Georgia Owner Financing Contract for Car

Description

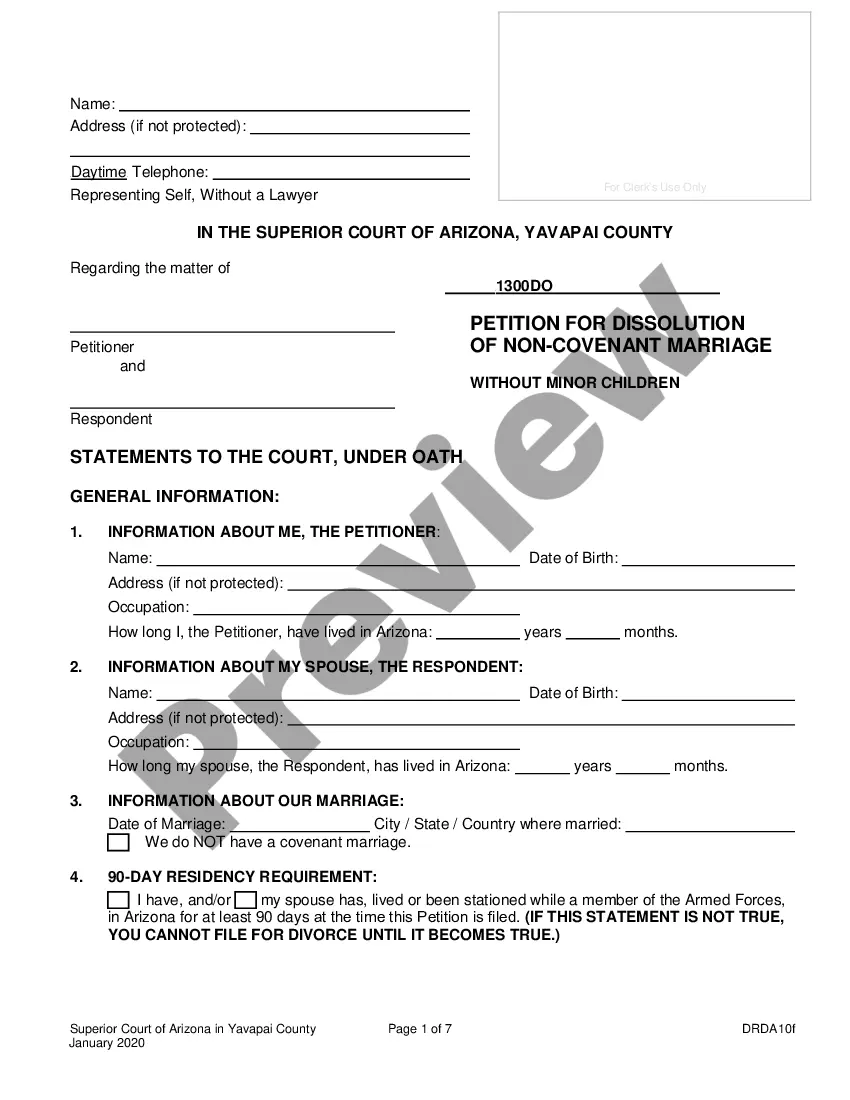

How to fill out Owner Financing Contract For Car?

Are you in a location where you occasionally need documents for organizational or personal purposes almost every day.

There is an assortment of legitimate document templates accessible online, yet locating ones that you can trust is not straightforward.

US Legal Forms offers thousands of form templates, such as the Georgia Owner Financing Agreement for Vehicle, that are crafted to comply with federal and state regulations.

Select the pricing plan you prefer, fill in the necessary information to process your payment, and complete the purchase using your PayPal or credit card.

Choose a convenient document format and download your copy. Access all the document templates you have purchased in the My documents list. You can obtain an additional copy of the Georgia Owner Financing Agreement for Vehicle at any time, if needed. Just select the desired document to download or print the template.

- If you are currently familiar with the US Legal Forms website and possess an account, simply Log In.

- Then, you can download the Georgia Owner Financing Agreement for Vehicle template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the document you need and ensure it is for the correct city/region.

- Utilize the Preview button to review the document.

- Check the description to confirm that you have selected the appropriate document.

- If the document is not what you need, use the Search bar to find the form that suits your needs and specifications.

- Once you find the correct document, simply click Buy now.

Form popularity

FAQ

Seller-financed interest from a Georgia Owner Financing Contract for Car is reported as income on the seller’s tax return. Typically, it is included on Schedule B if it exceeds $1,500 in interest income. Staying organized and using tools, like those provided by uslegalforms, can help ensure you accurately report this income.

When it comes to a Georgia Owner Financing Contract for Car, sellers report the interest income on their tax returns. The seller should maintain records of payments received and report the income on the appropriate tax forms. If you're unsure of the process, using reliable templates from uslegalforms can streamline your tax reporting efforts.

Owner financing in Georgia involves the seller providing financing directly to the buyer instead of through a bank. The buyer makes monthly payments that often include principal and interest. This can be a flexible option for buyers who may not qualify for traditional loans, making the Georgia Owner Financing Contract for Car a viable alternative.

To report income from a Georgia Owner Financing Contract for Car, the seller must include the interest received in their taxable income. This is usually done on Schedule B of Form 1040. If you have questions about how to accurately report this income, consulting a tax professional or using uslegalforms can help clarify the process.

Typically, seller financing may not appear on a credit report unless the seller reports it to the credit bureaus. In a Georgia Owner Financing Contract for Car, if the seller does not report the transactions, it is unlikely to affect the buyer’s credit score. However, missed payments may lead to complications and potential involvement of collection agencies.

In a Georgia Owner Financing Contract for Car, the seller typically retains the title to the vehicle while the buyer makes payments. Once the final payment is completed, the seller transfers the title to the buyer. This arrangement protects the seller's interests until the buyer fulfills their payment obligations.

Good terms for seller financing should include a reasonable interest rate, a manageable down payment, and a clear repayment schedule. In a Georgia Owner Financing Contract for Car, a typical interest rate might range from 5-10%, based on market conditions. Establishing mutually beneficial terms can help ensure a positive financial experience for both the buyer and seller, fostering trust and transparency throughout the transaction.

The average length of seller financing typically ranges from two to five years, depending on the agreement between the buyer and seller. In the context of a Georgia Owner Financing Contract for Car, both parties can negotiate the length to suit their financial circumstances. Shorter terms may result in higher monthly payments, while longer terms usually reduce the monthly amount but can increase overall interest costs.

One downside of owner financing in Georgia is the risk that the buyer may default on the payments, leading to potential financial loss for the seller. Additionally, as the seller, you remain responsible for the car title until the buyer pays in full, which can lead to complications if the buyer misuses the vehicle. Using a well-drafted Georgia Owner Financing Contract for Car can help outline responsibilities and protect your interests.

An example of owner financing might include a seller offering a buyer a $20,000 vehicle with a $4,000 down payment and a financing agreement that spreads the remaining $16,000 over a period of three years. In such a scenario, the agreement details monthly installments, interest rates, and responsibilities. A Georgia Owner Financing Contract for Car is essential to formalize this agreement and protect both parties' interests.