US Legal Forms - one of many greatest libraries of legal forms in the States - provides an array of legal file templates you are able to acquire or produce. While using internet site, you can find thousands of forms for company and person functions, sorted by categories, claims, or key phrases.You will discover the newest versions of forms just like the Georgia Security Agreement in Accounts and Contract Rights in seconds.

If you already possess a registration, log in and acquire Georgia Security Agreement in Accounts and Contract Rights in the US Legal Forms collection. The Download button will show up on each and every form you look at. You gain access to all previously acquired forms inside the My Forms tab of your own accounts.

If you want to use US Legal Forms the first time, listed here are basic guidelines to get you started out:

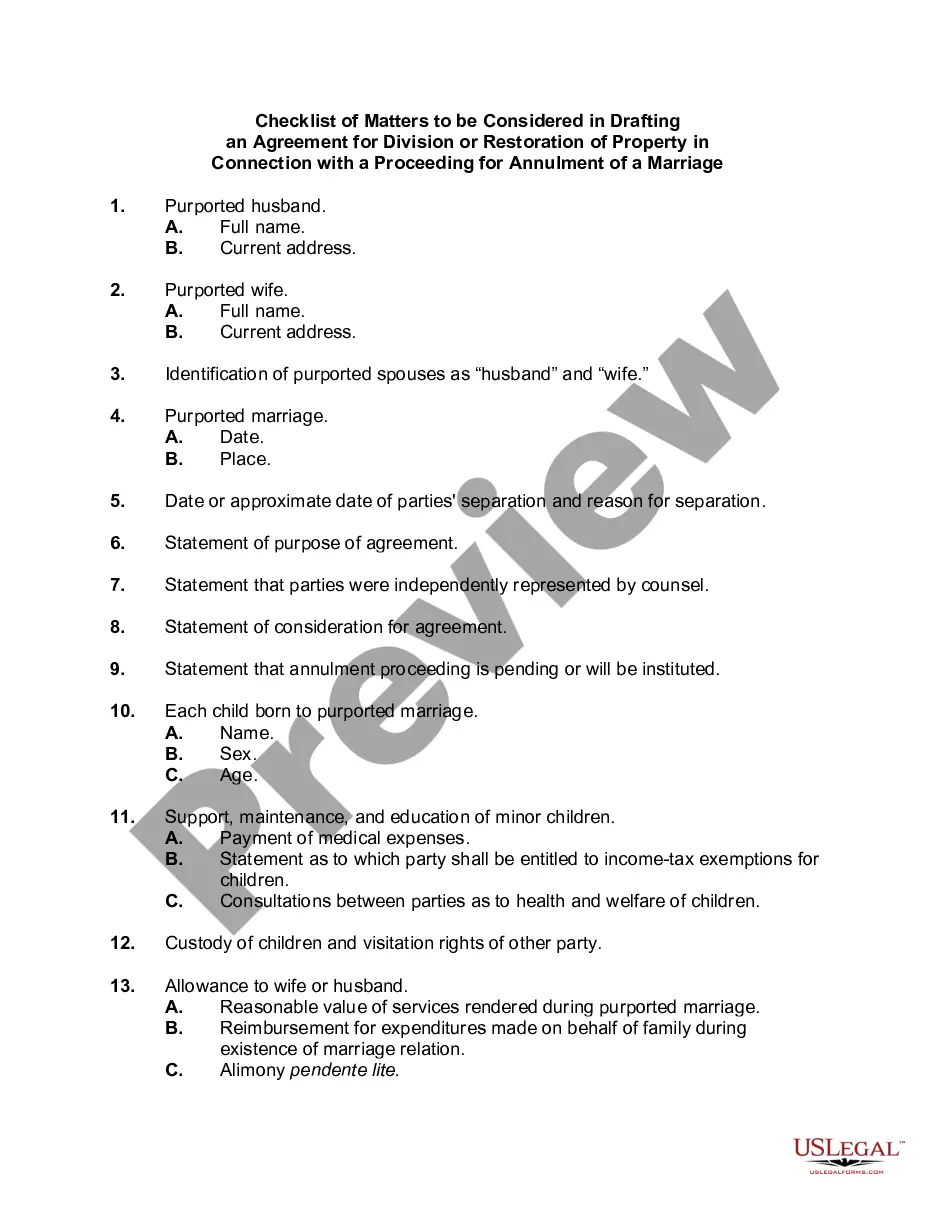

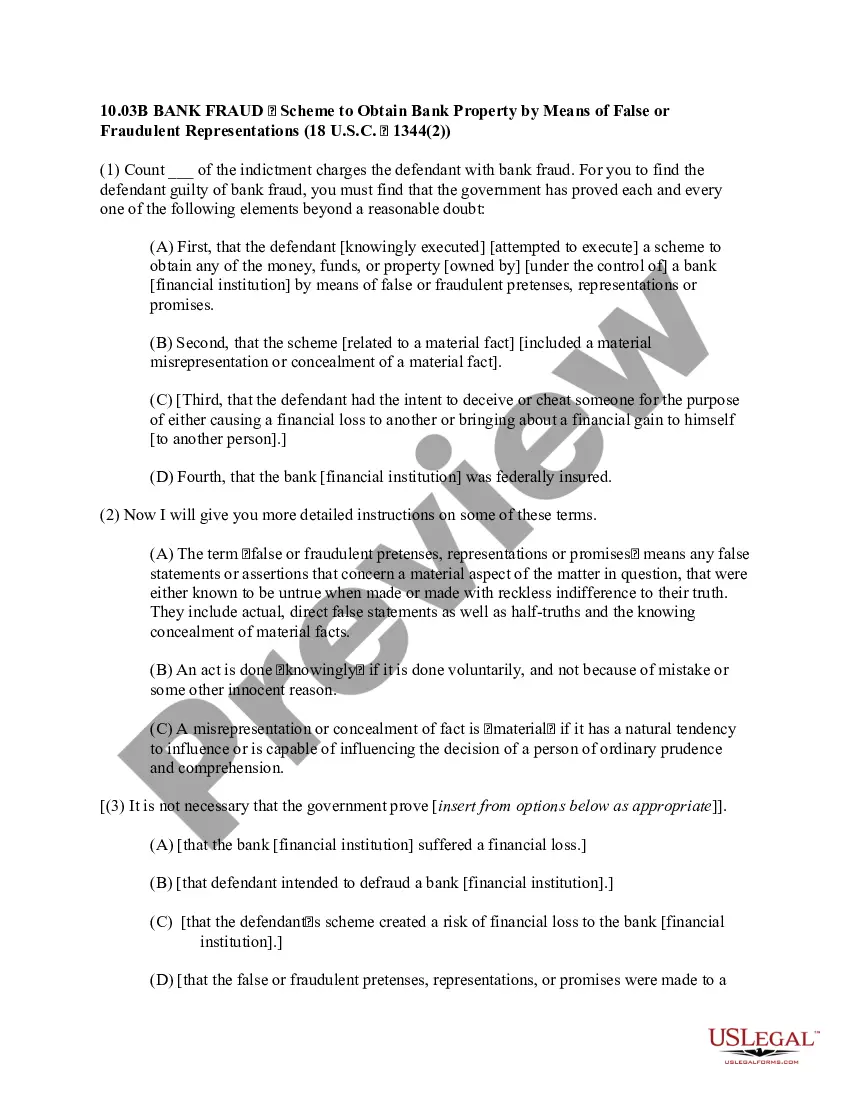

- Ensure you have picked out the proper form for the area/state. Click on the Review button to check the form`s information. Read the form information to ensure that you have chosen the right form.

- When the form does not fit your specifications, take advantage of the Look for field towards the top of the monitor to obtain the one that does.

- When you are content with the shape, validate your selection by clicking on the Get now button. Then, select the pricing strategy you favor and supply your credentials to sign up on an accounts.

- Procedure the purchase. Make use of Visa or Mastercard or PayPal accounts to finish the purchase.

- Select the structure and acquire the shape on the gadget.

- Make modifications. Fill out, edit and produce and indication the acquired Georgia Security Agreement in Accounts and Contract Rights.

Every web template you included with your money lacks an expiry time which is your own property for a long time. So, if you wish to acquire or produce one more copy, just visit the My Forms section and then click about the form you require.

Get access to the Georgia Security Agreement in Accounts and Contract Rights with US Legal Forms, by far the most considerable collection of legal file templates. Use thousands of professional and status-specific templates that satisfy your business or person demands and specifications.