Georgia Loan Guaranty Agreement

Description

How to fill out Loan Guaranty Agreement?

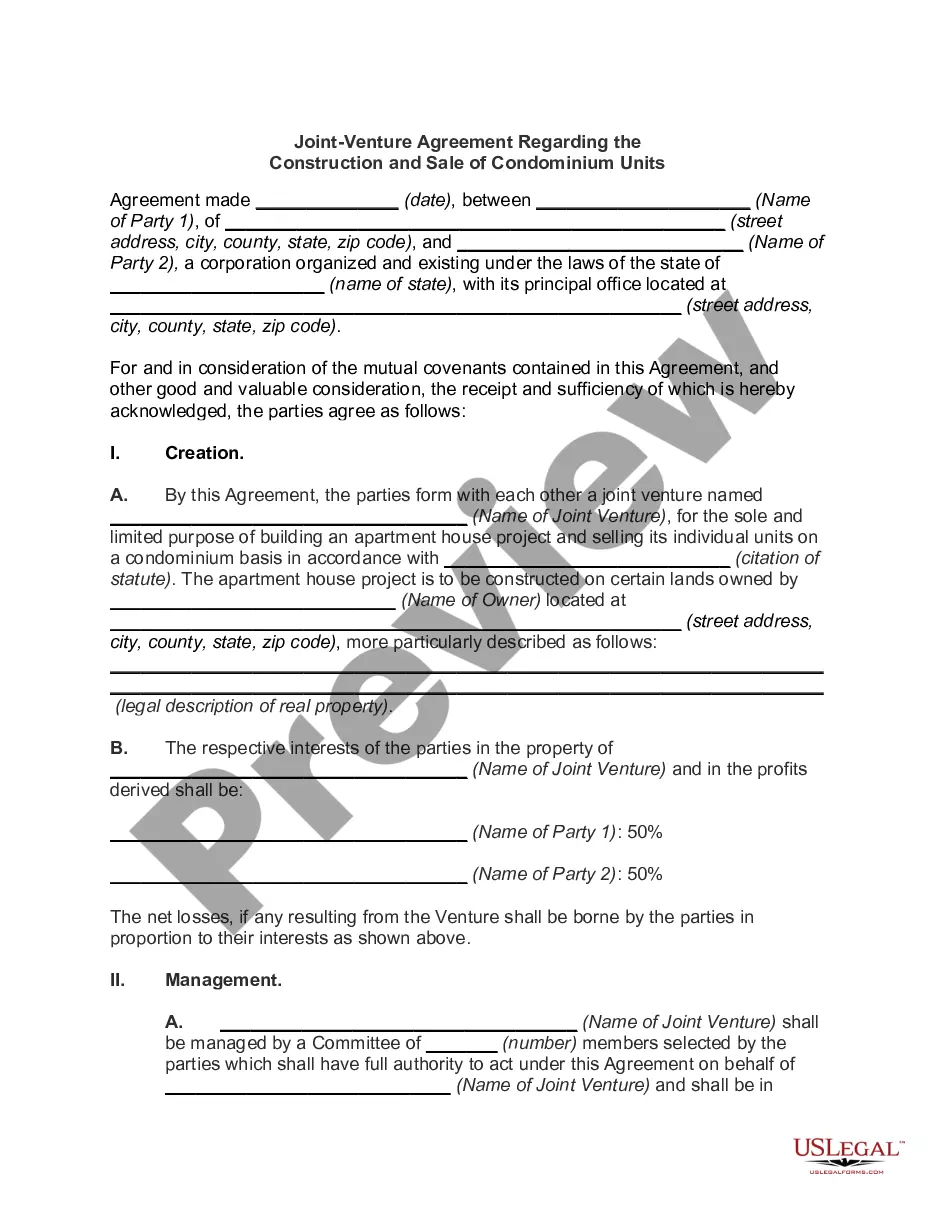

If you need to comprehensive, download, or printing authorized papers themes, use US Legal Forms, the biggest collection of authorized forms, that can be found on the web. Make use of the site`s simple and easy handy look for to get the files you need. Various themes for enterprise and specific functions are categorized by categories and claims, or keywords and phrases. Use US Legal Forms to get the Georgia Loan Guaranty Agreement with a number of click throughs.

When you are currently a US Legal Forms buyer, log in for your bank account and then click the Down load switch to obtain the Georgia Loan Guaranty Agreement. You can also access forms you previously acquired in the My Forms tab of the bank account.

If you use US Legal Forms the first time, follow the instructions under:

- Step 1. Be sure you have chosen the shape for the right area/region.

- Step 2. Take advantage of the Review option to check out the form`s content material. Do not overlook to read the outline.

- Step 3. When you are unsatisfied together with the develop, utilize the Look for industry near the top of the display screen to find other types in the authorized develop template.

- Step 4. Once you have identified the shape you need, select the Acquire now switch. Opt for the prices strategy you choose and include your references to register to have an bank account.

- Step 5. Procedure the financial transaction. You can use your Мisa or Ьastercard or PayPal bank account to accomplish the financial transaction.

- Step 6. Find the file format in the authorized develop and download it on your gadget.

- Step 7. Comprehensive, modify and printing or indication the Georgia Loan Guaranty Agreement.

Every single authorized papers template you buy is the one you have forever. You might have acces to each and every develop you acquired inside your acccount. Click on the My Forms area and pick a develop to printing or download once again.

Contend and download, and printing the Georgia Loan Guaranty Agreement with US Legal Forms. There are many skilled and condition-distinct forms you can utilize for your personal enterprise or specific requires.

Form popularity

FAQ

A loan guarantee is a legally binding commitment to pay a debt in the event the borrower defaults. This most often occurs between family members, where the borrower can't obtain a loan because of a lack of income or down payment, or due to a poor credit rating.

The guarantor's responsibility to the loan kicks in if the borrower does not pay. A surety can insist that the creditor sue the company first if default on the loan occurs. A guarantor contract states the specific performance of the three parties involved: the surety, the principal debtor, and the creditor.

In order for a guaranty agreement to be enforceable, it has to be in writing, the writing has to be signed by the guarantor, and the writing has to contain each of the following essential elements: 1. the identity of the lender; 2. the identity of the primary obligor; 3.

A guaranty clause can take many forms; a primary example is a loan agreement that is co-signed, which can signify a guaranty from the co-signer to a specific amount, even if the loan agreement does not use a specific "guarantor" title.

A guarantee is an agreement through which an individual or legal entity undertakes to meet certain obligations, such as paying a third party's debt if the latter defaults.

A guaranteed loan is a type of loan in which a third party agrees to pay if the borrower should default. A guaranteed loan is used by borrowers with poor credit or little in the way of financial resources; it enables financially unattractive candidates to qualify for a loan and assures that the lender won't lose money.

Guarantee is both a verb and a noun. Guaranty is a spelling variant for the noun, used in certain legal contexts. I can guarantee that Vicky will be back here within the week. What guarantee (or guaranty) can you offer to the other parties?

The Guarantor acknowledges and agrees with Lender that, but for the execution and delivery of this Validity Guaranty by the Guarantor, Lender would not have entered into the Credit Agreement.