Georgia Assignment of Commercial Leases as Collateral for Commercial Loan

Description

How to fill out Assignment Of Commercial Leases As Collateral For Commercial Loan?

You are able to invest hours on the Internet attempting to find the authorized papers format which fits the state and federal needs you need. US Legal Forms provides thousands of authorized kinds that happen to be analyzed by pros. You can actually acquire or print out the Georgia Assignment of Commercial Leases as Collateral for Commercial Loan from my services.

If you have a US Legal Forms bank account, you are able to log in and click on the Down load option. After that, you are able to comprehensive, modify, print out, or indicator the Georgia Assignment of Commercial Leases as Collateral for Commercial Loan. Each and every authorized papers format you buy is the one you have forever. To have an additional backup of the bought kind, go to the My Forms tab and click on the related option.

If you work with the US Legal Forms website initially, adhere to the straightforward guidelines beneath:

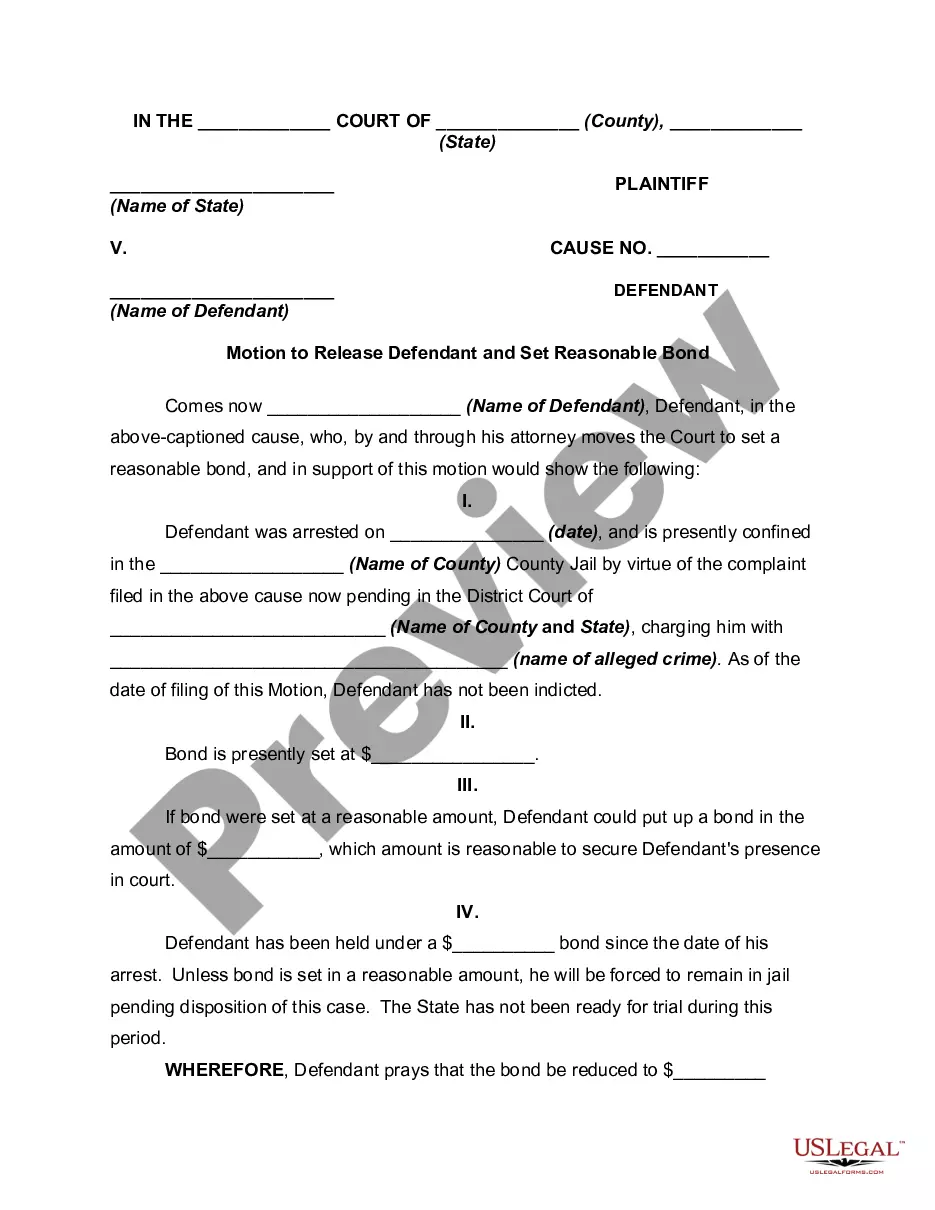

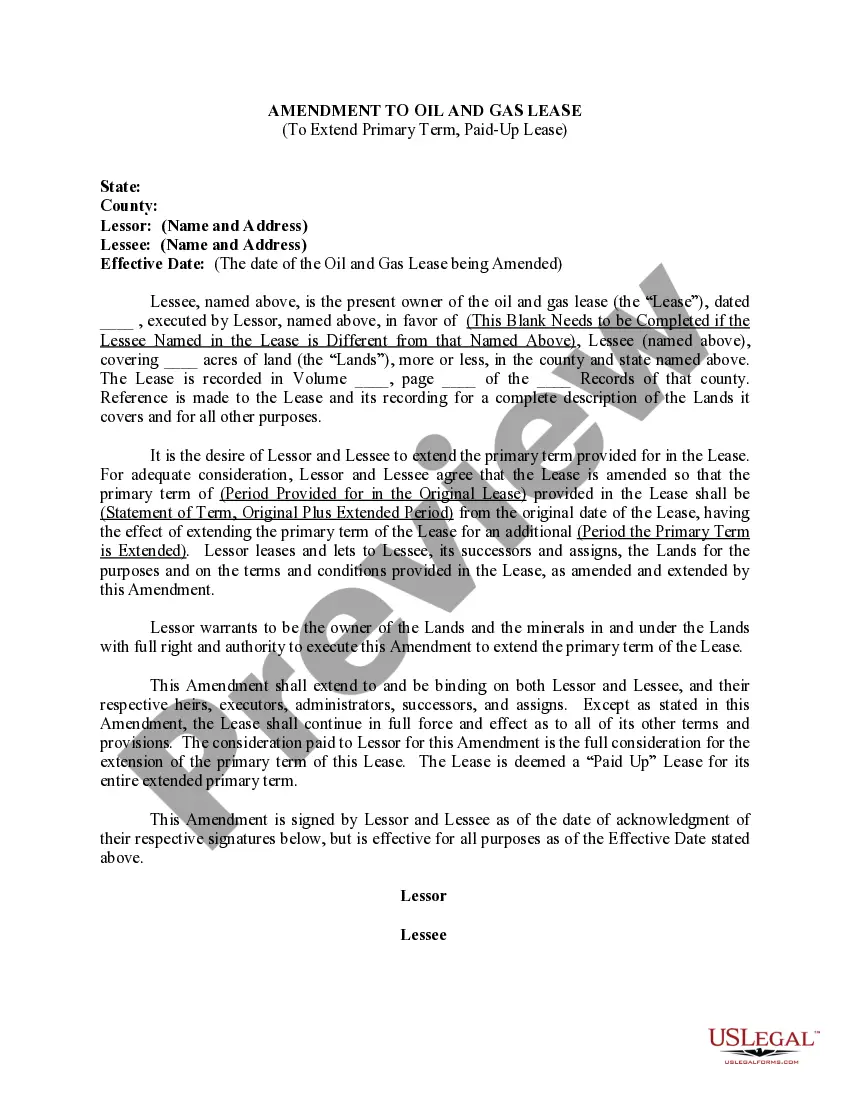

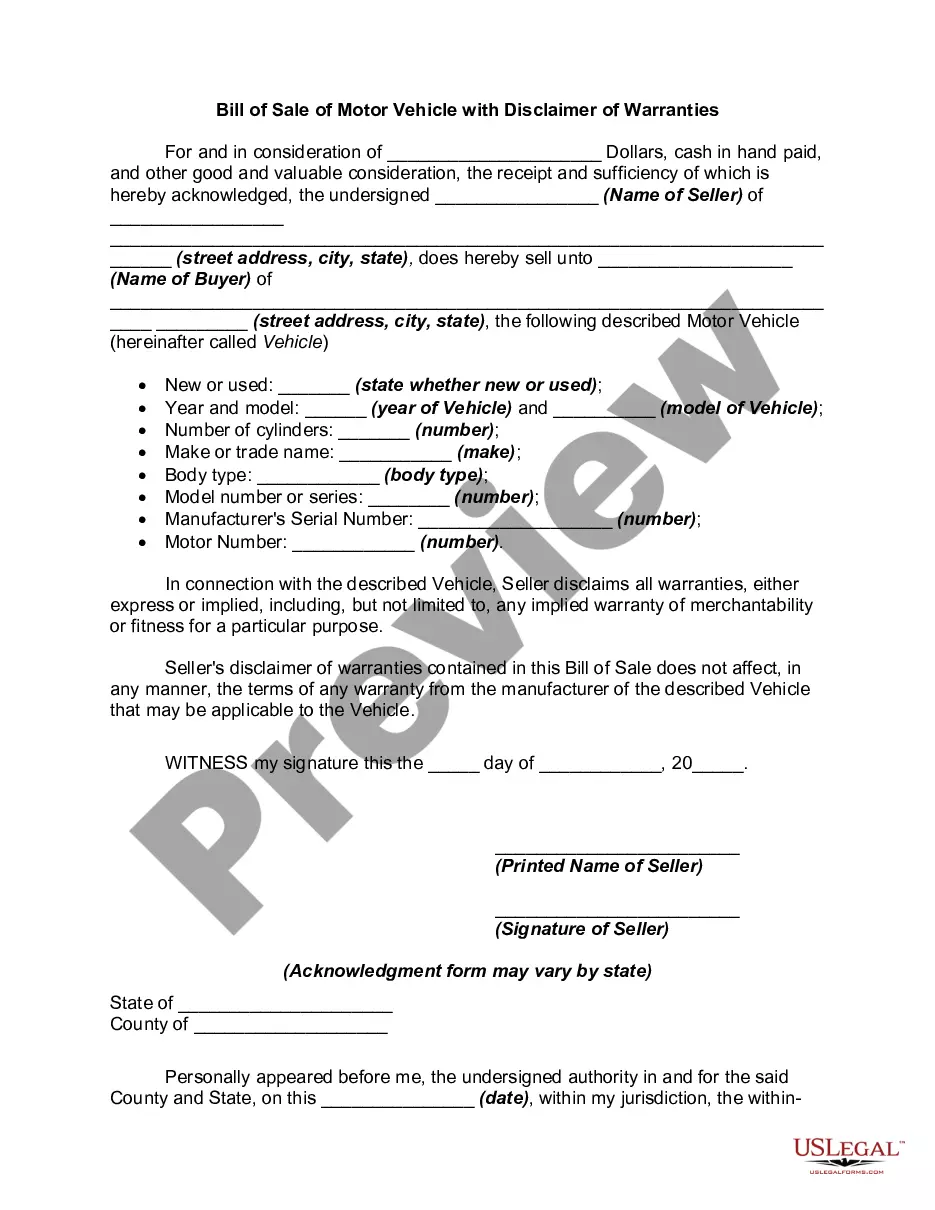

- Very first, ensure that you have chosen the best papers format for your county/area of your liking. Read the kind explanation to ensure you have picked out the proper kind. If available, utilize the Review option to search throughout the papers format at the same time.

