Georgia Provision in Testamentary Trust with Bequest to Charity for a Stated Charitable Purpose

Description

How to fill out Provision In Testamentary Trust With Bequest To Charity For A Stated Charitable Purpose?

Locating the appropriate authentic document template can be a challenge. Of course, there are numerous templates available online, but how do you secure the authentic form you need? Utilize the US Legal Forms website. This service offers an extensive array of templates, such as the Georgia Provision in Testamentary Trust with Bequest to Charity for a Stated Charitable Purpose, which you can utilize for both professional and personal needs. All the forms are verified by experts and comply with state and federal regulations.

If you are already registered, Log Into your account and click the Download button to obtain the Georgia Provision in Testamentary Trust with Bequest to Charity for a Stated Charitable Purpose. Use your account to track the legitimate forms you have previously acquired. Visit the My documents section of your account to obtain another copy of the document you need.

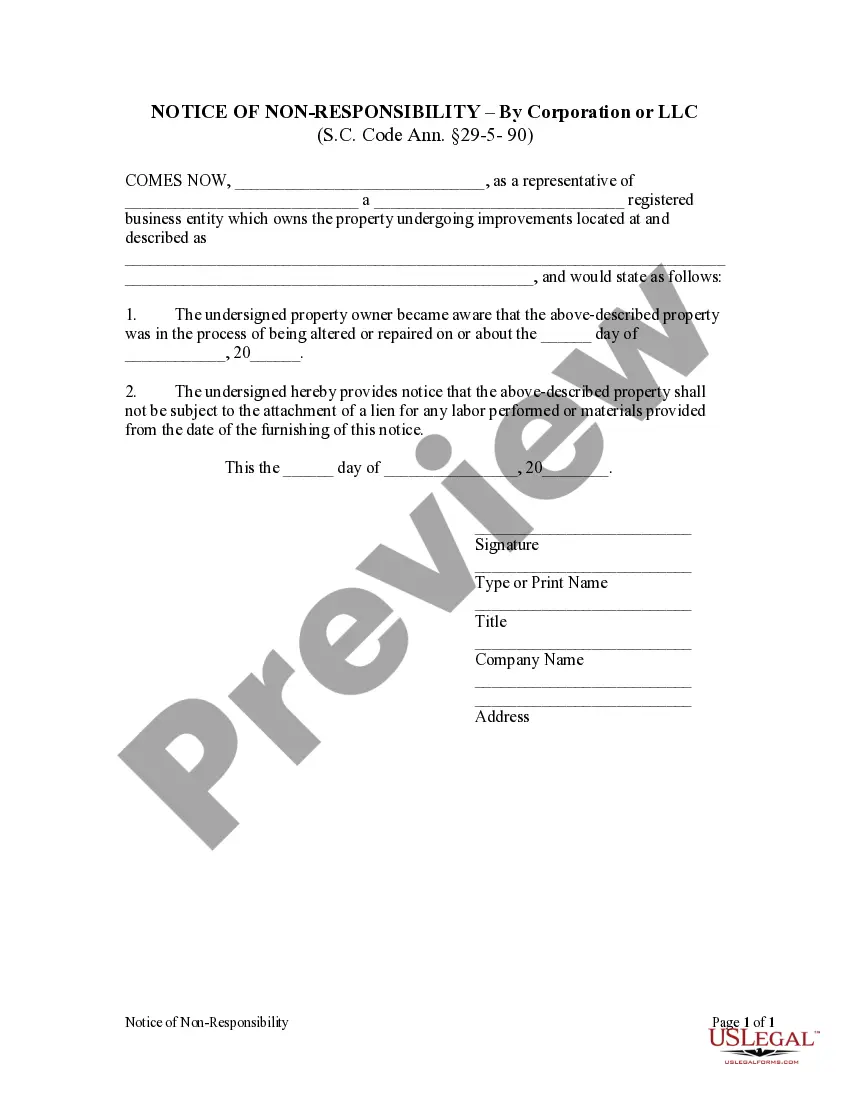

If you are a new user of US Legal Forms, here are simple instructions you can follow: First, ensure you have chosen the correct form for your jurisdiction/region. You can review the document using the Review button and browse the form summary to confirm it is suitable for you.

US Legal Forms is the largest collection of legal forms where you can find a variety of document templates. Utilize this service to acquire well-crafted documents that adhere to state requirements.

- If the document does not meet your needs, utilize the Search field to find the right form.

- Once you are sure the form is appropriate, click the Acquire now button to obtain the document.

- Select the pricing option you desire and fill in the required information.

- Create your account and complete the purchase using your PayPal account or credit card.

- Choose the file format and download the legal document template to your device.

- Complete, modify, print, and sign the acquired Georgia Provision in Testamentary Trust with Bequest to Charity for a Stated Charitable Purpose.

Form popularity

FAQ

Yes, a charitable trust can exist while the creator is alive if it is established as an inter vivos trust. However, many people choose to create a charitable trust through their will, which will take effect upon their death. By incorporating the Georgia Provision in Testamentary Trust with Bequest to Charity for a Stated Charitable Purpose, you can solidify your legacy while also enjoying tax benefits during your lifetime if applicable.

A charitable bequest is a gift in a will that is designated for charitable purpose.

Unlike with private trusts, the common law Rule Against Perpetuities (Rule) does not apply to the duration of charitable trusts.

RULE AGAINST PERPETUITIES. The rule against perpetuities applies to trusts other than charitable trusts. Accordingly, an interest is not good unless it must vest, if at all, not later than 21 years after some life in being at the time of the creation of the interest, plus a period of gestation.

1) Vested interest is not affected by the rule because once the interest are vested it cannot be bad for remoteness. 2) The rule is not applicable to land purchased or held by Corporation. 3) Gift to charities, the rule does not apply to transfer for the benefit of public for religious, pious, or charitable purposes.

A charitable trust is a type of charity run by a small group of people known as trustees. The trustees are appointed rather than elected, and there is no wider membership. A charitable trust is not incorporated, so it cannot enter into contracts or own property in its own right.

Charitable trust. noun. a trust set up for the benefit of a charity that complies with the regulations of the Charity Commissioners to enable it to be exempt from paying income tax.

A charitable trust is an irrevocable trust established for charitable purposes and, in some jurisdictions, a more specific term than "charitable organization". A charitable trust enjoys a varying degree of tax benefits in most countries.

There are two main types of charitable trusts charitable lead trusts (CLTs) and charitable remainder trusts (CRTs).

Cash: A trust's or estate's cash donations to charity can be deducted to the extent of the lesser of the taxable income for the year or the amount of the contribution.