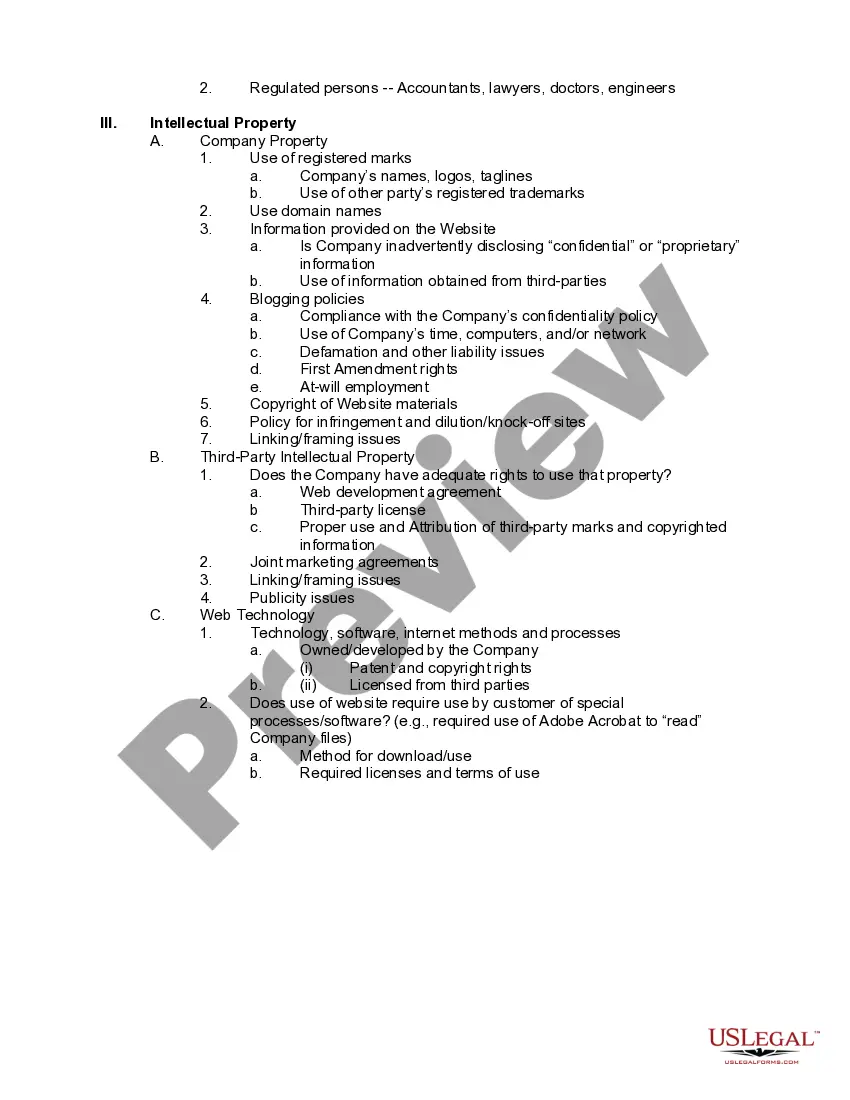

Georgia Compliance Checklist For Company Websites

Description

How to fill out Compliance Checklist For Company Websites?

Are you in a situation where you require documents for either business or personal tasks almost every day.

There are numerous legal document templates accessible online, but finding ones you can trust is not simple.

US Legal Forms provides thousands of template forms, including the Georgia Compliance Checklist For Company Websites, that are created to comply with federal and state regulations.

Select a convenient document format and download your copy.

You can find all the document templates you have purchased in the My documents section. You can acquire another copy of the Georgia Compliance Checklist For Company Websites at any point, if needed. Simply choose the form you need to download or print the document template.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After logging in, you can download the Georgia Compliance Checklist For Company Websites template.

- If you do not have an account and want to start using US Legal Forms, follow these instructions.

- Select the form you need and ensure it corresponds to the correct city/state.

- Utilize the Preview button to examine the form.

- Check the details to confirm you have selected the right form.

- If the form is not what you are looking for, use the Research section to find the form that suits your needs and requirements.

- Once you find the right form, click Get now.

- Choose the pricing plan you prefer, fill in the necessary information to create your account, and complete the purchase using your PayPal or credit card.

Form popularity

FAQ

Indeed, you need a business license for your LLC in Georgia to conduct business legally. This license varies based on your business's location and type. To simplify the process and ensure compliance, utilize the Georgia Compliance Checklist For Company Websites, which will help you identify all the necessary licenses based on your operations.

Yes, an LLC in Georgia generally requires a business license to operate legally. The exact license you need may depend on your location and the nature of your business activities. To avoid complications, it's wise to consult local regulations and the Georgia Compliance Checklist For Company Websites to ensure you obtain the correct licensing.

A business permit is usually required to comply with specific industry regulations, while a business license is necessary to legally operate within your city or county. Depending on your business activities, you may require one or both. To navigate the requirements effectively, refer to the Georgia Compliance Checklist For Company Websites, ensuring your business remains compliant.

While LLCs offer benefits like limited liability protection, there are disadvantages as well. For instance, LLCs in Georgia can face higher initial fees and annual registration costs compared to sole proprietorships. Additionally, LLCs may have more paperwork and compliance requirements. Using the Georgia Compliance Checklist For Company Websites can streamline your process and help you stay organized in addressing these disadvantages.

Yes, you can form an LLC in Georgia without actively conducting a business. Many individuals choose to establish an LLC to protect their personal assets or for future business endeavors. However, it's essential to understand that simply creating an LLC requires compliance with certain regulations. The Georgia Compliance Checklist For Company Websites can guide you through necessary legal considerations.

To file articles of incorporation in Georgia, you need to complete the appropriate form provided by the Georgia Secretary of State's office. You can file online through the Georgia Corporations Division website or submit the form by mail. Remember to include any required fees. Following the Georgia Compliance Checklist For Company Websites can help ensure you complete all necessary steps.

The principal law this office enforces, the Georgia Fair Business Practices Act, states as its purpose to protect consumers and legitimate business enterprises from unfair or deceptive practices in the conduct of any trade or commerce in part or wholly in the state.

You do not have to register your business with the state of Georgia unless you are planning to incorporate, become a specific legal entity or if you plan to do business with the state, in which case you will need to become a registered vendor through the Department of Administrative Services.

Anyone selling tangible items in the state of Georgia needs a sales tax permit.

The main state-level permit or license in Georgia is the seller's permit. You must obtain a seller's permit if you: Are engaged in business in Georgia. Intend to sell or lease goods or services subject to sales tax.