Georgia Disclaimer of Right to Inherit or Inheritance - All Property from Estate or Trust

Description

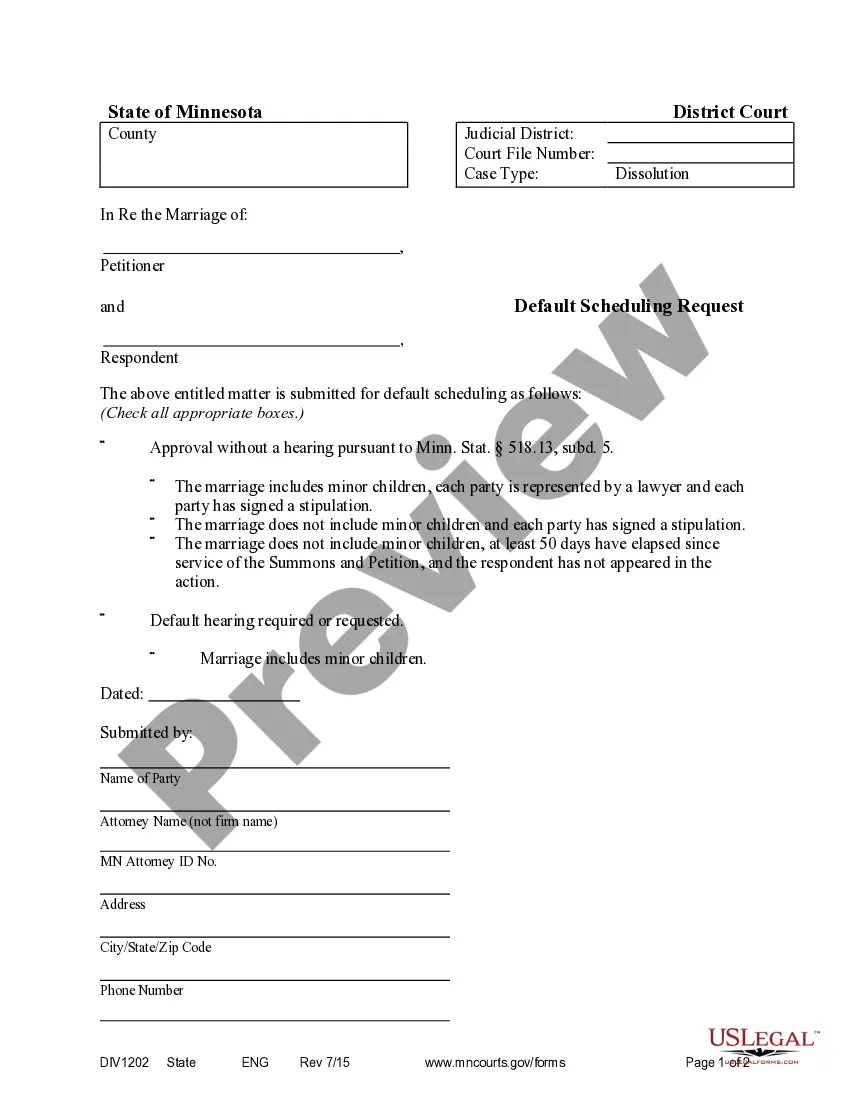

How to fill out Disclaimer Of Right To Inherit Or Inheritance - All Property From Estate Or Trust?

Are you currently in the placement where you will need papers for both organization or person purposes just about every working day? There are plenty of lawful record web templates available on the Internet, but getting versions you can rely on isn`t effortless. US Legal Forms gives 1000s of form web templates, such as the Georgia Disclaimer of Right to Inherit or Inheritance - All Property from Estate or Trust, which are created in order to meet state and federal demands.

When you are currently acquainted with US Legal Forms internet site and get a merchant account, just log in. After that, it is possible to download the Georgia Disclaimer of Right to Inherit or Inheritance - All Property from Estate or Trust design.

Unless you come with an account and would like to start using US Legal Forms, adopt these measures:

- Discover the form you will need and ensure it is for your proper town/region.

- Use the Preview option to examine the shape.

- Look at the information to actually have selected the appropriate form.

- In the event the form isn`t what you`re looking for, make use of the Search industry to get the form that suits you and demands.

- Whenever you discover the proper form, click on Acquire now.

- Choose the pricing strategy you want, fill in the required information and facts to make your account, and pay for an order with your PayPal or bank card.

- Choose a handy document format and download your backup.

Find all the record web templates you might have purchased in the My Forms food list. You can aquire a additional backup of Georgia Disclaimer of Right to Inherit or Inheritance - All Property from Estate or Trust any time, if necessary. Just select the required form to download or produce the record design.

Use US Legal Forms, one of the most substantial selection of lawful forms, in order to save efforts and stay away from errors. The services gives professionally created lawful record web templates which you can use for a selection of purposes. Make a merchant account on US Legal Forms and commence making your daily life a little easier.

Form popularity

FAQ

When you disclaim an inheritance, you will not receive the inheritance and it will instead pass onto the next Beneficiary. It is important to note that when you disclaim an inheritance, you do not get to choose who the Beneficiary will be in your place.

There is no deadline for settling a Georgia estate. Depending on the size of the estate, beneficiaries can anticipate the probate process to take anywhere from six months to several years. While there is no deadline, there are dispute deadlines that beneficiaries should consider.

You make your disclaimer in writing. Your inheritance disclaimer specifically says that you refuse to accept the assets in question and that this refusal is irrevocable, meaning it can't be changed. You disclaim the assets within nine months of the death of the person you inherited them from.

If you refuse to accept an inheritance, you will not be responsible for inheritance taxes, but you'll have no say in who receives the assets in your place.

A renunciation must be made by a written instrument that describes the renounced property, declares the renunciation and the extent of it, and is signed by the person making the renunciation. The day on which the person making the renunciation reaches the age of 21.

The disclaimer must be in writing: A signed letter by the person doing the disclaiming, identifying the decedent, describing the asset to be disclaimed, and the extent and amount, percentage or dollar amount, to be disclaimed, must be delivered to the person in control of the estate or asset, such as an executor, ...

When a person files a disclaimer he can disclaim all or any portion of the inheritance. It is not an ?all or nothing? proposition. For example, if the estate was $500,000, the beneficiary could disclaim $100,000 so that amount would pass to his children. The beneficiary would retain the remaining $400,000.

A spouse but no children, your spouse will inherit your entire estate. Children but no spouse, your children will split everything equally. This includes biological and adopted children. Both a spouse and one child, they will divide the estate equally.