Georgia Model Notice of Blackout Periods under Individual Account Plans

Description

How to fill out Model Notice Of Blackout Periods Under Individual Account Plans?

Have you ever been in a location where you need documents for various organizational or personal purposes almost constantly.

There are many legitimate document templates available online, but locating those you can trust is quite challenging.

US Legal Forms offers a vast selection of form templates, such as the Georgia Model Notice of Blackout Periods under Individual Account Plans, which can be tailored to meet state and federal regulations.

You can review all the document templates you have purchased in the My documents section.

You can access another copy of Georgia Model Notice of Blackout Periods under Individual Account Plans at any time, if necessary. Just follow the necessary steps to download or print the document template.

Utilize US Legal Forms, one of the largest collections of legal documents, to save time and avoid errors. The service provides properly designed legal document templates that can be used for a variety of purposes. Create an account on US Legal Forms and start making your life more convenient.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Georgia Model Notice of Blackout Periods under Individual Account Plans template.

- If you do not possess an account and wish to start using US Legal Forms, follow these instructions.

- Locate the form you need and ensure it is for the correct city/county.

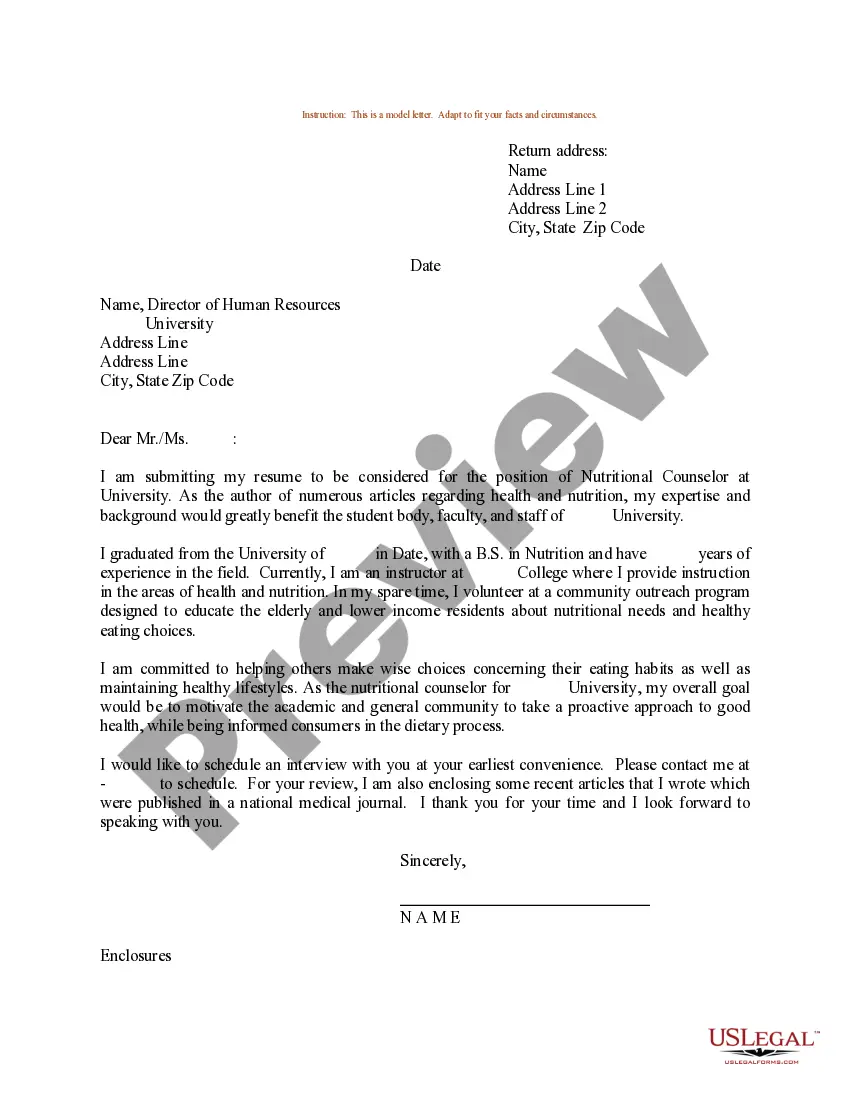

- Utilize the Review button to examine the document.

- Check the description to confirm you have selected the correct form.

- If the form does not meet your criteria, use the Search field to find the document that matches your needs and specifications.

- Once you find the suitable form, click Buy now.

- Choose the payment plan you desire, fill in the required information to create your account, and complete the transaction using your PayPal or credit card.

- Select a convenient file format and download your copy.

