Georgia Travel and Advance Authorization

Description

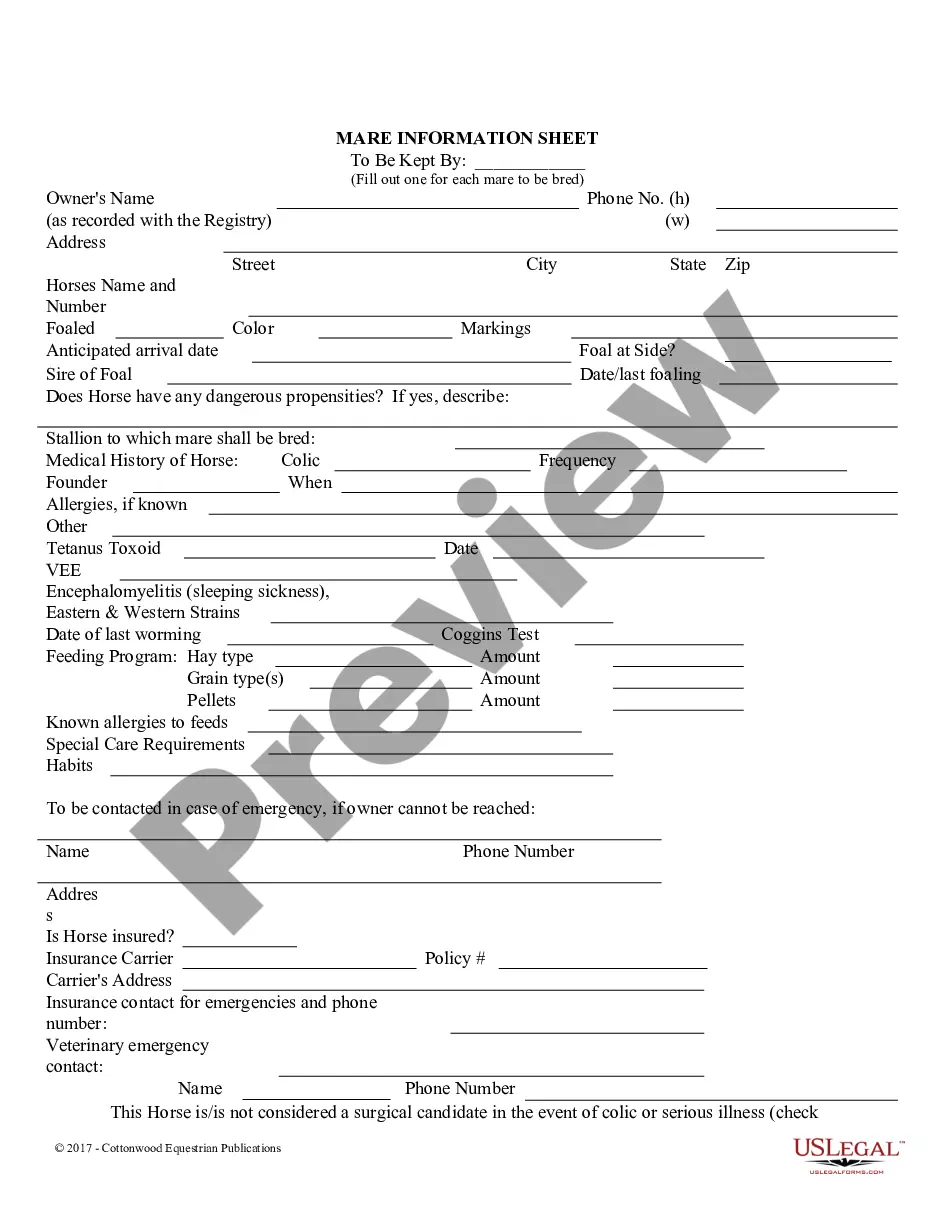

How to fill out Travel And Advance Authorization?

You are capable of dedicating hours on the internet trying to locate the legal document template that meets the federal and state requirements you require.

US Legal Forms offers a vast array of legal forms that have been reviewed by professionals.

You can easily download or print the Georgia Travel and Advance Authorization from the service.

If available, utilize the Preview button to view the document template as well. In order to find another version of the form, use the Search field to locate the template that suits your needs.

- If you already have a US Legal Forms account, you can Log In and click the Download button.

- Then, you can fill out, edit, print, or sign the Georgia Travel and Advance Authorization.

- Each legal document template you purchase belongs to you indefinitely.

- To obtain another copy of any purchased form, go to the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple directions below.

- First, make sure you have selected the correct document template for the state/city of your choice.

- Read the form details to ensure you have chosen the correct form.

Form popularity

FAQ

Items like postdated checks, certificates of deposit, IOUs, stamps, and travel advances are not classified as cash. These would customarily be classified in accounts such as receivables, short-term investments, supplies, or prepaid expenses.

Travel advances are funds occasionally issued to those eligible to receive them in order to cover travel costs. Prepaid travel represents money already spent (e.g., flights, hotel expenses, etc.) in advance of expected travel.

The term travel advance is used to describe a sum of money paid to an employee prior to business-related travel. An advance would cover reimbursable expenses such as meals, transportation, lodging, and incidental items. Companies can account for this cost as a prepaid expense or as accounts payable.

Units that have advance accounts should do the following:Design procedures based on separation of duties.Submit appropriate advance forms with original signatures.Debit a balance sheet account for the advance - not an operating account.Review advance accounts throughout the year.More items...

A Travel Advance is a payment made to a traveller prior to departing on a business trip. The travel advance must be accounted for within 10 days of his or her return by submitting a travel expense report.

The purpose of a travel advance is to provide a means for travelers to seek funds in advance of travel.

Travel advances are payments made before a trip takes place. They can be cash to an employee or non-employee traveler. Travel advances are granted when the traveler does not qualify for, or does not yet have, a Travel and Entertainment card.

Georgia workers' compensation law specifies exactly how much an individual is to be reimbursed for travel. Rule 203(e) states that the mileage reimbursement shall be paid at $0.40 per mile.

Examples of travel expenses include airfare and lodging, transport services, cost of meals and tips, use of communications devices. Travel expenses incurred while on an indefinite work assignment, which lasts more than one year according to the IRS, are not deductible for tax purposes.

If a corporation is required to make an advance payment, it is recorded as a prepaid expense on the balance sheet under the accrual accounting method.