Georgia Unrestricted Charitable Contribution of Cash

Description

How to fill out Unrestricted Charitable Contribution Of Cash?

Are you in a scenario where you need to possess documentation for both organizational or personal reasons frequently.

There are numerous legitimate document templates accessible on the internet, but finding ones you can rely on is not simple.

US Legal Forms provides a vast array of form templates, including the Georgia Unrestricted Charitable Contribution of Cash, which can be downloaded to comply with federal and state regulations.

Utilize US Legal Forms, the most extensive collection of legal forms, to save time and avoid errors.

The service offers professionally crafted legal document templates that can be used for a variety of purposes. Create an account on US Legal Forms and start simplifying your life.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you will be able to download the Georgia Unrestricted Charitable Contribution of Cash template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you need and ensure it is for your correct city/region.

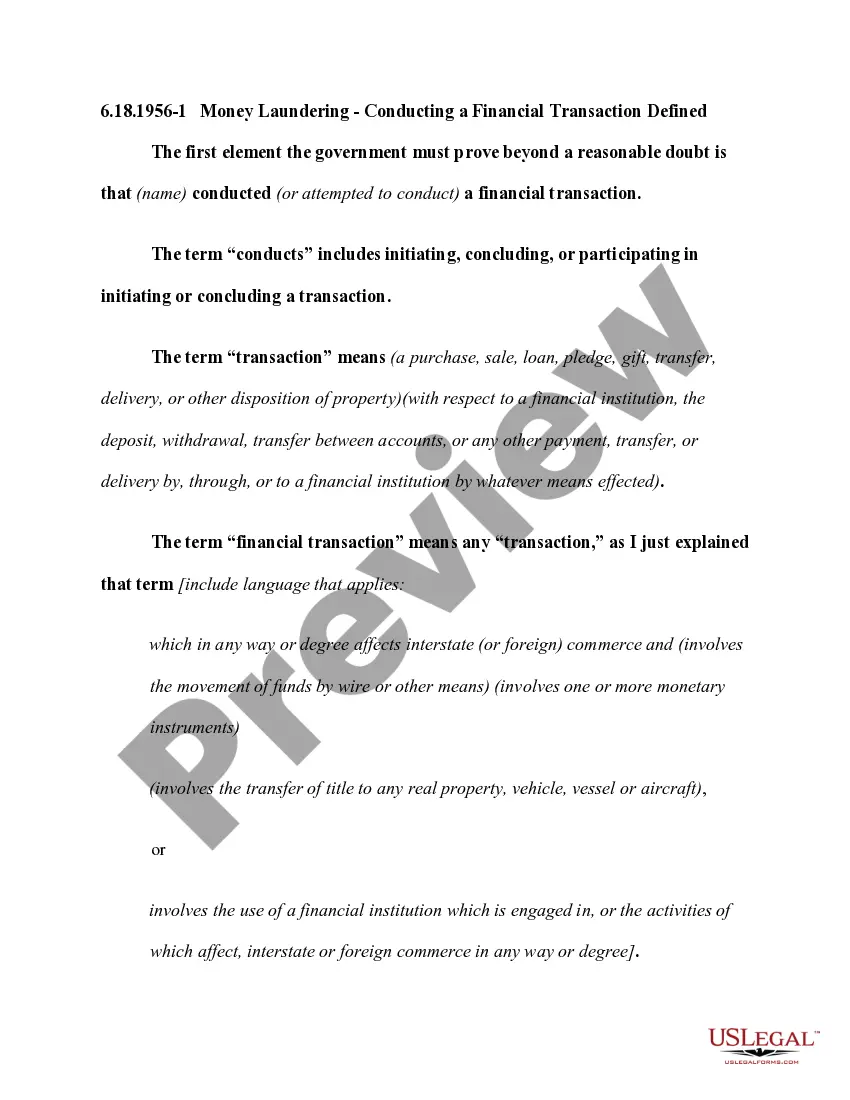

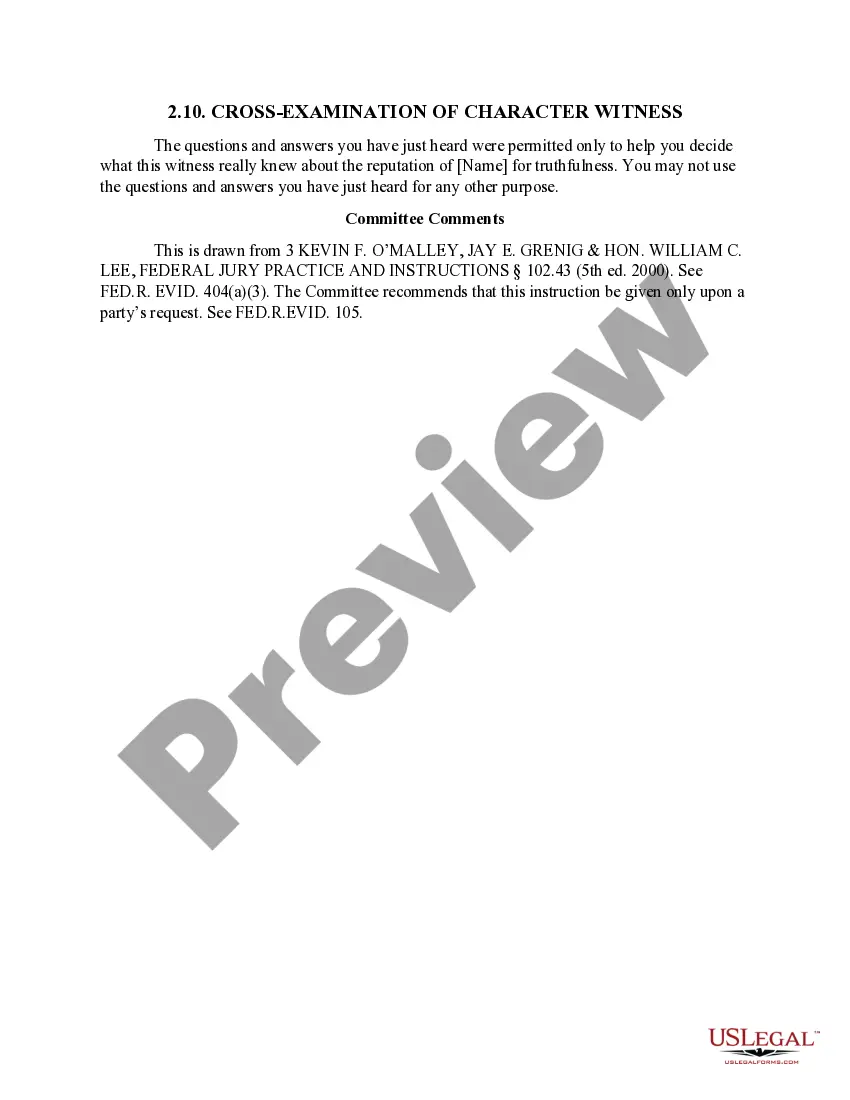

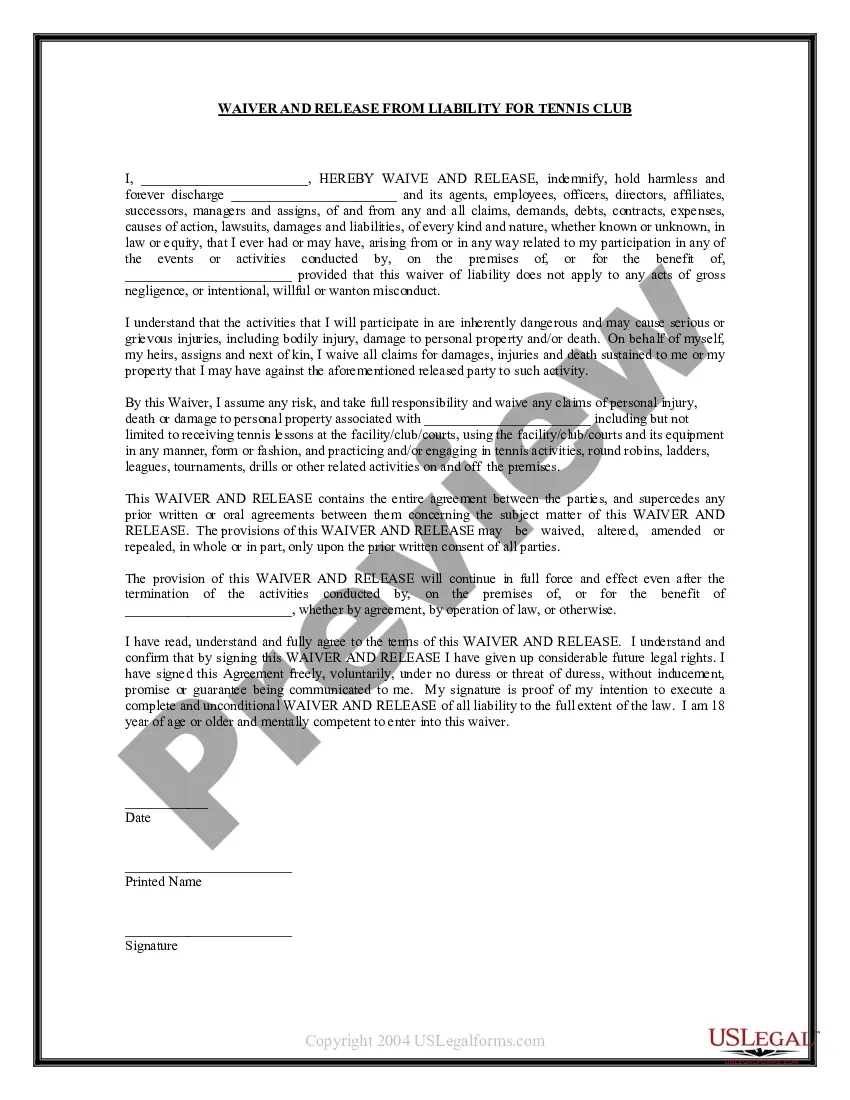

- Use the Preview button to view the form.

- Check the details to ensure you have selected the correct form.

- If the form is not what you are looking for, utilize the Search field to find the form that meets your requirements and specifications.

- Once you find the appropriate form, click Purchase now.

- Select the pricing option you want, provide the necessary information to process your payment, and make a purchase using your PayPal or credit card.

- Choose a convenient file format and download your copy.

- Access all the document templates you have purchased in the My documents section.

- You can retrieve an additional copy of the Georgia Unrestricted Charitable Contribution of Cash at any time if needed. Just select the necessary form to download or print the document template.

