No particular language is necessary for the acceptance or rejection of a claim or for subsequent notices and reports so long as the instruments used clearly convey the necessary information.

Georgia Rejection of Claim and Report of Experience with Debtor

Description

How to fill out Rejection Of Claim And Report Of Experience With Debtor?

Are you currently in a situation where you need documents for either business or personal purposes every single day.

There are numerous legal document templates available online, but finding reliable ones can be challenging.

US Legal Forms offers a wide range of form templates, such as the Georgia Rejection of Claim and Report of Experience with Debtor, specifically designed to meet federal and state requirements.

- If you already have an account on the US Legal Forms site, simply Log In.

- Once logged in, you will be able to download the Georgia Rejection of Claim and Report of Experience with Debtor template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for your specific city/county.

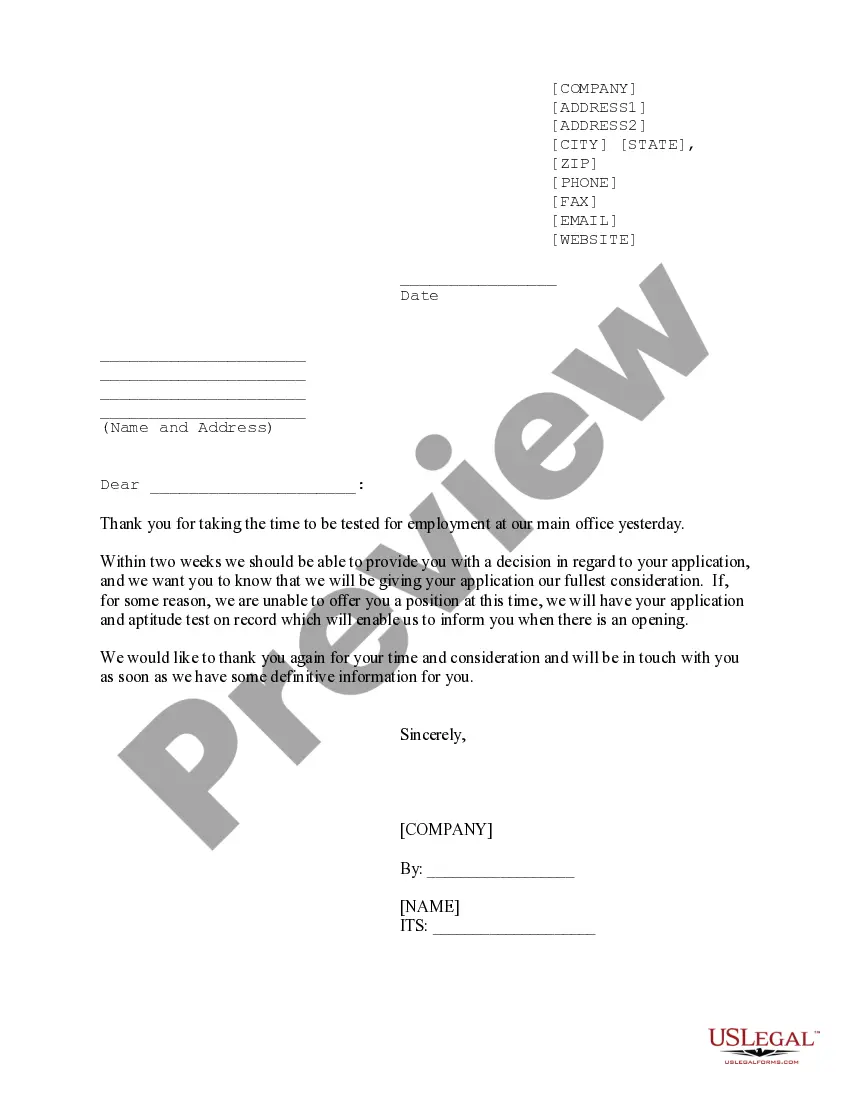

- Utilize the Preview option to review the document.

- Check the description to confirm you have selected the correct form.

- If the form does not match your requirements, use the Search field to locate the form that fits your needs.

- Upon finding the right form, click Get now.

- Select the pricing plan you prefer, fill out the necessary information to create your account, and complete the purchase using your PayPal or credit card.

Form popularity

FAQ

Georgia Rule of Civil Procedure 56 governs the process of summary judgment in civil cases, allowing parties to request the court to decide a case based on the evidence presented, without proceeding to trial. This rule plays a crucial role in the Georgia Rejection of Claim and Report of Experience with Debtor as it streamlines the litigation process. By enabling parties to resolve disputes efficiently, it helps reduce costs and save time for both creditors and debtors. Understanding this rule can significantly impact how you manage legal claims related to debtor experiences.

To defend a claim statement, prepare a comprehensive answer that addresses each claim made against you, providing evidence and arguments that counter those claims. A solid defense often involves showing that the plaintiff has not met their burden of proof or highlighting legal deficiencies in their claim. This level of detail is crucial when considering the Georgia rejection of claim and report of experience with debtor. Engaging with US Legal Forms can offer valuable insights and templates for your defense.

A 12(b)(6) motion to dismiss in Georgia is a legal request asking the court to dismiss a case because the complaint does not state a claim upon which relief can be granted. Essentially, this motion argues that even if all facts presented are true, there is no legal basis for a lawsuit. Understanding this can be helpful when considering the Georgia rejection of claim and report of experience with debtor. Consult with legal experts to see if this motion suits your situation.

To respond to a letter of claim, first acknowledge receipt of the letter, then outline your position on the claims made. It's important to do this in a structured manner that addresses all of the letter's key points. A thorough response can greatly influence the outcome, especially in context of the Georgia rejection of claim and report of experience with debtor. If you feel overwhelmed, US Legal Forms offers resources to guide you.

When writing a response to a claim, clearly and specifically state your position regarding each allegation. Ensure your response is legally sound and timely filed according to Georgia's court rules, typically within 30 days. Crafting a clear response is vital for navigating the Georgia rejection of claim and report of experience with debtor. If you need help, consider leveraging the US Legal Forms platform for attorney-reviewed templates.

Code 9-11-34 in Georgia refers to the rules governing the examination of witnesses before trial. This code allows parties to request discovery of evidence which may help establish the facts of their case. Understanding this code can aid in the preparation for a Georgia rejection of claim and report of experience with debtor. Utilizing all available resources is crucial for building a strong case.

The answer to a statement of claim is your formal written response that addresses the allegations made against you. In Georgia, the answer must specifically respond to each point, providing clarity on your stance. This process is an important aspect of the Georgia rejection of claim and report of experience with debtor framework. Crafting a well-thought-out answer can strengthen your position in legal proceedings.

To respond to a statement of claim in Georgia, you must file an answer within the required time frame, typically 30 days after being served. An answer should address each allegation in the claim, either admitting, denying, or asserting a lack of knowledge. This structured response is vital in the context of the Georgia rejection of claim and report of experience with debtor. Being thorough and precise can significantly impact the case outcome.

The two dismissal rule in Georgia refers to a legal principle stating that if a plaintiff voluntarily dismisses a case twice, they cannot bring that claim again. This rule encourages plaintiffs to consider their cases carefully. Consequently, understanding the Georgia rejection of claim and report of experience with debtor process is essential for effectively navigating these legal waters. This principle protects defendants from repeated claims.

You generally have 30 days to respond to a counterclaim in Georgia, similar to the response time for other legal documents. This timeframe ensures that both parties engage fairly in the legal process. Responding promptly enables you to present your case effectively. For support with these procedures, US Legal Forms offers helpful materials related to the Georgia Rejection of Claim and Report of Experience with Debtor.