Georgia Sample Letter for Attempt to Collect Debt before Acceleration

Description

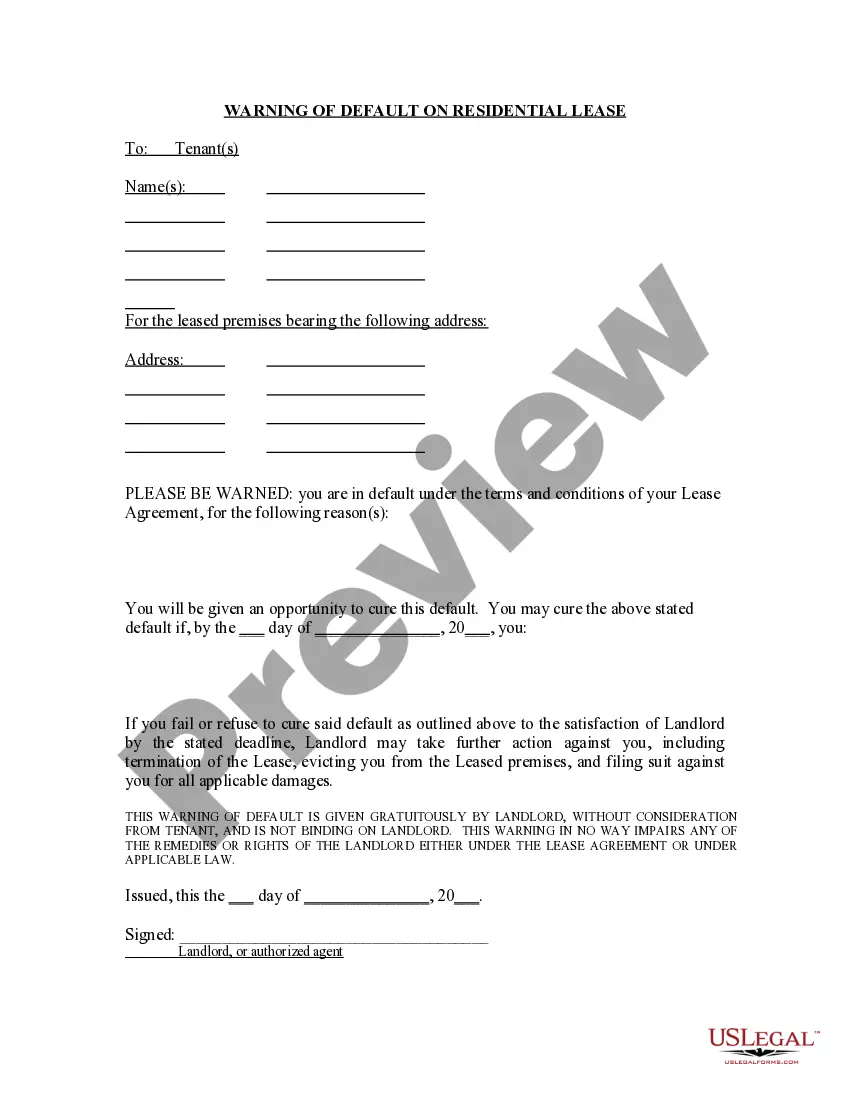

How to fill out Sample Letter For Attempt To Collect Debt Before Acceleration?

You may devote several hours on the web searching for the legal papers template that fits the federal and state demands you will need. US Legal Forms supplies 1000s of legal types that happen to be examined by pros. You can actually download or produce the Georgia Sample Letter for Attempt to Collect Debt before Acceleration from our assistance.

If you already have a US Legal Forms profile, you can log in and click on the Acquire switch. Afterward, you can total, edit, produce, or sign the Georgia Sample Letter for Attempt to Collect Debt before Acceleration. Each legal papers template you acquire is yours for a long time. To get one more version of the acquired type, visit the My Forms tab and click on the related switch.

If you use the US Legal Forms website for the first time, follow the easy instructions listed below:

- First, make sure that you have chosen the best papers template for that region/city that you pick. Browse the type explanation to make sure you have chosen the right type. If readily available, use the Preview switch to appear through the papers template also.

- In order to locate one more version of your type, use the Search field to get the template that fits your needs and demands.

- Once you have found the template you want, just click Buy now to proceed.

- Select the rates strategy you want, type your qualifications, and register for a merchant account on US Legal Forms.

- Complete the deal. You may use your credit card or PayPal profile to pay for the legal type.

- Select the structure of your papers and download it for your device.

- Make adjustments for your papers if possible. You may total, edit and sign and produce Georgia Sample Letter for Attempt to Collect Debt before Acceleration.

Acquire and produce 1000s of papers templates using the US Legal Forms Internet site, which offers the biggest variety of legal types. Use expert and status-distinct templates to take on your business or personal demands.

Form popularity

FAQ

Collectors are required by Fair Debt Collection Practices Act (FDCPA) to send you a written debt validation notice with information about the debt they're trying to collect. It must be sent within five days of the first contact. The debt validation letter includes: The amount owed.

The letter typically includes the amount of debt, the date it was incurred, and consequences for non-payment like legal action or late fees. Debt collection letters are often the first step in the debt collection process.

How to Write An Effective Collection Letter Reference the products or services that were purchased. ... Maintain a friendly but firm tone. ... Remind the payee of their contract or agreement with you. ... Offer multiple ways the payee can take action. ... Add a personal touch. ... Give them a new deadline.

The collection dispute letter to debt collectors should include the following information: Your details ? name, address, official email address, etc. Request for more information about the creditor. Amount of debt owed. A request note to not report the matter to the credit reporting agency until the matter is resolved.

What do you include in a debt collection letter? The amount the debtor owes you, including any interest (attach the original invoice as well); The initial date of payment and the new date of payment; Clear instructions on how to pay the outstanding debt (banking details, etc);

This first collection letter should contain the following information: Days past due. Amount due. Note previous attempts to collect. Summary of account. Instructions- what would you like them to do next? Due date for payment- it is important to use an actually date, not ?in the next 7 business days? as this can be vague.

Dear [RECIPIENT'S NAME], Despite our previous reminders, the above amount due remains unpaid. As such, we would appreciate you making this payment as soon as possible. We regret to advise that unless payment is received by [DATE] this collection will be passed over to our debt collection agency/lawyer.

Start with a polite reminder or enquiry about the bill, as overdue payment may not be any fault of the customer, and then follow up as necessary. Try one or more of the follow-up tactics below: Personal visit ? a face-to-face encounter can often solve the issue or ensure you get priority treatment.