Georgia Assignment of Security Agreement and Note with Recourse

Description

How to fill out Assignment Of Security Agreement And Note With Recourse?

Selecting the correct sanctioned document format can be quite a challenge.

Clearly, there are numerous templates accessible online, but how can you acquire the sanctioned form that you need.

Utilize the US Legal Forms site. This service provides thousands of templates, including the Georgia Assignment of Security Agreement and Note with Recourse, which you can employ for business and personal purposes.

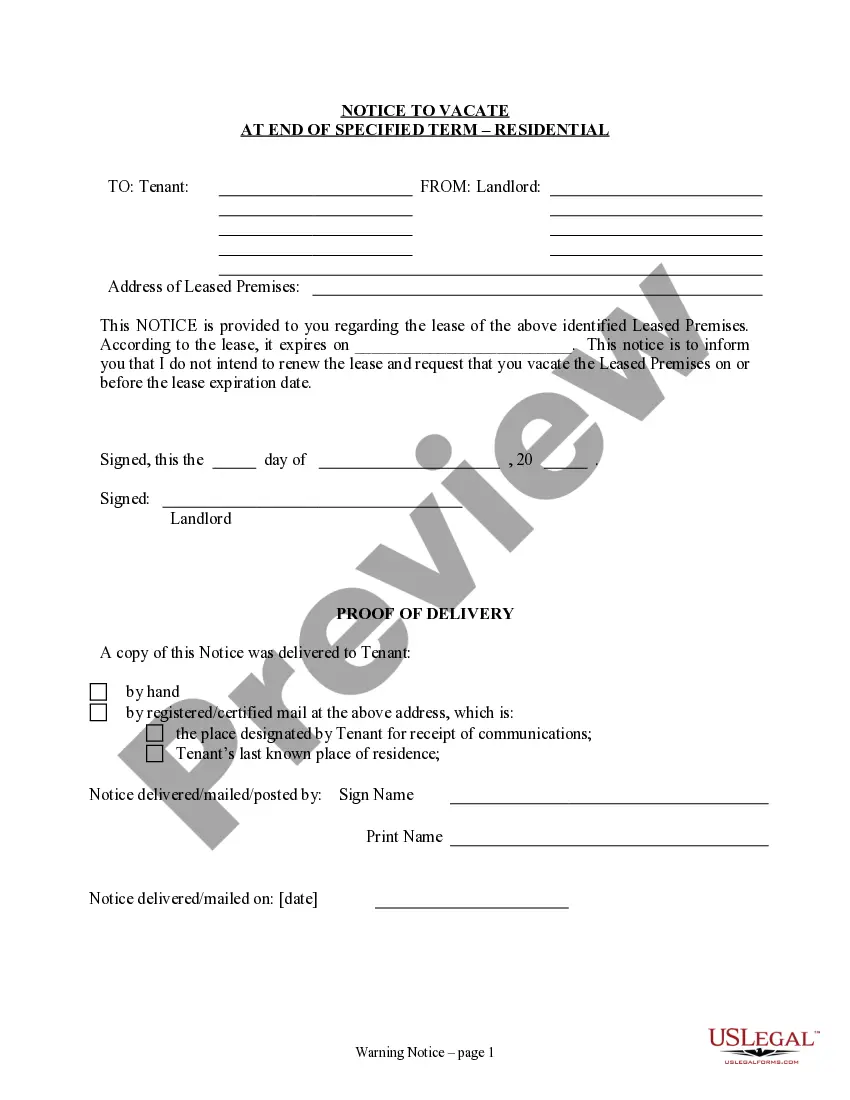

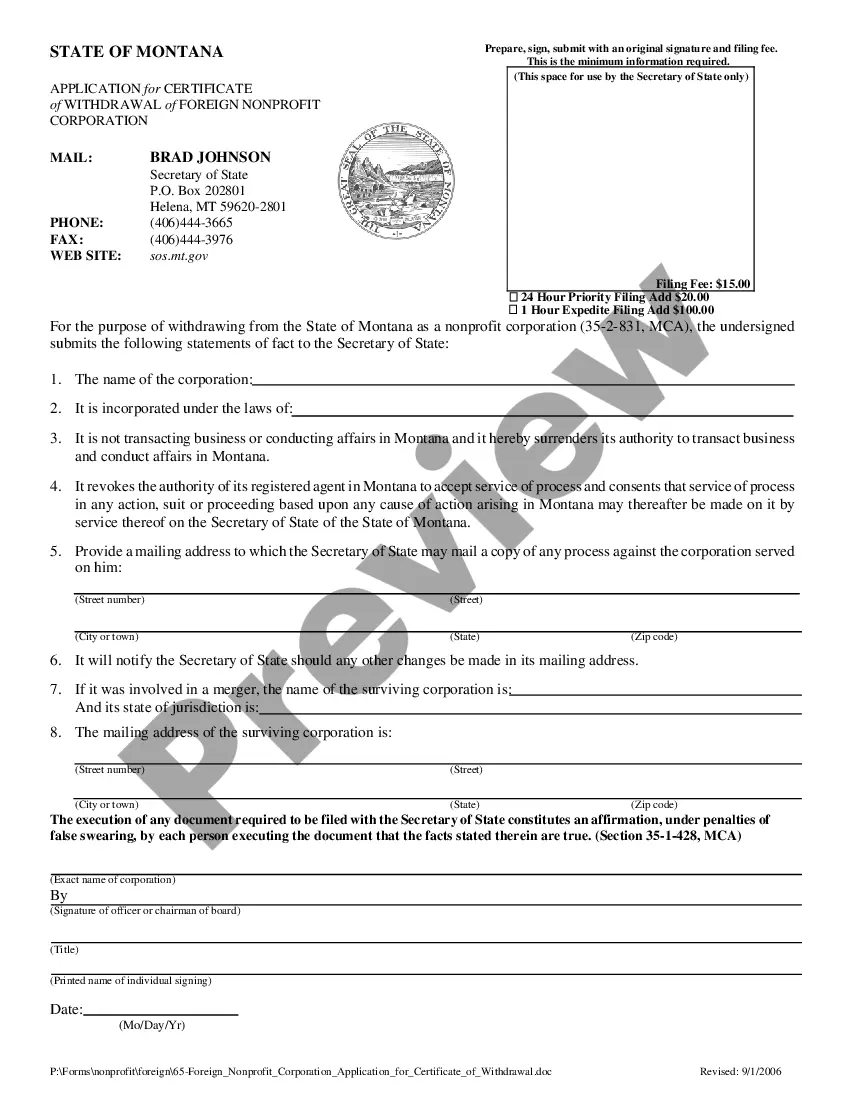

You can examine the form using the Review button and read the form description to confirm it is the correct one for your requirements.

- All of the documents are reviewed by professionals and comply with state and federal regulations.

- If you are already registered, Log In to your account and click the Acquire button to obtain the Georgia Assignment of Security Agreement and Note with Recourse.

- Use your account to search through the legal forms you have purchased previously.

- Go to the My documents section of your account and download another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple instructions for you to follow.

- First, ensure you have selected the appropriate form for your area/county.

Form popularity

FAQ

Assignment of Security Instruments means an instrument in a form reasonably acceptable to Buyer to be executed and delivered by Seller to sell, assign and transfer Buyer the security for an individual Assumed Loan.

What Is a Deed of Trust? A deed of trust, like a mortgage, pledges real property to secure a loan. This document is used instead of a mortgage in some states.

In general, the promissory note is your written promise to repay the loan and a security agreement is used when collateral is given for the loan.

A security agreement is a document that provides a lender a security interest in a specified asset or property that is pledged as collateral. Security agreements often contain covenants that outline provisions for the advancement of funds, a repayment schedule, or insurance requirements.

Unlike a promissory note, a loan agreement imposes obligations on both parties, which is why both the borrower and lender must sign the agreement. A loan agreement should state what purpose the loan is used for, and whether the borrower must provide compensation if the lender suffers loss.

A security agreement is a document that provides a lender a security interest in a specified asset or property that is pledged as collateral. Security agreements often contain covenants that outline provisions for the advancement of funds, a repayment schedule, or insurance requirements.

Loans from banks or other institutional lenders are always made using a number of documents, two of which are a promissory and security agreement. In general, the promissory note is your written promise to repay the loan and a security agreement is used when collateral is given for the loan.

Security agreements are generally used to supplement a secured promissory note. The note is the borrower's actual promise to repay the money it received. The enclosed security agreement assumes the existence of a secured promissory note, but that agreement is not included with this package.

A secured note is a type of loan or corporate bond that is backed by the borrower's assets as a form of collateral. If a borrower defaults on a secured note, the assets pledged as collateral can be sold to repay the note.