Georgia Independent Contractor Agreement with Massage Therapist

Description

How to fill out Independent Contractor Agreement With Massage Therapist?

You might devote hours online attempting to locate the valid document template that meets your state and federal requirements.

US Legal Forms provides a vast range of legitimate forms that are reviewed by experts.

You can obtain or create the Georgia Independent Contractor Agreement with Massage Therapist through their assistance.

To find another version of your form, use the Search field to locate the template that fits your needs.

- If you already possess a US Legal Forms account, you can Log In and then select the Obtain button.

- From there, you can fill out, modify, create, or sign the Georgia Independent Contractor Agreement with Massage Therapist.

- Each legal document template you buy is yours to keep indefinitely.

- To get an additional copy of any purchased form, navigate to the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have chosen the correct document template for your area/city.

- Review the form details to confirm you have selected the right form.

Form popularity

FAQ

Yes, it is illegal to give massages without a license in Georgia. Practicing without proper certification can result in penalties and adverse legal actions. For independent contractors, having a valid license is critical when entering into a Georgia Independent Contractor Agreement with Massage Therapist. This ensures compliance with state regulations and builds trust with clients.

Yes, massaging without a license in Georgia can lead to legal issues, including fines and possible criminal charges. Authorities take the practice of unlicensed massage seriously as it poses risks to consumers. Creating a Georgia Independent Contractor Agreement with Massage Therapist highlights the necessity of compliance with licensing laws, protecting both parties involved.

To set up an independent contractor agreement, start by defining the terms of service, including payment and responsibilities. It is advisable to include all relevant information, such as the duration of the agreement and dispute resolution procedures. Utilizing resources like uslegalforms can assist you in crafting a thorough Georgia Independent Contractor Agreement with Massage Therapist that meets legal standards.

Some states do not require a massage license, which can attract individuals to practice without formal training. However, this can affect service quality. It is essential to research state-by-state regulations if you plan to work as an independent contractor elsewhere. Always consider the benefits of working under a Georgia Independent Contractor Agreement with Massage Therapist to ensure compliance.

If you encounter an unlicensed massage therapist in Georgia, you can report them to the Georgia Secretary of State's office. They investigate allegations of unlicensed practice. When reporting, gather any relevant information about the therapist and the service they provided. Protecting consumers is crucial, and your report helps maintain professional standards.

Yes, in Georgia, massage therapists must be licensed to practice legally. Obtaining a license ensures that therapists meet certain standards of education and training. If you are an independent contractor, securing a license might be a requirement when establishing your Georgia Independent Contractor Agreement with Massage Therapist. This step protects both the therapist and the clients.

The IRS code for massage therapists typically falls under 6241, which relates to therapeutic services. It's essential to classify your services correctly to ensure compliance with tax requirements. Understanding the IRS code is crucial when filing your taxes as a massage therapist under the Georgia Independent Contractor Agreement.

Certain expenses related to massage therapy can be tax-deductible if you're self-employed. Expenses such as supplies, marketing, and professional training may qualify for tax deductions. By keeping thorough records and understanding your tax obligations, you can maximize these deductions.

Yes, you can freelance as a massage therapist, provided you adhere to local licensing and business regulations. Many therapists choose freelance work for its flexibility and independence. A Georgia Independent Contractor Agreement with Massage Therapist helps formalize this arrangement and clarify expectations.

