28 U.S.C.A. § 1961 provides in part that interest shall be allowed on any money judgment in a civil case recovered in a district court. Such interest would continue to accrue throughout an appeal that was later affirmed.

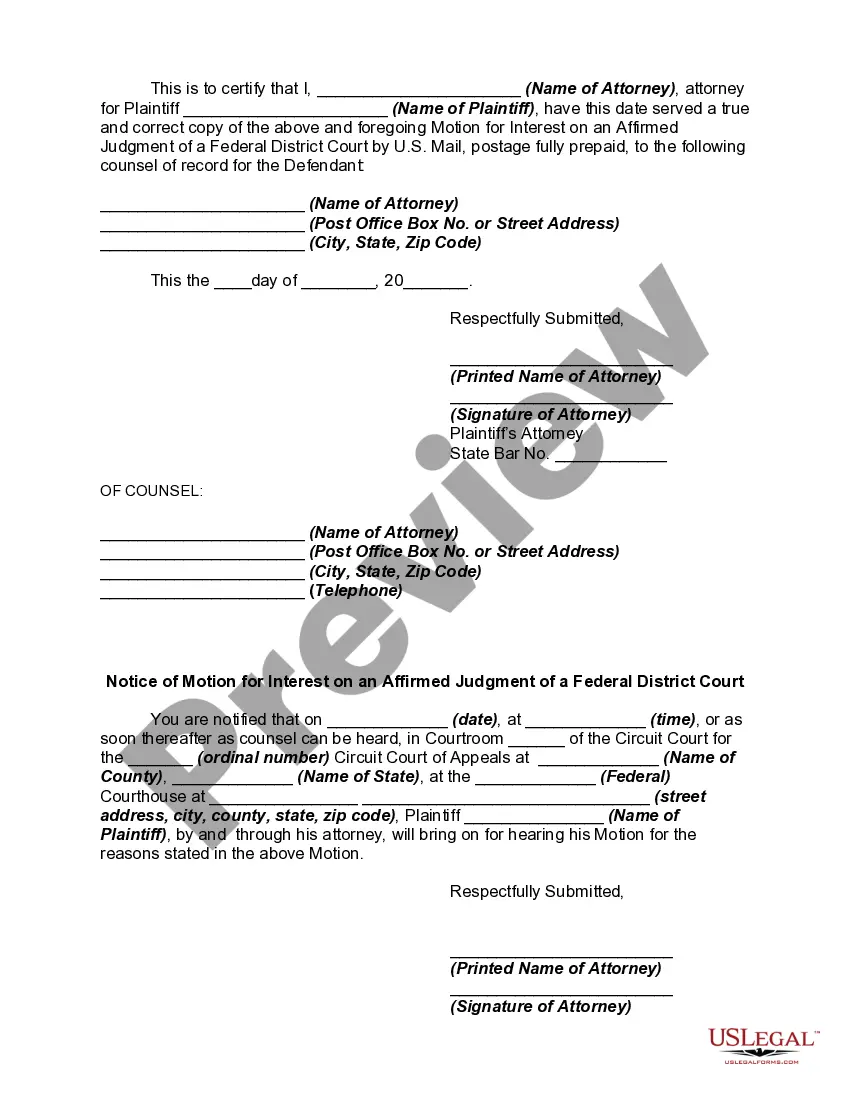

Georgia Motion for Interest on an Affirmed Judgment of a Federal District Court

Description

How to fill out Motion For Interest On An Affirmed Judgment Of A Federal District Court?

It is possible to devote hrs online attempting to find the legitimate papers design that meets the federal and state demands you want. US Legal Forms provides a huge number of legitimate types that are examined by experts. It is possible to download or printing the Georgia Motion for Interest on an Affirmed Judgment of a Federal District Court from our service.

If you already possess a US Legal Forms profile, it is possible to log in and click on the Download option. Afterward, it is possible to comprehensive, modify, printing, or indicator the Georgia Motion for Interest on an Affirmed Judgment of a Federal District Court. Each legitimate papers design you purchase is the one you have permanently. To get another duplicate for any obtained type, visit the My Forms tab and click on the related option.

If you use the US Legal Forms site for the first time, keep to the basic recommendations under:

- Very first, be sure that you have chosen the proper papers design to the area/area of your choice. Browse the type information to make sure you have picked the appropriate type. If readily available, utilize the Preview option to search throughout the papers design also.

- If you wish to get another edition of your type, utilize the Research discipline to find the design that meets your requirements and demands.

- Once you have found the design you want, just click Buy now to proceed.

- Choose the rates strategy you want, type in your references, and register for an account on US Legal Forms.

- Full the purchase. You may use your bank card or PayPal profile to pay for the legitimate type.

- Choose the file format of your papers and download it for your gadget.

- Make alterations for your papers if necessary. It is possible to comprehensive, modify and indicator and printing Georgia Motion for Interest on an Affirmed Judgment of a Federal District Court.

Download and printing a huge number of papers layouts while using US Legal Forms web site, which offers the biggest collection of legitimate types. Use professional and status-specific layouts to handle your business or specific demands.

Form popularity

FAQ

The rate of interest used in calculating the amount of post-judgment interest is the weekly average 1-year constant maturity (nominal) Treasury yield, as published by the Federal Reserve System each Monday for the preceding week (unless that day is a holiday in which case the rate is published on the next business day) ...

If a Defendant fails to show at trial, a default judgment is issued and there is no appeal. If the defendant fails to answer a civil claim within 30 days, the case is in default and the Defendant has 15 days in which he/she may open the default by paying court cost and filing an answer.

Post-judgment interest rate: 10.10% (the amount of post judgment interest is set by Rule 36.7 of the Uniform Civil Procedure Rules 2005).

To calculate your own pre-judgment interest, count the number of days between the 180th day after you notified your defendant of a pending lawsuit or the date you filed the lawsuit, and multiply the number of days by the appropriate rate.

As of April 2023, the Georgia post judgment legal interest rate is 11%. The federal prime interst rate is 8%. Georgia statutory/legal rate of interest is prime rate plus 3%. Therefore, the present Georgia post judgment interest rate is 11%.

The details of this arrangement (e.g. the precise interest, whether the interest is simple or compound, etc) will depend on what jurisdiction your case is in. In California, for example, post-judgment interest is 10% simple per year, as specified in California Code of Civil Procedure section 685.010(a).

The interest that a creditor, usually a plaintiff in the case, is entitled to collect, derived from the amount of a judgment, which compensates the creditor for an injury which occurred before the judgment.

Interest on a court judgment that a creditor, usually the plaintiff in the case, can collect from the debtor, usually the defendant, from time the judgment is entered in the court clerk's record until the judgment is paid.