Georgia Challenge to Credit Report of Experian, TransUnion, and/or Equifax

Description

How to fill out Challenge To Credit Report Of Experian, TransUnion, And/or Equifax?

Finding the right lawful papers design could be a have a problem. Naturally, there are a variety of themes available on the Internet, but how can you get the lawful kind you need? Take advantage of the US Legal Forms site. The support provides a huge number of themes, including the Georgia Challenge to Credit Report of Experian, TransUnion, and/or Equifax, that you can use for company and private demands. Every one of the forms are checked by professionals and fulfill federal and state requirements.

Should you be previously listed, log in to your accounts and click the Down load option to get the Georgia Challenge to Credit Report of Experian, TransUnion, and/or Equifax. Utilize your accounts to look throughout the lawful forms you have bought previously. Go to the My Forms tab of your respective accounts and obtain another duplicate in the papers you need.

Should you be a whole new consumer of US Legal Forms, here are simple recommendations that you should adhere to:

- First, ensure you have selected the right kind for the metropolis/region. You can look over the form utilizing the Review option and browse the form description to make certain it will be the right one for you.

- In the event the kind will not fulfill your preferences, use the Seach area to obtain the right kind.

- Once you are positive that the form would work, click on the Buy now option to get the kind.

- Select the prices plan you would like and enter in the required details. Design your accounts and purchase the order making use of your PayPal accounts or bank card.

- Opt for the file structure and download the lawful papers design to your device.

- Full, revise and print out and indicator the obtained Georgia Challenge to Credit Report of Experian, TransUnion, and/or Equifax.

US Legal Forms may be the greatest local library of lawful forms where you can see different papers themes. Take advantage of the service to download skillfully-made documents that adhere to state requirements.

Form popularity

FAQ

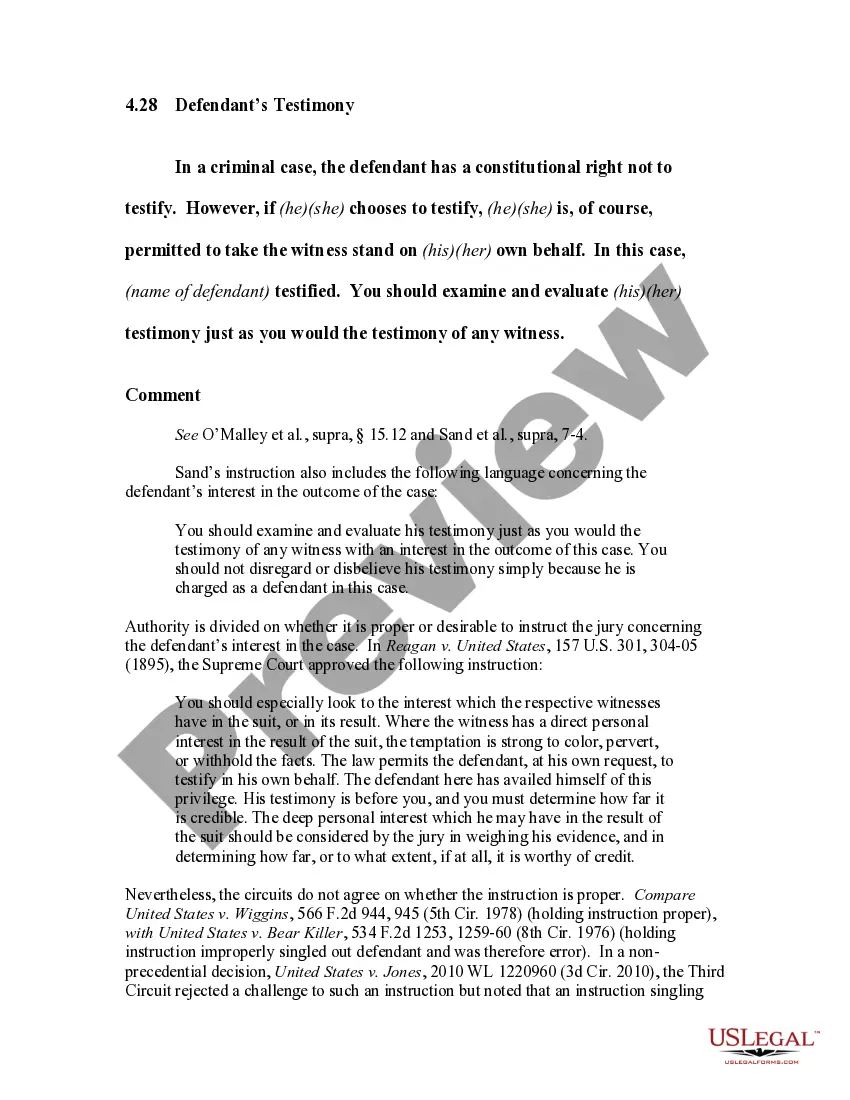

If you identify an error on your credit report, you should start by disputing that information with the credit reporting company (Experian, Equifax, and/or Transunion). You should explain in writing what you think is wrong, why, and include copies of documents that support your dispute.

