This form is an example of a contract to donate a horse to a rescue or other organization. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Georgia Equine or Horse Donation Contract

Description

How to fill out Equine Or Horse Donation Contract?

You are capable of spending time online looking for the official document template that satisfies the federal and state requirements you need.

US Legal Forms offers thousands of legal templates that have been reviewed by experts.

You can download or print the Georgia Equine or Horse Donation Agreement from my services.

Browse the form details to ensure you have chosen the correct document. If available, use the Review button to go through the document template as well.

- If you already possess a US Legal Forms account, you may Log In and click on the Obtain button.

- After that, you can fill out, modify, print, or sign the Georgia Equine or Horse Donation Agreement.

- Each legal document template you purchase is yours indefinitely.

- To acquire another copy of any purchased form, visit the My documents tab and click on the relevant button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, make sure you have selected the correct document template for your state/city that you prefer.

Form popularity

FAQ

Yes, donating a horse can be tax-deductible if the receiving organization qualifies as a charitable entity. By using a Georgia Equine or Horse Donation Contract, you create a clear record of the donation, which is essential for tax purposes. Ensure that you keep a copy of the contract and any appraisal if the horse holds significant value, as this will help in claiming your deduction accurately.

To give away a horse, you should first assess the horse's health and behavior, ensuring it is suitable for the new owner. It is highly recommended to use a Georgia Equine or Horse Donation Contract to formalize the transfer, which protects both you and the recipient. Additionally, consider contacting local horse rescues or sanctuaries, as they often have networks and resources to help rehome horses responsibly.

Donating to a horse rescue can provide potential tax benefits, as contributions are often tax-deductible. To qualify, make sure the rescue organization is a registered 501(c)(3) charity. When you fill out a Georgia Equine or Horse Donation Contract, you outline the transaction clearly, which can help substantiate your deduction claims when tax season arrives. Always consult a tax professional to ensure you fully understand your options.