Form popularity

FAQ

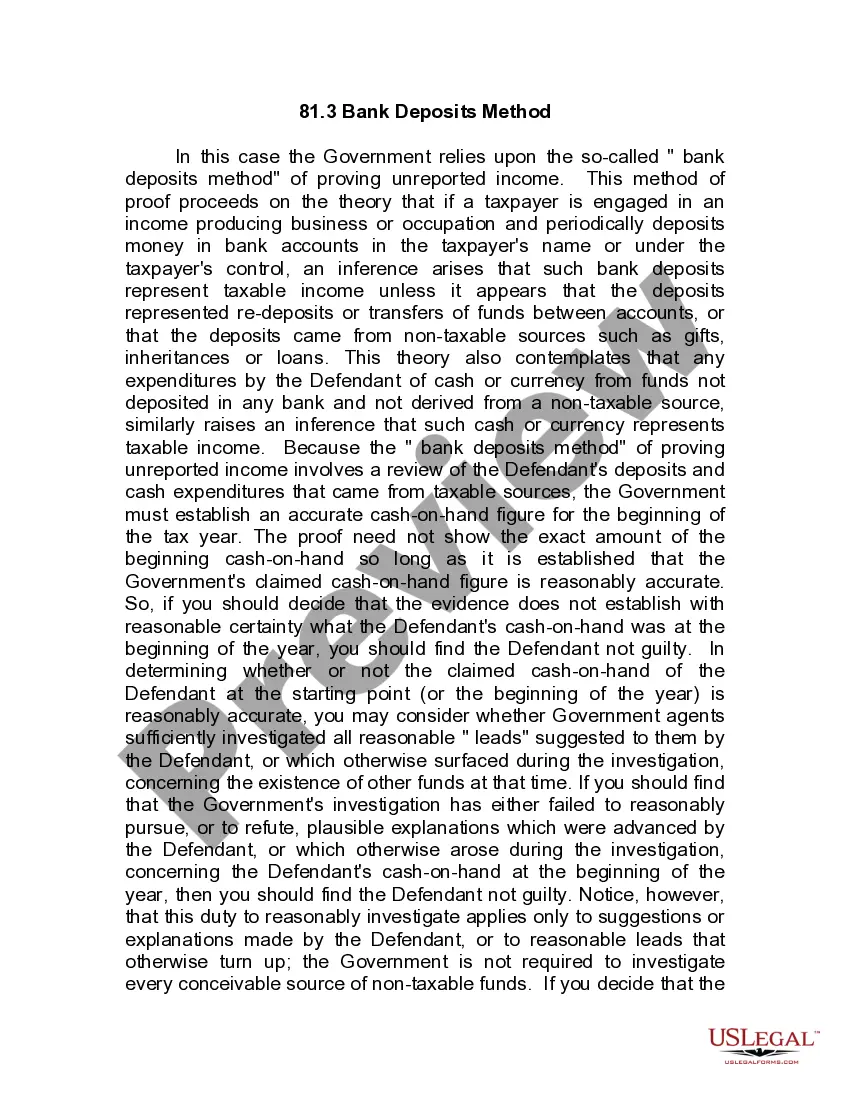

A blackout notice should contain information on the expected beginning and end date of the blackout. The notice should also provide the reason for the blackout and what rights will be restricted as a result. The notice must specify a plan contact for answering any questions about the blackout period.

A blackout period in financial markets is a period of time when certain peopleeither executives, employees, or bothare prohibited from buying or selling shares in their company or making changes to their pension plan investments. With company stock, a blackout period usually comes before earnings announcements.

How long does a blackout period last? A blackout period usually lasts about 10 business days. However, it may need to be extended due to unforeseen circumstances, which are rare; but there is no legal maximum limit for a blackout period.

A blackout period is a temporary interval during which access to certain actions is limited or denied. The primary purpose of blackout periods in publicly traded companies is to prevent insider trading. A blackout period for an employee retirement plan temporarily prevents participants from modifying their plans.

A blackout period is a time when participants are not able to access their 401(k) accounts because a major plan change is being made. During this time, they are not allowed to direct their investments, change their contribution rate or amount, make transfers, or take loans or distributions.

BLACKOUT NOTICE. EXPLANATION. DEFINITION OF A. BLACKOUT PERIOD. A blackout period is defined by the Department of Labor as a period of more than three consecutive business days during which participants will not be able to direct of diversify their investments, obtain a loan or take a distribution.

There is a mandatory 2 week blackout period for all employees of the Company prior to the release of quarterly and annual financial statements which shall continue until two trading days after the time such information has been released to the public.

When must the blackout notice be provided? In general, the employer must provide the blackout notice to all affected participants and beneficiaries at least 30 days, but not more than 60 days, before the last date the affected rights could be exercised before the blackout period begins.