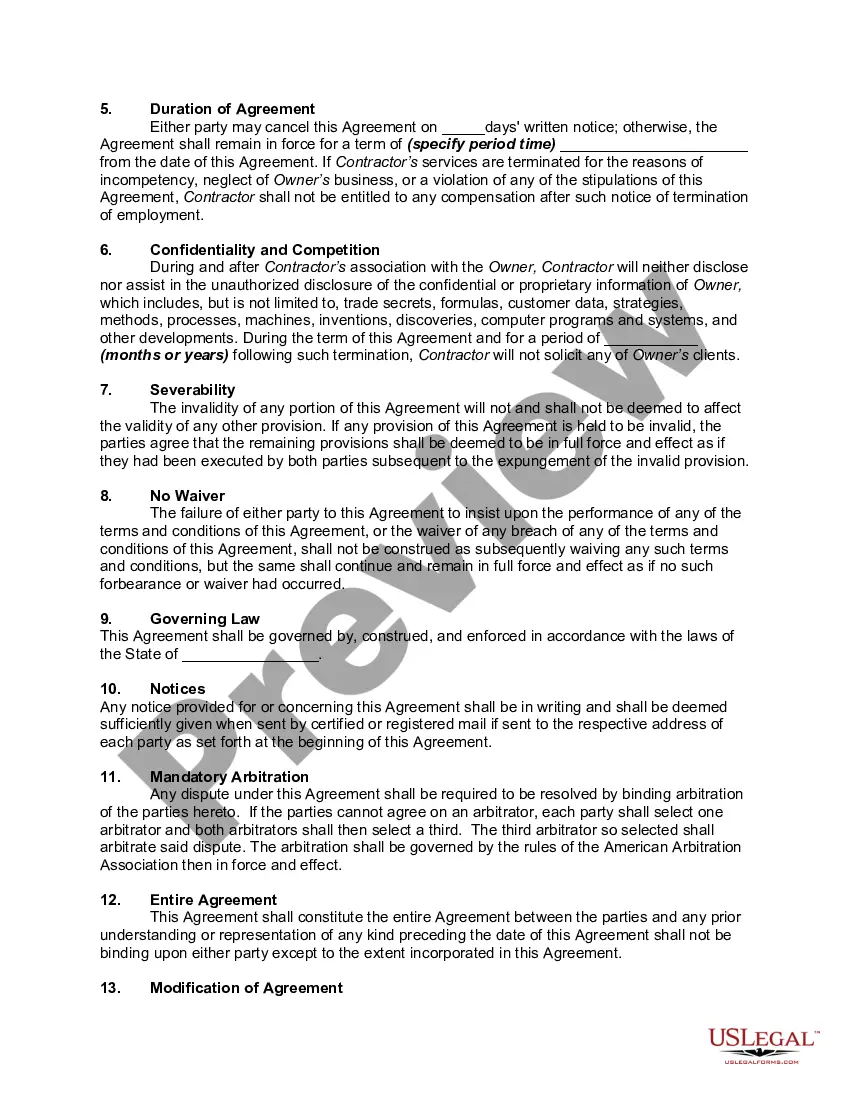

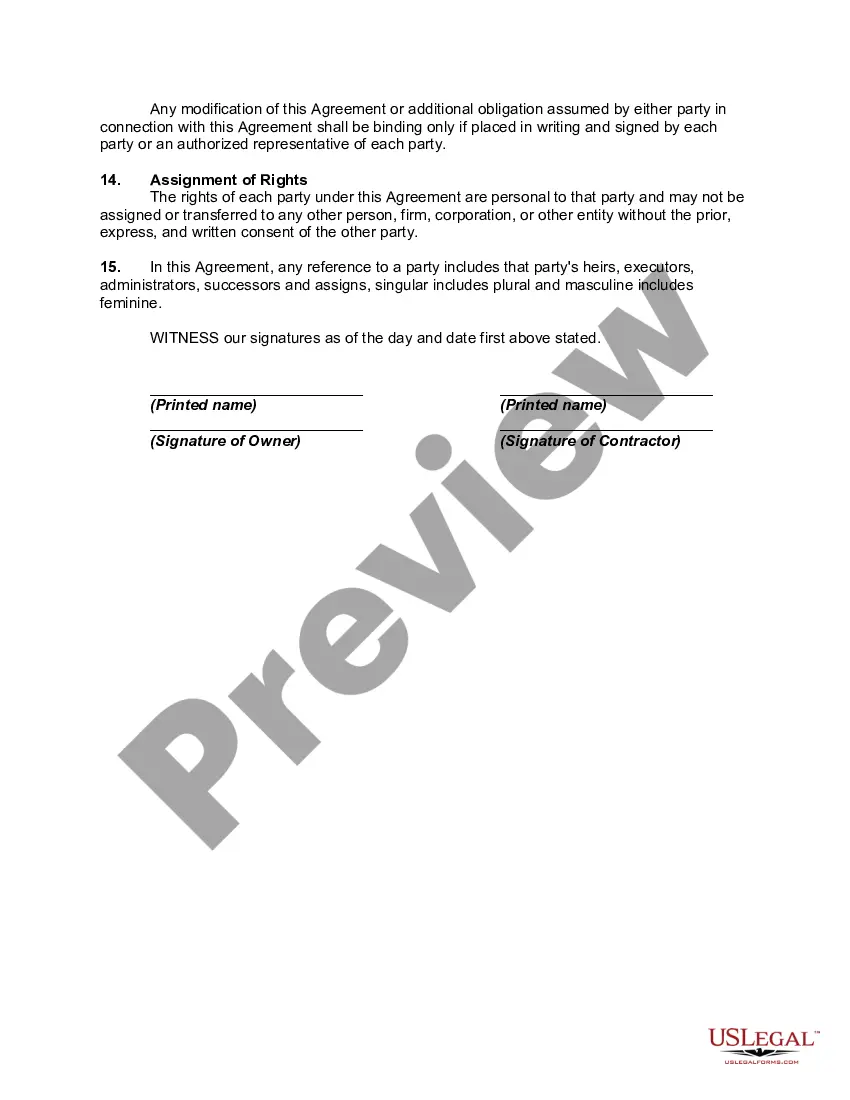

To write an independent contractor agreement, start by clearly defining the scope of work, payment terms, and duration of the agreement. Include provisions regarding confidentiality and termination, if necessary. Using a template for a Georgia Independent Contractor Agreement with Massage Therapist can simplify the process and ensure you cover all critical aspects.