When you are applying for a mortgage to buy a home, lenders will typically look at all of your credit history reports from the three major credit bureaus ? Experian, Equifax, and TransUnion. In most cases, mortgage lenders will look at your FICO score. There are different FICO scoring models.

FICO ® Scores are the most widely used credit scores?90% of top lenders use FICO ® Scores. Every year, lenders access billions of FICO ® Scores to help them understand people's credit risk and make better?informed lending decisions.

Although Experian is the largest credit bureau in the U.S., TransUnion and Equifax are widely considered to be just as accurate and important.

To freeze your credit, you have to contact each of the three credit bureaus individually. Placing a credit freeze is free for you and your children, as is lifting it when applying for new credit.

More companies use Experian for credit reporting than use Equifax. This alone does not make Experian better, but it does indicate that any particular debt is more likely to appear on an Experian reports.

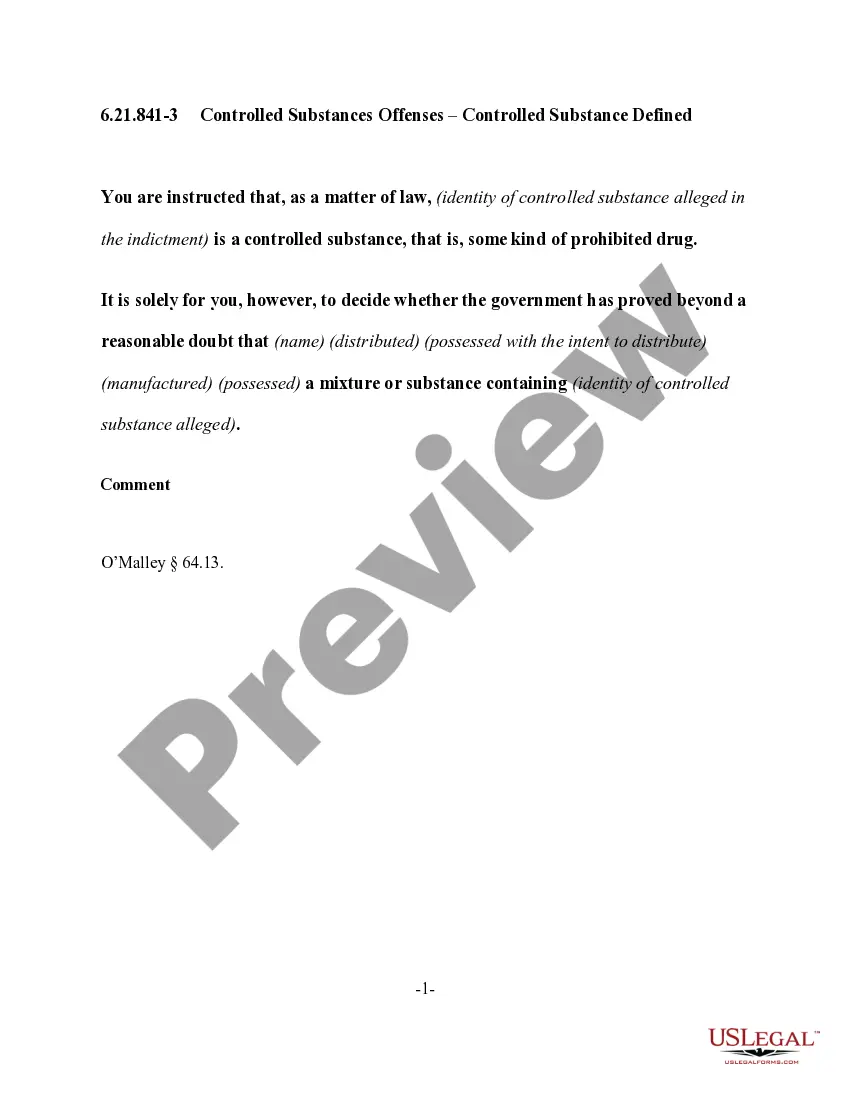

The Georgia Fair Credit Reporting Act is a law that is an add-on to the federal Fair Credit Reporting Act ("FCRA") which requires creditors, also known as furnishers, and the crediting reporting agencies or CRAs maintain the accuracy of consumer credit reports and files.

Lenders typically use your FICO® Score to gauge your creditworthiness. Compared to TransUnion's algorithm, Equifax's algorithm more closely resembles the FICO® model. Therefore, your Equifax score may better predict whether you'll qualify for a loan. Your Equifax score won't be a tell-all, though.