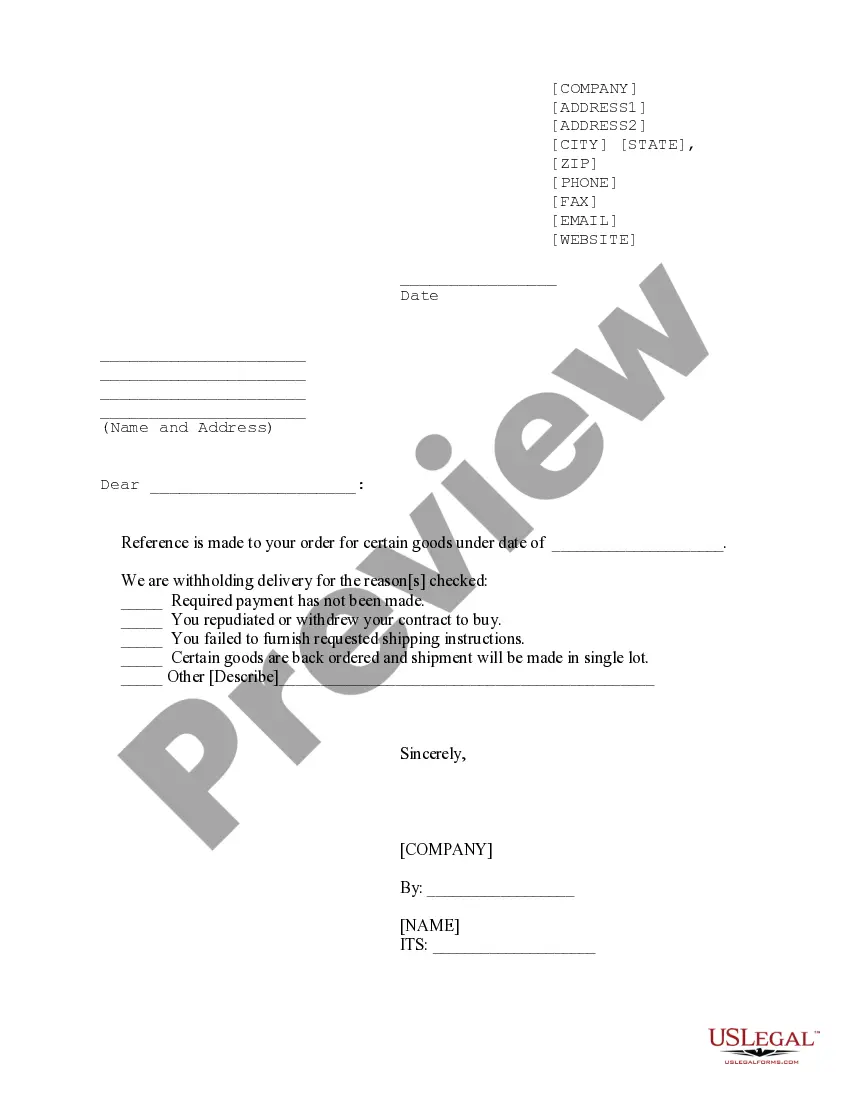

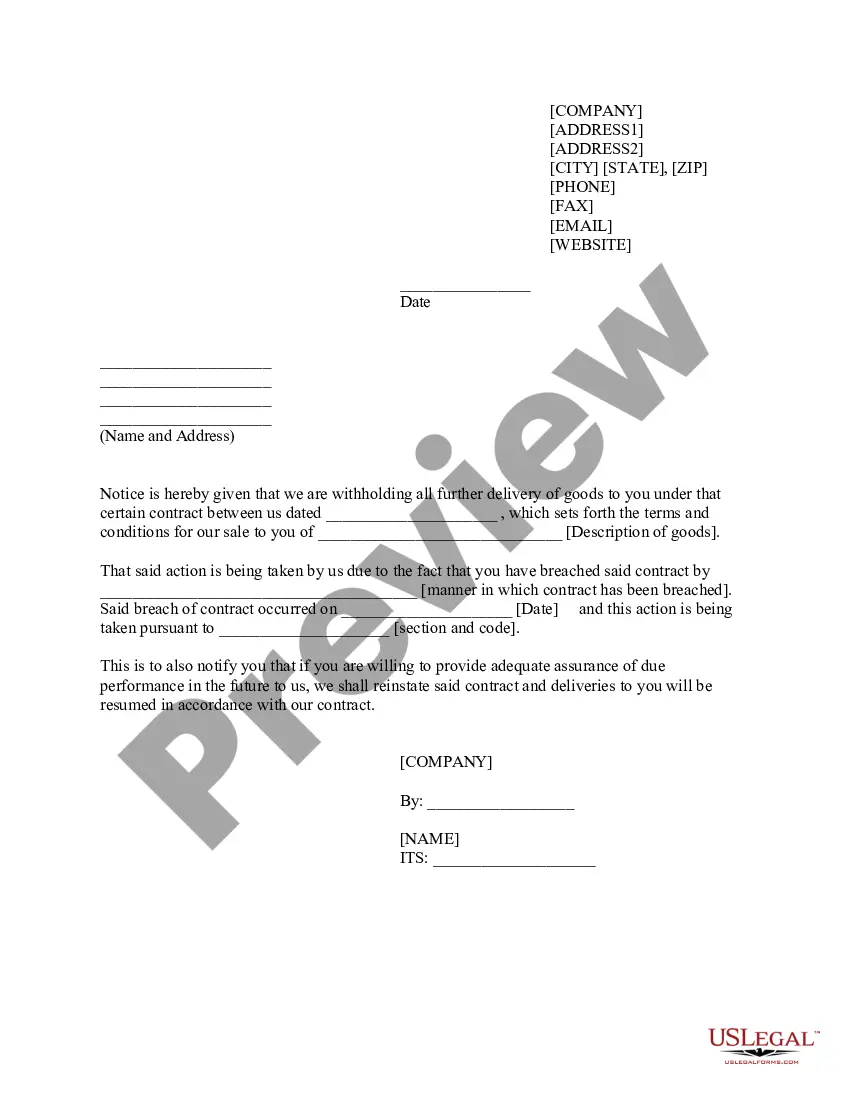

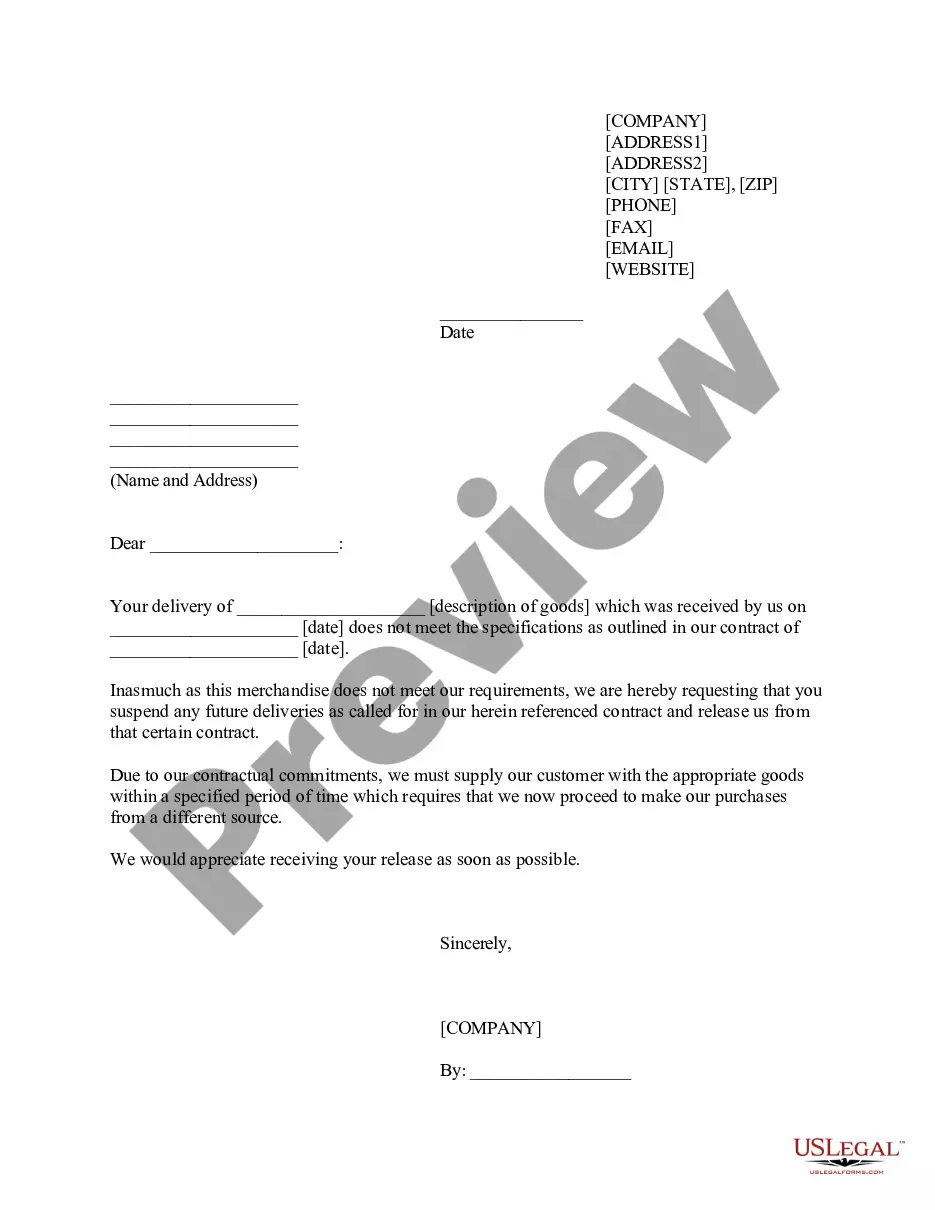

Georgia Withheld Delivery Notice

Description

How to fill out Withheld Delivery Notice?

You might spend hours online searching for the valid document format that fulfills the federal and state criteria you require.

US Legal Forms offers thousands of valid templates that have been evaluated by experts.

You can easily obtain or create the Georgia Withheld Delivery Notice from their service.

If you wish to find a different version of your form, utilize the Search field to locate the template that satisfies your needs and requirements.

- If you already have a US Legal Forms account, you can Log In and click on the Download button.

- Then, you can complete, modify, print, or sign the Georgia Withheld Delivery Notice.

- Every valid document you download is yours indefinitely.

- To obtain another copy of any downloaded form, visit the My documents tab and click on the appropriate button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions outlined below.

- First, ensure that you've selected the correct document format for the region/area of your choice.

- Review the form details to confirm you've chosen the right one. If available, make use of the Preview button to look at the format as well.

