Georgia Summary of Account for Inventory of Business

Description

How to fill out Summary Of Account For Inventory Of Business?

Have you been within a situation in which you need to have files for sometimes organization or individual functions just about every day? There are a lot of authorized file layouts accessible on the Internet, but getting versions you can rely is not easy. US Legal Forms provides a large number of form layouts, such as the Georgia Summary of Account for Inventory of Business, which can be written to satisfy federal and state specifications.

Should you be already informed about US Legal Forms web site and have a merchant account, basically log in. Afterward, you are able to download the Georgia Summary of Account for Inventory of Business web template.

Unless you provide an profile and want to start using US Legal Forms, abide by these steps:

- Get the form you want and make sure it is for that correct town/area.

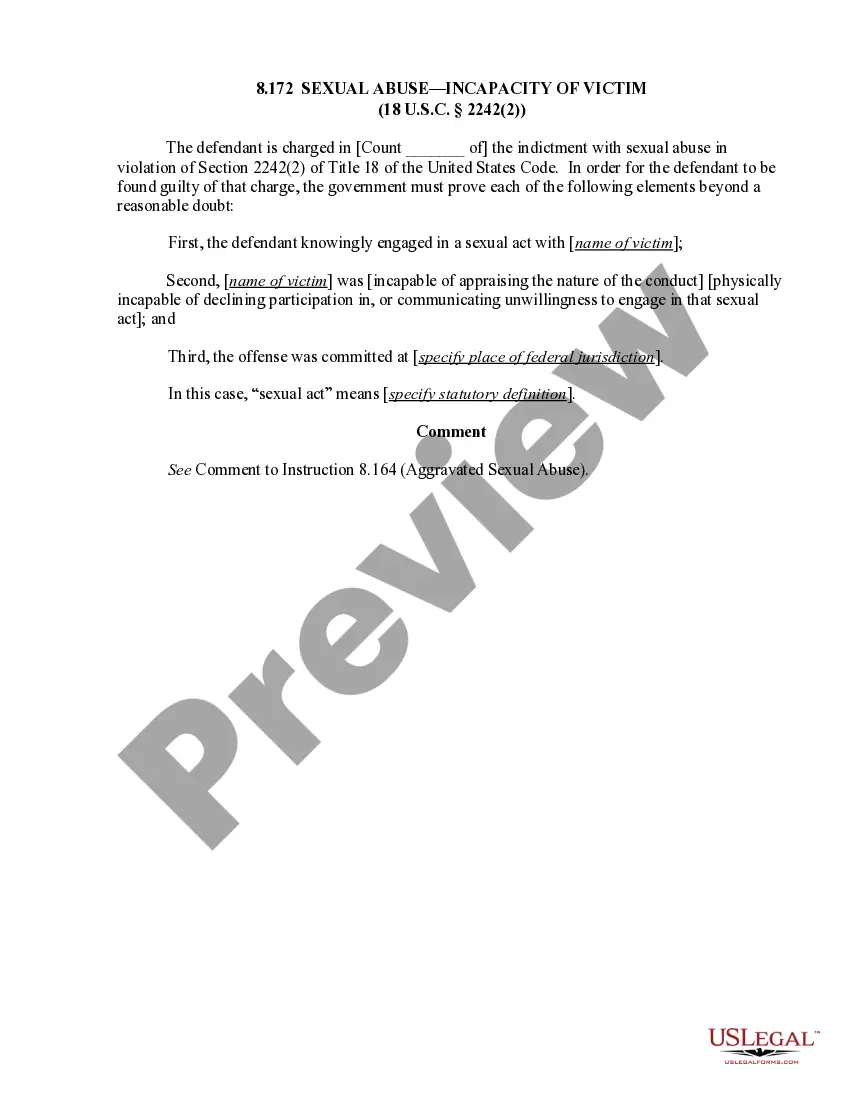

- Take advantage of the Review switch to analyze the shape.

- Browse the outline to ensure that you have chosen the correct form.

- In case the form is not what you`re looking for, make use of the Search discipline to discover the form that fits your needs and specifications.

- Once you discover the correct form, simply click Purchase now.

- Opt for the rates program you need, complete the required info to make your account, and pay money for your order with your PayPal or Visa or Mastercard.

- Decide on a handy data file file format and download your backup.

Locate all of the file layouts you possess bought in the My Forms food list. You can obtain a more backup of Georgia Summary of Account for Inventory of Business at any time, if necessary. Just go through the needed form to download or print the file web template.

Use US Legal Forms, the most extensive variety of authorized kinds, to conserve time as well as stay away from blunders. The service provides professionally produced authorized file layouts which you can use for a selection of functions. Produce a merchant account on US Legal Forms and initiate creating your daily life a little easier.

Form popularity

FAQ

You'd be surprised to know that many people think inventory is simply an expense, because they are purchasing it for resale. It's an asset. You are buying/creating an asset, so it should be shown on your balance sheet as such in an inventory asset account.

Business inventory is exempt from state property taxes (as of January 1, 2016). Almost all (93 percent) of Georgia's counties and over 140 of the cities have adopted a Level One Freeport Exemption, set at 20, 40, 60, 80 or 100 percent of the inventory value.

Inventory tax is a property tax that is determined by the value of inventory and usually falls under a Business Tangible Personal Property tax. Other types of property that often fall under this same classification are machinery, office equipment, and furniture.

In fact, in some states, inventory carries additional taxes, though the exact amount varies by location. This means that inventory is one of those expenses that is very difficult to offset come tax time, and you need to be aware of how much you can afford to keep.

A company's inventory typically involves goods in three stages of production: raw goods, in-progress goods, and finished goods that are ready for sale. Inventory accounting will assign values to the items in each of these three processes and record them as company assets.

Businesses generally must use inventories for income tax purposes when necessary to clearly reflect income. To clearly reflect income, businesses must take inventories at the beginning and end of each tax year in which the production, purchase or sale of merchandise is an income-producing factor.

Some goods are exempt from sales tax under Georgia law. Examples include some prescription drugs, medical supplies, and manufacturing equipment. Non-prepared food items are exempt from state sales tax, but are subject to local sales taxes.

Licensed, nonprofit in-patient general hospitals, mental hospitals, nursing homes, and hospices. Nonprofit private schools any combination of grades 1-12. Nonprofit blood banks. Nonprofit groups whose primary activity is raising money for public libraries.