Form popularity

FAQ

For noncash charitable contributions, you typically use Form 8283 to report these donations on your tax return. This form allows you to detail the items you donated and their fair market value. If you made a Georgia Unrestricted Charitable Contribution of Cash, that contribution would not require this form but should still be documented properly. Utilizing resources from uslegalforms can simplify your understanding of the necessary forms and ensure compliance.

To deduct charitable contributions, you first need to itemize your deductions on your tax return. You can include the Georgia Unrestricted Charitable Contribution of Cash as part of your total charitable donations. Be sure to keep all receipts and documentation to support your contributions. If you are unsure of the process, consider using a trusted platform like uslegalforms to guide you through the necessary steps.

Obtaining 501(c)(3) status in Georgia involves several steps that can be straightforward with the right resources. First, you need to form a nonprofit corporation and apply for an Employer Identification Number (EIN). Then, you will file the IRS Form 1023 to apply for tax-exempt status, which includes detailing your Georgia Unrestricted Charitable Contribution of Cash activities. Using services like USLegalForms can streamline the preparation and submission of necessary paperwork.

To claim your charitable contributions, you will need to document your Georgia Unrestricted Charitable Contribution of Cash accurately. You typically report these donations on your federal tax return using Schedule A if you itemize deductions. Ensure you maintain records, including bank statements and receipts, as proof of your contributions. If you need guidance, platforms like USLegalForms can provide the necessary documentation tools.