Form popularity

FAQ

The 2020 percentage method tables, standard deductions and personal allowances are unchanged from 2019. As we previously reported, the maximum Georgia income tax rate was temporarily reduced to 5.75% effective for tax year 2019, down from 6.0%.

Should I 0 or 1 on a Form W4 for Tax Withholding Allowance being a dependent? If you put "0" then more will be withheld from your pay for taxes than if you put "1"--so that is correct. The more "allowances" you claim on your W-4 the more you get in your take-home pay.

Check the box if you qualify to claim exempt from withholding. You can claim exempt if you filed a Georgia income tax return last year and the amount on Line 4 of Form 500EZ or Line 16 of Form 500 was zero, and you expect to file a Georgia tax return this year and will not have a tax liability.

Withholding is the amount deducted from wages for taxes: federal, state, or local.

Georgia requires employers to withhold state income tax from employees' wages and remit the amounts withheld to the Department of Revenue. Georgia residents working outside the state are exempt from Georgia income tax withholding if their compensation is subject to withholding in that state.

Georgia requires employers to withhold state income tax from employees' wages and remit the amounts withheld to the Department of Revenue. Georgia residents working outside the state are exempt from Georgia income tax withholding if their compensation is subject to withholding in that state.

How to Complete the W-4 Tax FormDetermine your allowances.Fill out your personal information.Claim an exemption if it applies.Fill out itemized deductions, if you're using them.Figure out how much additional withholding you need.

INSTRUCTIONS FOR COMPLETING FORM G-4Enter your full name, address and social security number in boxes 1 a through 2b. Line 3: Write the number of allowances you are claiming in the brackets beside your marital status. Line 4: Enter the number of dependent allowances you are entitled to claim.

The following states require state tax withholding whenever federal taxes are withheld. We will apply the state's default with- holding rate to the taxable portion of your distribution if you reside in: Iowa, Kansas, Maine, Massachusetts, Nebraska, Oklahoma, or Virginia. You may not elect out of state withholding.

If you want an extra set amount withheld from each paycheck to cover taxes on freelance income or other income, you can enter it on lines 4(a) and 4(c) of Form W-4.