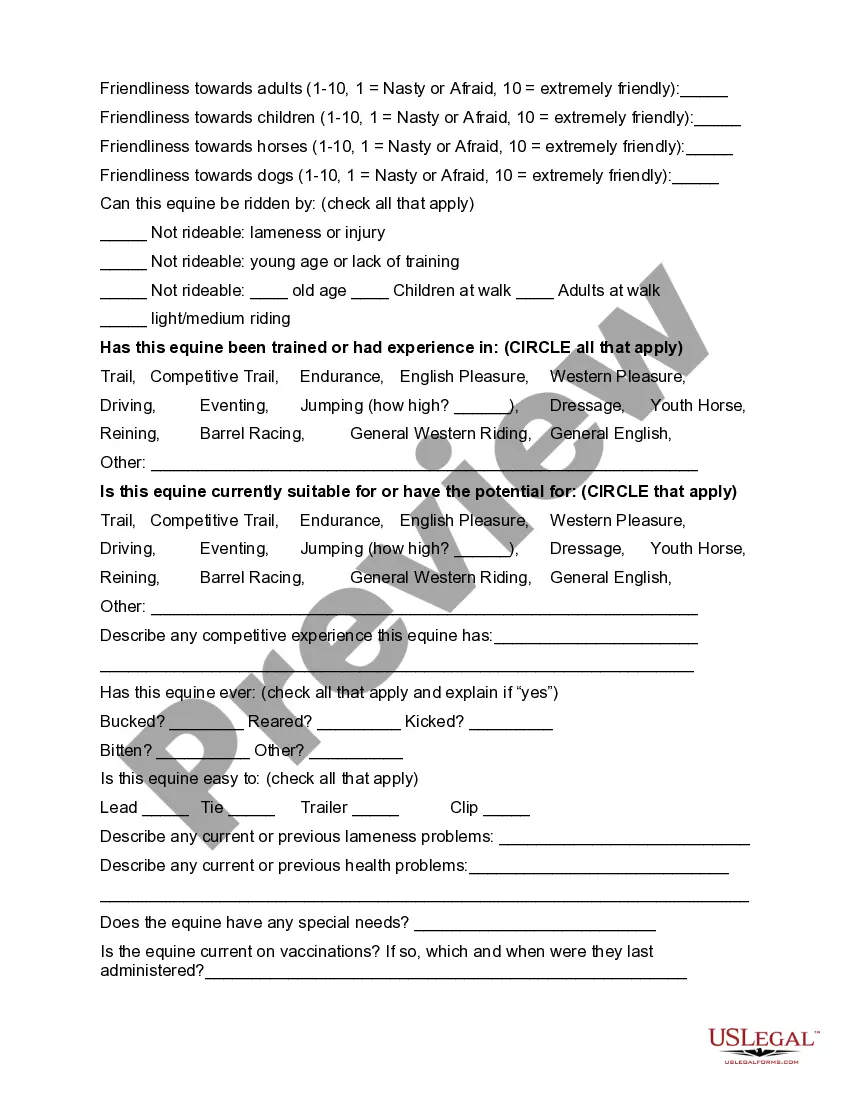

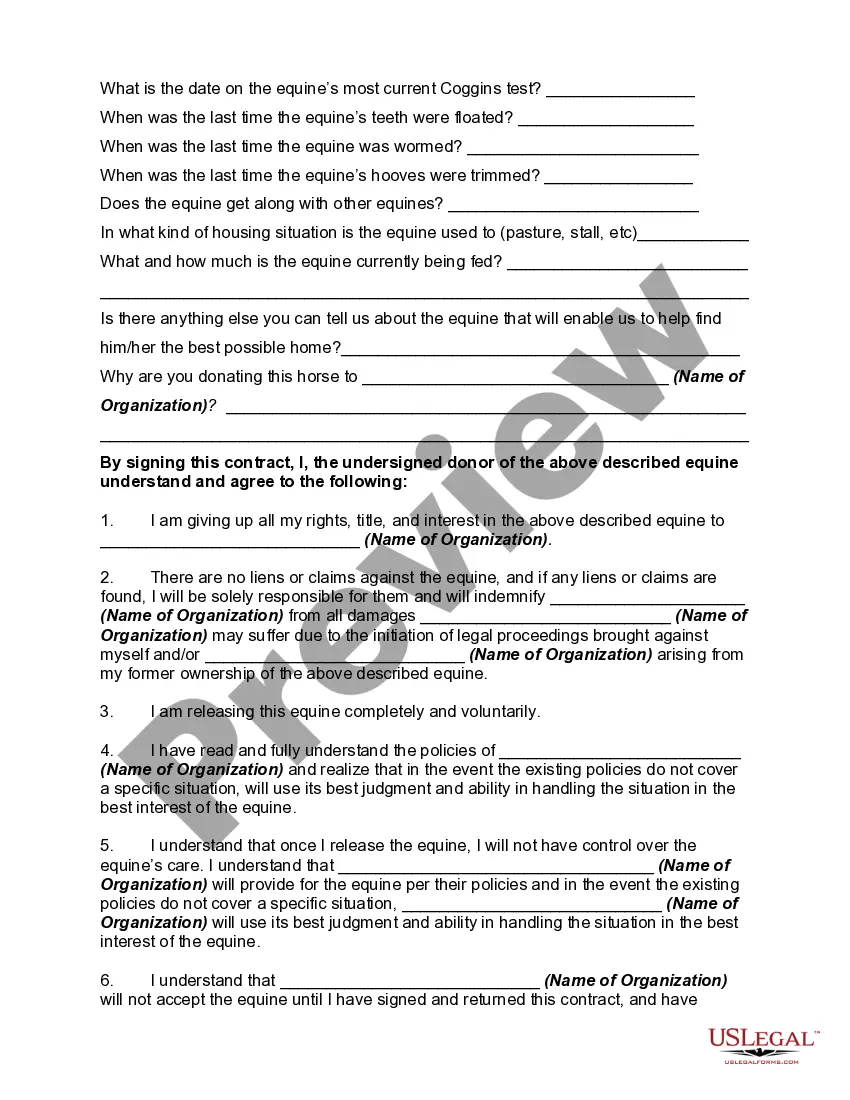

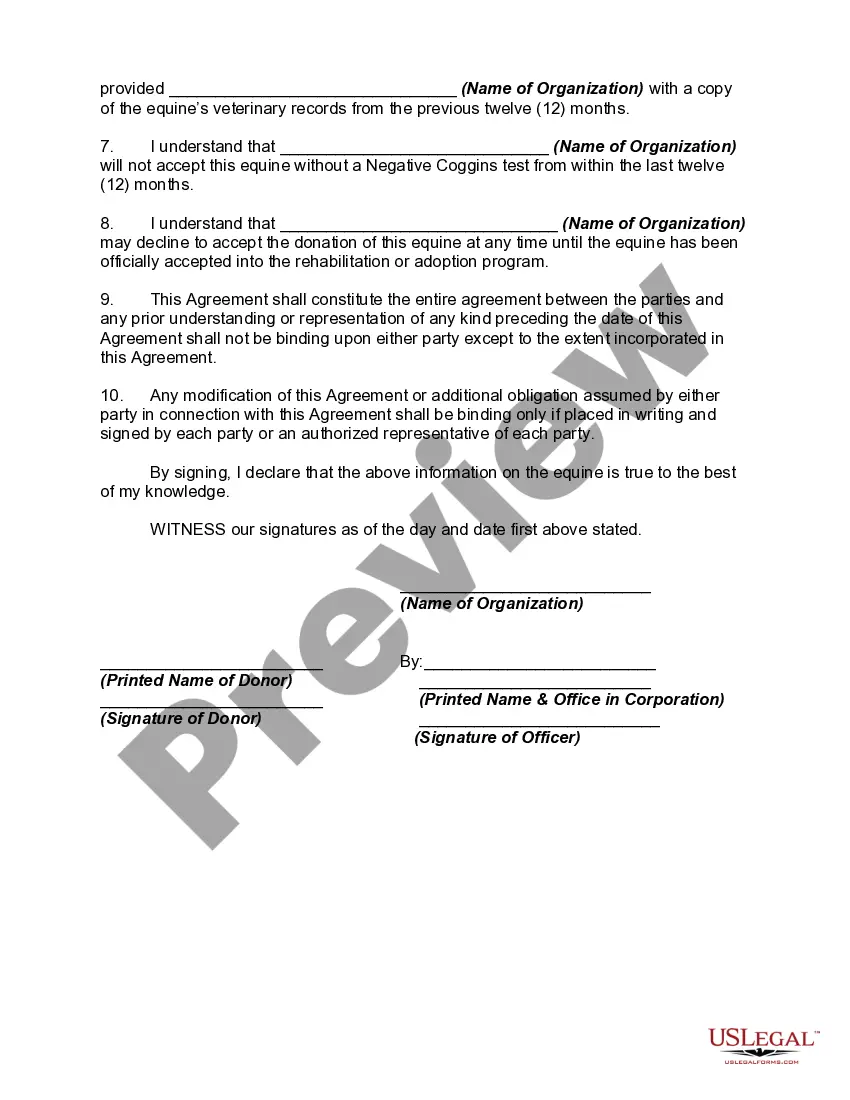

A donation agreement is a legal document that outlines the terms under which a horse is donated. This agreement typically includes details about the horse, the donor, and the recipient, along with any conditions regarding the use of the horse. Having a clear Georgia Equine or Horse Donation Contract can simplify this process, ensuring all parties are on the same page.

To sell a horse, you typically need a Bill of Sale, health records, and registration papers if applicable. You might also want to provide any information about the horse's training and performance history. This documentation not only smooths the transaction but also builds trust with the buyer. A Georgia Equine or Horse Donation Contract can guide you through this paperwork.

Yes, you can receive a tax write-off for donating a horse if you follow the required steps. The deduction is contingent upon the horse's fair market value and adherence to IRS guidelines. Using a Georgia Equine or Horse Donation Contract can help you track the necessary information for tax purposes. Always consult a tax professional to maximize your benefits from the donation.

If you have an unwanted horse, there are several options available. You may choose to donate the horse to a charity, sell it, or look for a sanctuary that provides a comfortable environment. Always consider using a Georgia Equine or Horse Donation Contract to facilitate any charitable donations. Platforms like US Legal Forms can guide you through the process to ensure that you handle the situation responsibly.

Choosing the best charity for horses depends on your values and objectives. Some well-respected organizations focus on rescue, rehabilitation, and education about equine care. Look for a charity with a transparent operation and positive reviews. Consider using a Georgia Equine or Horse Donation Contract when donating to ensure your contribution is utilized effectively.

To donate a horse to UC Davis, you should contact their veterinary school to discuss the donation process. They often require a Georgia Equine or Horse Donation Contract, detailing your horse’s history and any relevant medical information. It's essential to follow their guidelines to ensure a smooth transition for your horse. By collaborating with US Legal Forms, you can easily create and manage the necessary documentation.

To qualify for a tax write-off when donating a horse, the amount must meet specific criteria established by the IRS. Generally, donations valued above $500 allow you to benefit from a tax deduction. The exact deduction depends on the horse's fair market value and the charity's status. A Georgia Equine or Horse Donation Contract can help you document the donation accurately, ensuring you meet IRS requirements.