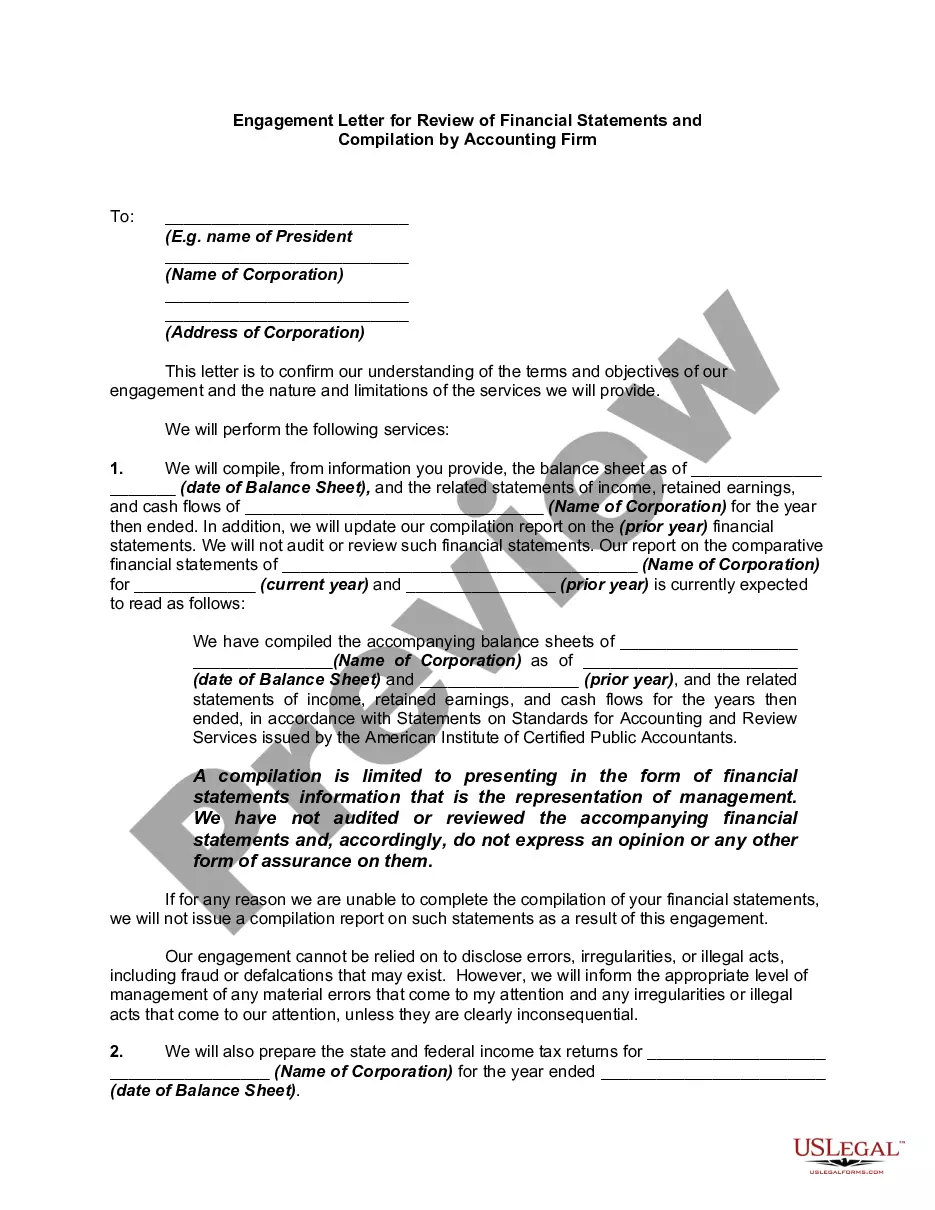

In a compilation engagement, the accountant presents in the form of financial statements information that is the representation of management (owners) without undertaking to express any assurance on the statements. In other words, using management's records, the accountant creates financial statements without gathering evidence or opining about the validity of those underlying records. Because compiled financial statements provide the reader no assurance regarding the statements, they represent the lowest level of financial statement service accountants can provide to their clients. Accordingly, standards governing compilation engagements require that financial statements presented by the accountant to the client or third parties must at least be compiled.

