Georgia Letter to Creditor Requesting a Temporary Payment Reduction

Description

How to fill out Letter To Creditor Requesting A Temporary Payment Reduction?

If you need to compile, obtain, or produce legal document templates, utilize US Legal Forms, the largest selection of legal forms, which are accessible online.

Employ the website's straightforward and user-friendly search to find the documents you need.

Various templates for business and personal purposes are organized by categories and jurisdictions, or keywords.

Step 4. Once you have found the form you need, click the Buy now button. Choose the payment plan you prefer and provide your details to register for an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Employ US Legal Forms to obtain the Georgia Letter to Creditor Requesting a Temporary Payment Reduction in just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and click the Download button to receive the Georgia Letter to Creditor Requesting a Temporary Payment Reduction.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, adhere to the instructions below.

- Step 1. Ensure you have selected the form for the correct area/state.

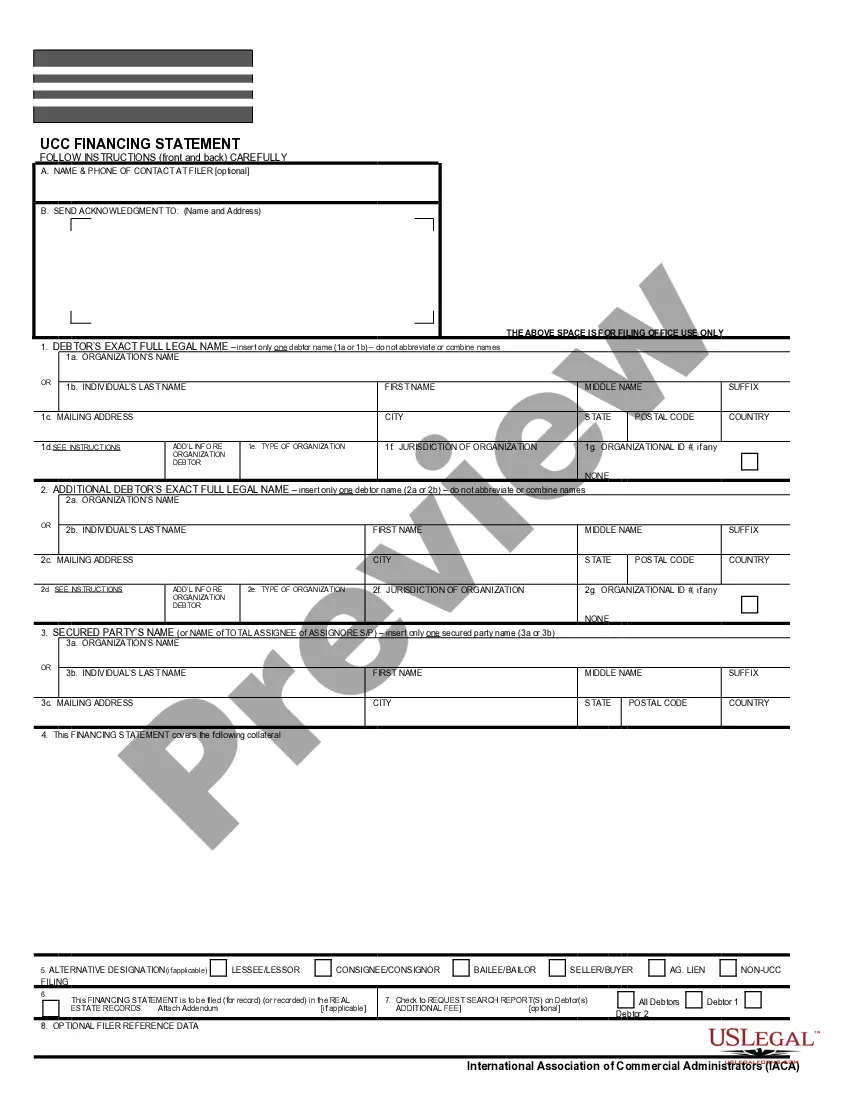

- Step 2. Utilize the Preview feature to review the form’s details. Remember to read the description.

- Step 3. If you are not satisfied with the form, use the Search bar at the top of the page to find other versions in the legal form format.

Form popularity

FAQ

Bank statements showing a reduction of income, essential spending and reduced savings. a report from a financial counselling service. debt repayment agreements. any other evidence you have to explain your circumstances.

Dear Sir/Madam, I have obtained a car/home/personal loan from your esteemed bank as per the following details. I would like to humbly request you to lower the interest rate on the loan amount as it is becoming extremely difficult for me to pay the loan installments. a) Loan account number: .

Tips for Writing a Hardship LetterKeep it original.Be honest.Keep it concise.Don't cast blame or shirk responsibility.Don't use jargon or fancy words.Keep your objectives in mind.Provide the creditor an action plan.Talk to a Financial Couch.

Dear Creditor: Due to a layoff, I am temporarily out of work and am experiencing financial difficulty. Due to my financial hardship and in order to meet necessary household expenses plus credit payments, I am asking each creditor to accept a reduced payment for the next (#) months on my debt.

Some examples of events that a lender may consider to be a financial hardship include:Layoff or reduction in pay.New or worsening disability.Serious injury.Serious illness.Divorce or legal separation.Death.Incarceration.Military deployment or Permanent Change of Station orders.More items...?19-Nov-2021

Contact the creditor you've selected and ask the requirements for a letter of credit. You'll need to follow the creditor's procedures to get your letter. Provide any documents the creditor requests, such as the agreement you have with the seller and your financial documents.

10 Tips for Negotiating with CreditorsIs Negotiation the Right Move For You? It's important to think carefully about negotiation.Know Your Terms.Keep Your Story Straight.Ask Questions, and Don't Tolerate Bullying.Take Notes.Read and Save Your Mail.Talk to Creditors, Not Collection Agencies.Get It in Writing.More items...?

I am hoping you will accept a reduced payment of per month. Amounts will be increased as soon as possible until the debt is totally paid. I hope you find this plan acceptable. I look forward to your letter of acknowledgement; I have enclosed a pre-addressed envelope for your use.

How to Write a Hardship Letter The Ultimate GuideHardship Examples. There are a variety of situations that may qualify as a hardship.Keep it original.Be honest.Keep it concise.Don't cast blame or shirk responsibility.Don't use jargon or fancy words.Keep your objectives in mind.Provide the creditor an action plan.More items...

Dear Sir/ Madam, This is in with reference to the purchase of (Product/ Service/ Project) against your purchase order no. (order number) dated // (Date). We would like to request you for changing payment terms to (mention new terms).