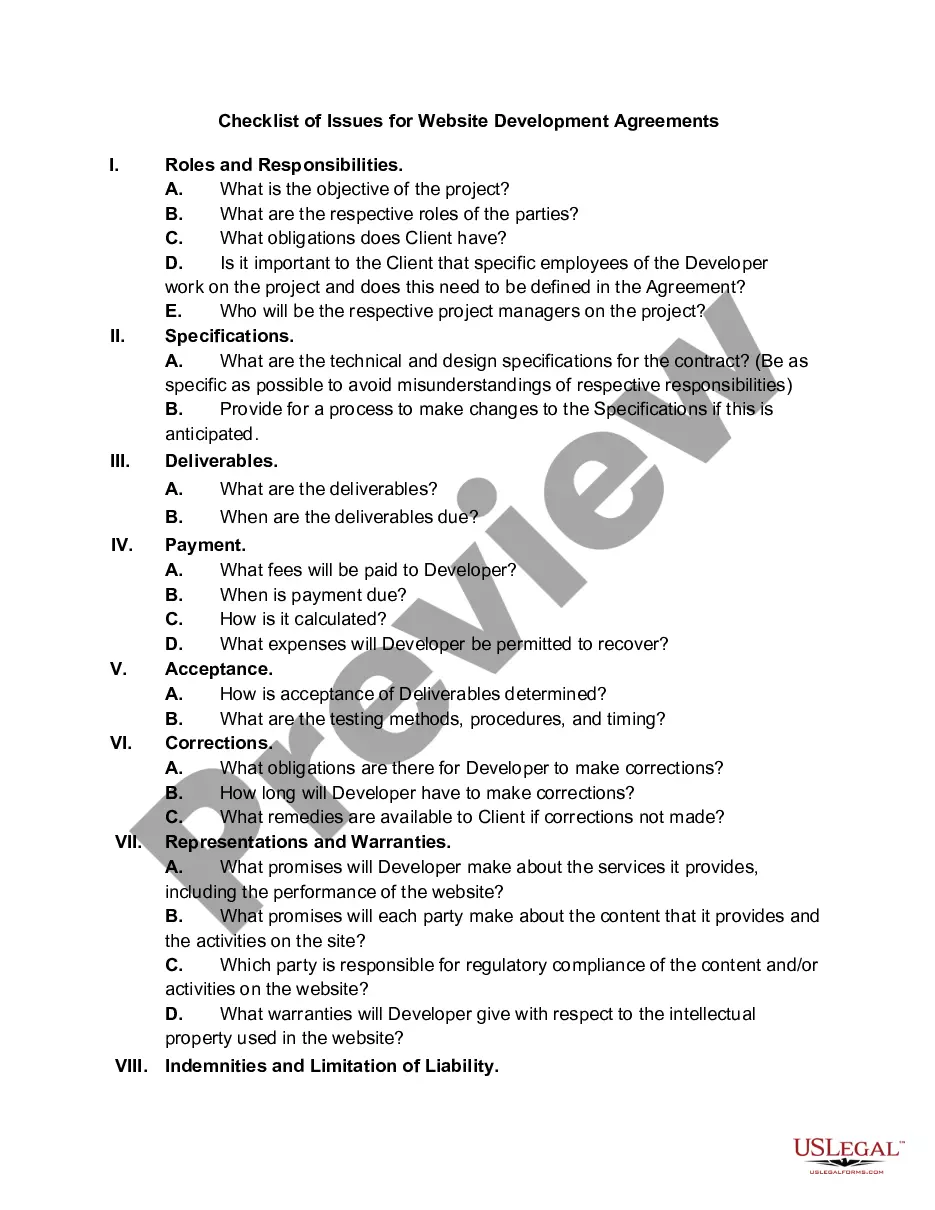

Georgia Checklist - For Establishing a Website

Description

How to fill out Checklist - For Establishing A Website?

If you need to finish, retrieve, or print legal document templates, use US Legal Forms, the largest repository of legal forms available online.

Leverage the site's user-friendly search feature to find the documents you require.

Various templates for business and personal purposes are organized by categories and states, or keywords.

Step 4. Once you find the form you need, click the Buy now button. Choose your preferred pricing plan and enter your details to register for an account.

Step 5. Complete the payment. You can use your Visa or MasterCard or PayPal account to finalize the purchase.

- Utilize US Legal Forms to locate the Georgia Checklist - For Setting Up a Website in just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and click the Download button to obtain the Georgia Checklist - For Setting Up a Website.

- You can also access forms you have previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow these steps.

- Step 1. Ensure you have selected the form for the appropriate area/state.

- Step 2. Use the Review option to browse through the form’s details. Don’t forget to read the summary.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other versions of the legal form template.

Form popularity

FAQ

The time required to register a business in Georgia can vary but generally falls within the 5 to 15 business days range. Online submissions are processed more quickly than paper applications. For a smooth registration experience, consult our Georgia Checklist - For Establishing a Website, which includes crucial steps and guidelines to follow.

Registering a company in Georgia typically takes around 5 to 15 business days, depending on the method used. Online registrations are usually faster, while mail submissions take longer to process. For a detailed and efficient registration experience, refer to our Georgia Checklist - For Establishing a Website, which includes tips for expediting your application.

The approval process for an LLC in Georgia usually takes about 5 to 10 business days if you file online. If you choose to file by mail, it may take longer, generally up to 15 business days. To facilitate this process, consider using our Georgia Checklist - For Establishing a Website, which outlines the steps and options available for faster LLC formation.

Yes, an LLC in Georgia typically requires a business license to operate legally. This license confirms that your business complies with local regulations. A comprehensive approach, including our Georgia Checklist - For Establishing a Website, can provide a clear path to securing the appropriate licenses for your LLC.

Starting a small business in Georgia requires several key steps. First, you should determine your business structure, such as an LLC, corporation, or sole proprietorship. Then, register your business name and obtain any necessary permits. Utilize our Georgia Checklist - For Establishing a Website to navigate these steps efficiently and ensure you meet all legal requirements.

Yes, you typically need a business license for your online business in Georgia. This license helps to ensure that you comply with state and local regulations. To simplify this process, you can follow our Georgia Checklist - For Establishing a Website. This checklist can guide you in understanding the necessary documentation and permits required for your specific business model.

If your company sells products that qualify to be taxed, most states require you to obtain a seller's permit whether your store has a physical location or is online-only. You'll need to collect sales tax, which is what a seller's permit allows you to do.

In most states, forming an LLC doesn't require a business license, but you'll need to follow your state's procedures. An LLC requires registering with the state and filing the appropriate forms. But even though you don't need a business license to form an LLC, you probably need one to operate the LLC as a business.

In order to operate your business in Georgia, you'll need to obtain a general business license from the city or county. Certain professional industries require special licensing. LLCs with employees will also need to apply for a Georgia state taxpayer identification number and workers compensation insurance.

Anyone selling tangible items in the state of Georgia needs a sales tax permit.