Georgia Report from Review of Financial Statements and Compilation by Accounting Firm

Description

How to fill out Report From Review Of Financial Statements And Compilation By Accounting Firm?

You can spend time online searching for the suitable legal document template that meets both state and federal criteria you require.

US Legal Forms offers thousands of legal documents that can be reviewed by professionals.

You can download or print the Georgia Report from Review of Financial Statements and Compilation by Accounting Firm from our service.

First, ensure that you have selected the correct document template for the state/region that you choose. Review the form details to guarantee you have chosen the right template. If available, use the Review button to view the document template as well.

- If you possess a US Legal Forms account, you can Log In and hit the Acquire button.

- After that, you can complete, modify, print, or sign the Georgia Report from Review of Financial Statements and Compilation by Accounting Firm.

- Every legal document template you purchase is yours permanently.

- To obtain another copy of any purchased form, navigate to the My documents section and click the appropriate button.

- If you are visiting the US Legal Forms website for the first time, follow the simple instructions below.

Form popularity

FAQ

Filling out a financial report involves collecting important financial data such as income, expenses, and assets. You need to organize this information into clear sections, typically including the balance sheet and income statement. Using a Georgia Report from Review of Financial Statements and Compilation by Accounting Firm can streamline this process, making it easier for you to compile and present your financial information accurately.

A financial review is an assessment conducted by an accounting firm that provides limited assurance on the accuracy of financial statements. Unlike audits, financial reviews require less extensive procedures, but they still offer valuable insights into the financial health of a business. A Georgia Report from Review of Financial Statements and Compilation by Accounting Firm can serve as a crucial tool for business owners seeking to understand their financial position without the comprehensive scope of an audit.

When conducting a review of financial statements, the CPA must obtain a level of understanding of the entity, its environment, and its internal controls. This understanding helps them perform analytical procedures and inquiries to assess the plausibility of the financial statements. The outcome is often a Georgia Report from Review of Financial Statements and Compilation by Accounting Firm, offering assurance to stakeholders about the reliability of financial reporting. Utilizing professional services can ensure compliance and enhance the credibility of your financial documents.

While a bookkeeper can assist with gathering and organizing financial data, they are generally not qualified to compile financial statements. A CPA is typically required for the preparation of these statements, especially when producing a Georgia Report from Review of Financial Statements and Compilation by Accounting Firm. These reports require professional judgment and adherence to accounting standards. It's important for businesses to ensure that their financial documents are prepared accurately and meet regulatory requirements.

The difference between a compilation and a review of financial statements revolves around the depth of evaluation and assurance. A compilation is a straightforward presentation of financial data, while a review includes inquiries and analytical procedures that provide limited assurance on the information's integrity. For businesses seeking clarity, the Georgia Report from Review of Financial Statements and Compilation by Accounting Firm serves as an ideal solution that addresses these differences effectively.

The primary difference between a financial statement review and a compilation lies in the level of assurance provided. A compilation simply presents financial data without verification, while a review involves analytical procedures and inquiries to ensure greater accuracy. Opting for the Georgia Report from Review of Financial Statements and Compilation by Accounting Firm can help you receive a valuable review service that adds important credibility to your financials.

A financial statement review involves an accounting professional evaluating a company’s financial statements to provide limited assurance about their reliability. This type of review is less intensive than an audit, but it gives users of the statements more confidence. Utilizing the Georgia Report from Review of Financial Statements and Compilation by Accounting Firm can help ensure that your financial statements have undergone this essential review process.

No, a compilation and a review are not the same. A compilation provides a basic level of service where an accounting firm compiles financial information without verifying its accuracy. In contrast, the Georgia Report from Review of Financial Statements and Compilation by Accounting Firm offers a more thorough examination that provides some assurance on the accuracy of the financial data.

An audit report offers a detailed level of assurance and involves extensive procedures to assess financial statements, while a limited review report provides a superficial level of assurance, focused mainly on analytical inquiries. Limited reviews are faster and less expensive than audits. For further clarity and insights, consider a Georgia Report from Review of Financial Statements and Compilation by Accounting Firm, which summarizes key findings effectively.

To find a company's audit report, start by checking the company's investor relations page or their filings with the SEC through the EDGAR database. For private companies, auditing firms may provide these reports directly or, in some cases, through additional requests. Additionally, a Georgia Report from Review of Financial Statements and Compilation by Accounting Firm can offer an organized view of this information.