Georgia Sample Letter of Credit

Description

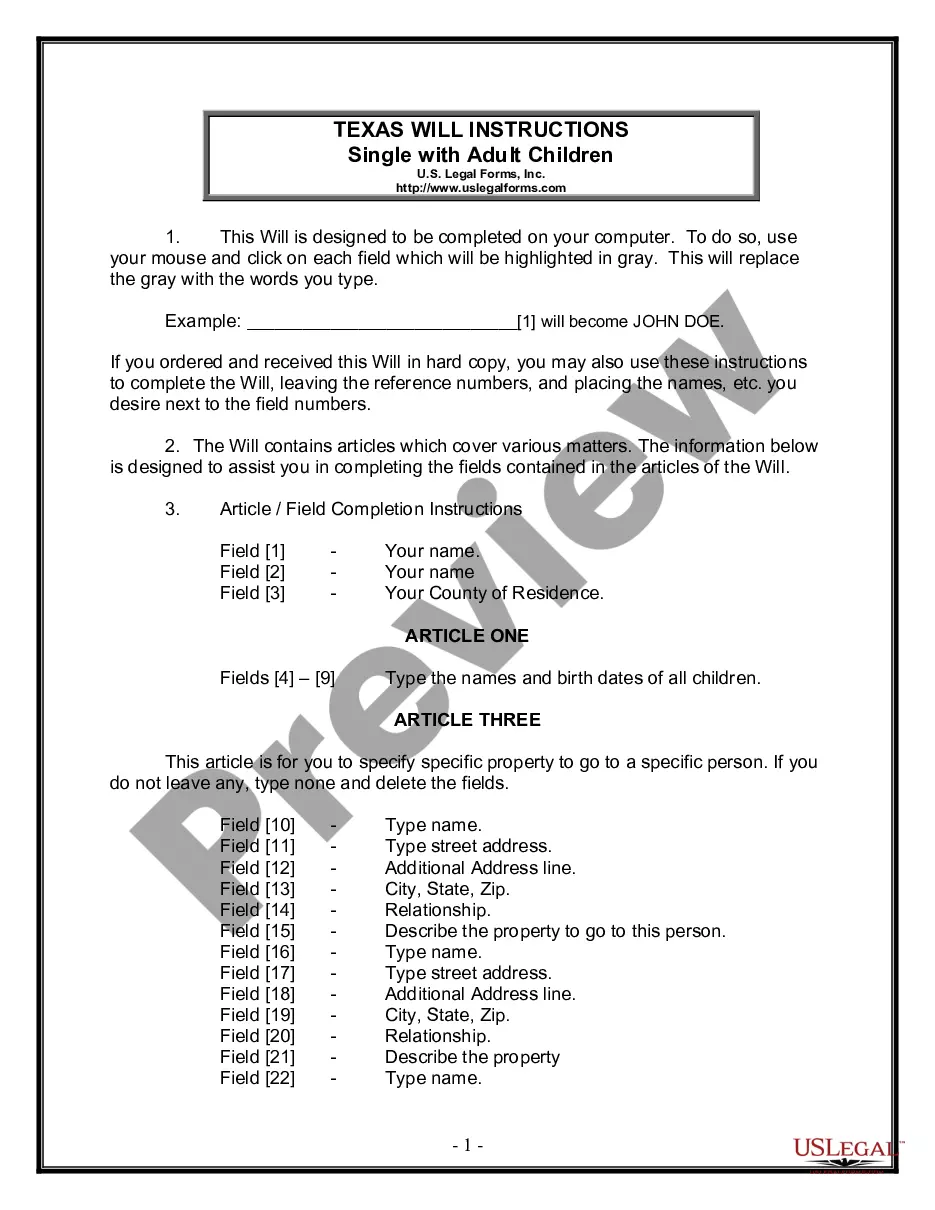

How to fill out Sample Letter Of Credit?

It is possible to spend several hours online attempting to find the legitimate file template that meets the federal and state specifications you will need. US Legal Forms gives a large number of legitimate varieties which are reviewed by pros. It is possible to obtain or print the Georgia Sample Letter of Credit from your assistance.

If you have a US Legal Forms accounts, you are able to log in and then click the Down load button. Afterward, you are able to full, revise, print, or indication the Georgia Sample Letter of Credit. Every legitimate file template you acquire is the one you have for a long time. To get another version of the acquired kind, check out the My Forms tab and then click the related button.

If you are using the US Legal Forms site for the first time, stick to the basic guidelines below:

- Initially, be sure that you have chosen the best file template to the county/area of your liking. Browse the kind description to make sure you have selected the proper kind. If readily available, utilize the Review button to check through the file template too.

- In order to locate another variation of the kind, utilize the Look for industry to find the template that meets your requirements and specifications.

- Upon having discovered the template you would like, simply click Purchase now to proceed.

- Choose the rates plan you would like, enter your accreditations, and sign up for an account on US Legal Forms.

- Total the financial transaction. You can utilize your bank card or PayPal accounts to pay for the legitimate kind.

- Choose the format of the file and obtain it for your system.

- Make modifications for your file if required. It is possible to full, revise and indication and print Georgia Sample Letter of Credit.

Down load and print a large number of file themes utilizing the US Legal Forms Internet site, which offers the largest variety of legitimate varieties. Use skilled and state-distinct themes to tackle your company or personal requires.

Form popularity

FAQ

Aside from trade credit insurance, there are other alternatives to a letter of credit. Those include: Purchase order financing: Purchase order financing provides you cash up front to complete a purchase order. Under this agreement, a financing company pays your supplier for goods you need to fulfill a purchase order.

A guarantee is a promise is assume the obligations of a debtor in the event of a default i.e. if the debtor does not fulfill the terms and conditions of a financial agreement. An undertaking is a promise to do or abstain from doing something and is normally made to a presiding judge or magistrate.

The bank will charge a service fee of 1% to 10% for each year when the financial instrument remains valid. If the buyer meets its obligations in the contract before the due date, the bank will terminate the SBLC without a further charge to the buyer.

Two parties are involved in the letter of credit that is a seller and the purchaser. It is more secured as it conations all the information regarding the purchase. A letter of undertaking provides assurance against the payment of the agreed amount to the other party, but it is not mentioned in the contract.

Pursuant to the request of our customer, ___________________________________________________________ we, (Bank) ___________________________________________________ hereby establish and give to you an irrevocable Letter of Credit in your favour in the total amount of $ _____________ which may be drawn on by you at any ...

Different types of Letter of Credit Revocable. Notably, the Letter can be canceled or amended at any time by either the buyer or the issuing bank without any formal notification. ... Confirmed. ... Transferrable. ... Straight. ... Restricted. ... Term (Usance)

Letters of credit are also sometimes used as part of fraudulent investment schemes. In the international banking system, a Letter of Undertaking (LOU) is a provisional bank guarantee, under which a bank allows its customer to raise money from another bank's foreign branch in the form of a short term credit.

A letter of undertaking (LOU) is a letter of guarantee written by one person to another to demonstrate a purpose, commitment, or pledge to perform a previously agreed-upon responsibility. A case in which some students damage school property during a rally is a perfect example.