- In order to locate an additional version of the kind, utilize the Look for area to get the format that meets your needs and needs.

- After you have identified the format you desire, click Purchase now to proceed.

- Find the costs program you desire, type in your credentials, and sign up for an account on US Legal Forms.

- Complete the purchase. You may use your charge card or PayPal bank account to pay for the authorized kind.

- Find the formatting of the papers and acquire it to your system.

- Make alterations to your papers if required. You are able to comprehensive, modify and indicator and print out Georgia Assignment of Commercial Leases as Collateral for Commercial Loan.

Down load and print out thousands of papers web templates utilizing the US Legal Forms site, that provides the largest collection of authorized kinds. Use skilled and express-distinct web templates to take on your business or individual requires.

Form popularity

FAQ

Key Purposes of a Collateral Assignment Collateral assignment concerns allocating a property's ownership privileges, or a specific interest, to a lender as loan collateral. The lender retains a security interest in the asset until the borrower entirely settles the loan.

What is an assignment of leases? An assignment is when the tenant transfers their lease interest to a new tenant using a Lease Assignment. The assignee takes the assignors place in the landlord-tenant relationship, although the assignor may remain liable for damages, missed rent payments, and other lease violations.

By contrast, an assignment occurs when you transfer all your space to someone else (called an assignee) for the entire remaining term of the lease. As with a sublet, you are free to choose your assignee and determine the rent unless your lease says otherwise.

You have a whole life insurance policy with a cash value of $65,000 and a death benefit of $300,000, which the bank accepts as collateral. So, you then designate the bank as the policy's assignee until you repay the $50,000 loan.

Sample 1Sample 2. Lease Collateral means all security deposits, letters of credit, advance payments and any other property provided by the Lessees of the Engines as security for the payment and performance of the obligations of such Lessees under the Leases of the Engines. Sample 1Sample 2.

With an absolute assignment, the entire ownership of the policy would be transferred to the assignee, or the lender. Then, the lender would be entitled to the full death benefit. With a collateral assignment, the lender is only entitled to the balance of the outstanding loan.

A collateral assignment of life insurance is a method of securing a loan by using a life insurance policy as collateral. If you pass away before the loan is repaid, the lender can collect the outstanding loan balance from the death benefit of your life insurance policy.

A collateral assignment of lease is a legal contract that transfers the rights to rental payments from the asset's owner to a lender to secure funding. In this contract, the lease's rentals are like a loan from the funder to the lessor and the lease acts as security.