Yes, charitable donations can be tax-deductible in Georgia. When you make a Georgia Unrestricted Charitable Contribution of Cash, you may qualify for federal and state tax deductions. It's essential to keep proper documentation, like receipts from the charity, to support your claims. Consulting a tax professional can help ensure you maximize your benefits.

Yes, Georgia allows charitable deductions for eligible contributions. Among these, Georgia Unrestricted Charitable Contributions of Cash are recognized, making it easier for you to support your favorite causes. By taking advantage of these deductions, you can contribute to the community while receiving potential tax benefits.

The maximum you can write off for charitable donations generally depends on your adjusted gross income. For cash contributions, you can typically deduct up to 60% of your AGI in Georgia Unrestricted Charitable Contributions of Cash. It’s important to track your contributions to make the most of your deductions.

Charitable contributions can be classified into various categories, including cash donations, in-kind contributions, and planned giving. For Georgia Unrestricted Charitable Contributions of Cash, it is essential to keep accurate records to support your tax claims. Classifying your contributions correctly ensures compliance with both state and federal tax laws.

Yes, nonprofits can be tax-exempt in Georgia if they meet the qualifying criteria set by the state and federal government. This tax-exempt status allows those organizations to receive Georgia Unrestricted Charitable Contributions of Cash without incurring tax liabilities. Donors benefit from making tax-deductible contributions to these nonprofits.

In Georgia, several expenses are tax deductible, including specific charitable contributions. You can deduct Georgia Unrestricted Charitable Contributions of Cash, subject to certain limits. Always keep your receipts and documentation to ensure compliance and maximize your deductions.