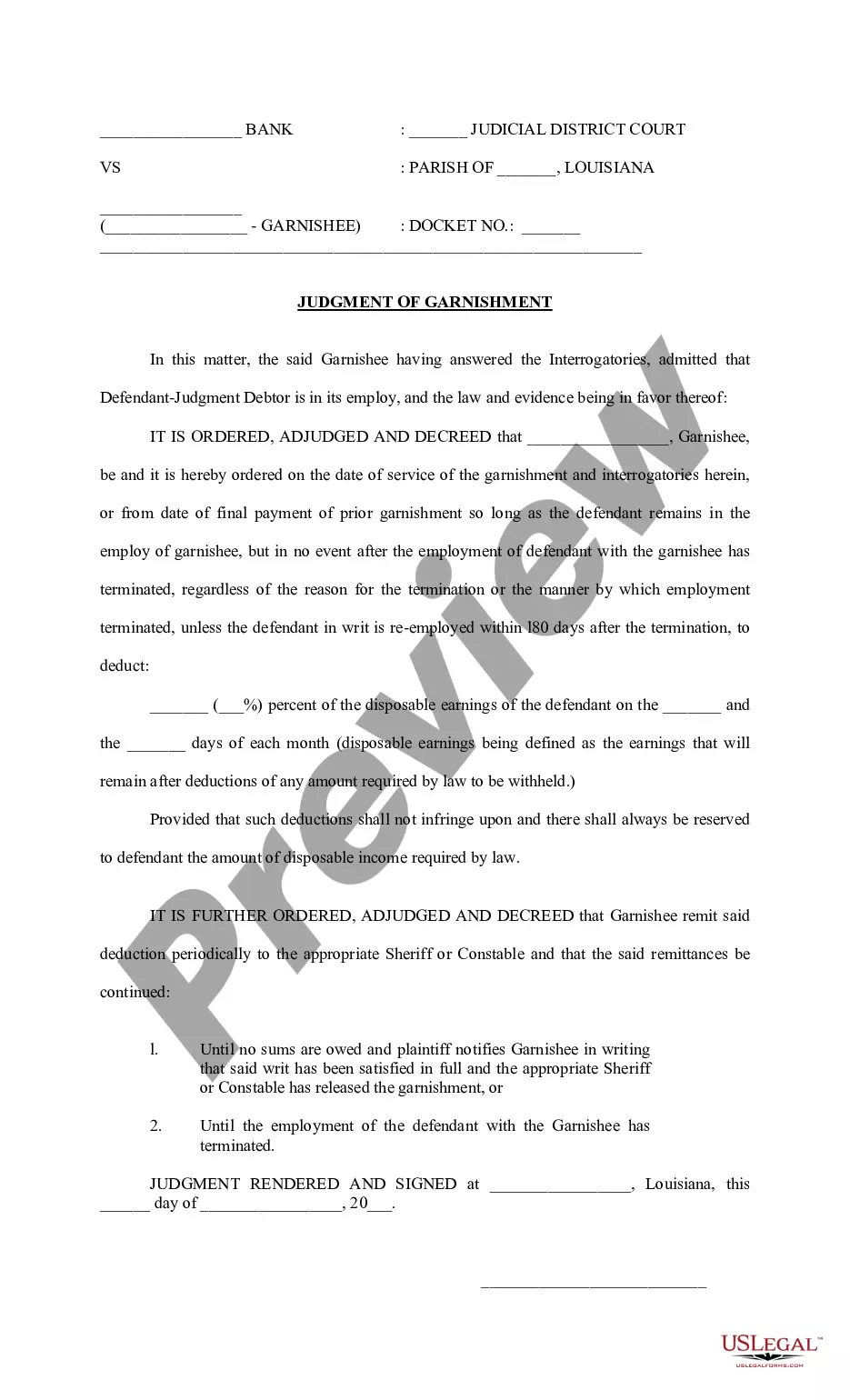

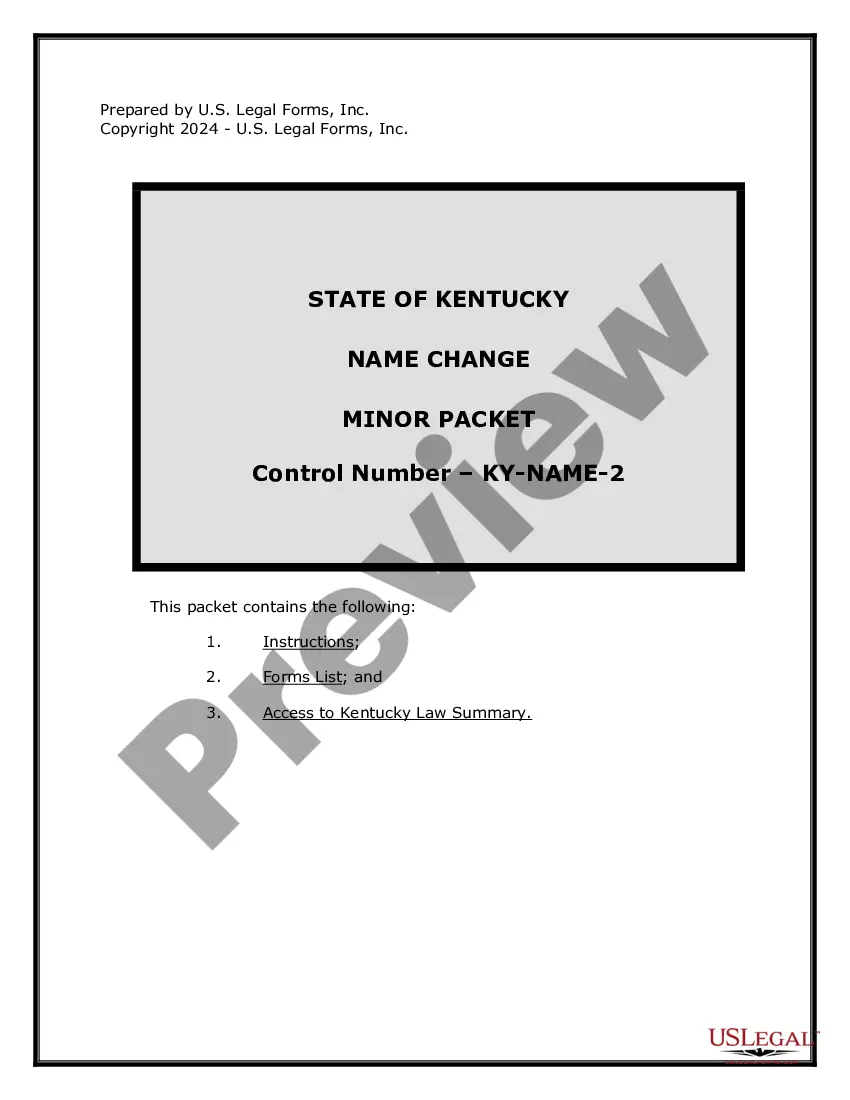

- Discover the kind you need and make sure it is for your right metropolis/state.

- Utilize the Review key to examine the shape.

- See the outline to actually have chosen the correct kind.

- When the kind is not what you are searching for, make use of the Search discipline to get the kind that meets your requirements and needs.

- Once you discover the right kind, simply click Purchase now.

- Choose the prices strategy you want, complete the required information to generate your money, and pay for the order with your PayPal or Visa or Mastercard.

- Pick a handy data file formatting and acquire your version.

Find each of the record templates you may have bought in the My Forms food selection. You can get a additional version of Georgia Revenue Procedure 93-34 any time, if possible. Just go through the needed kind to acquire or print out the record template.

Use US Legal Forms, one of the most comprehensive selection of legitimate types, to save some time and stay away from errors. The support provides skillfully produced legitimate record templates which can be used for a variety of purposes. Produce an account on US Legal Forms and initiate generating your daily life a little easier.