Georgia Sample Letter for Issuance of New Check

Description

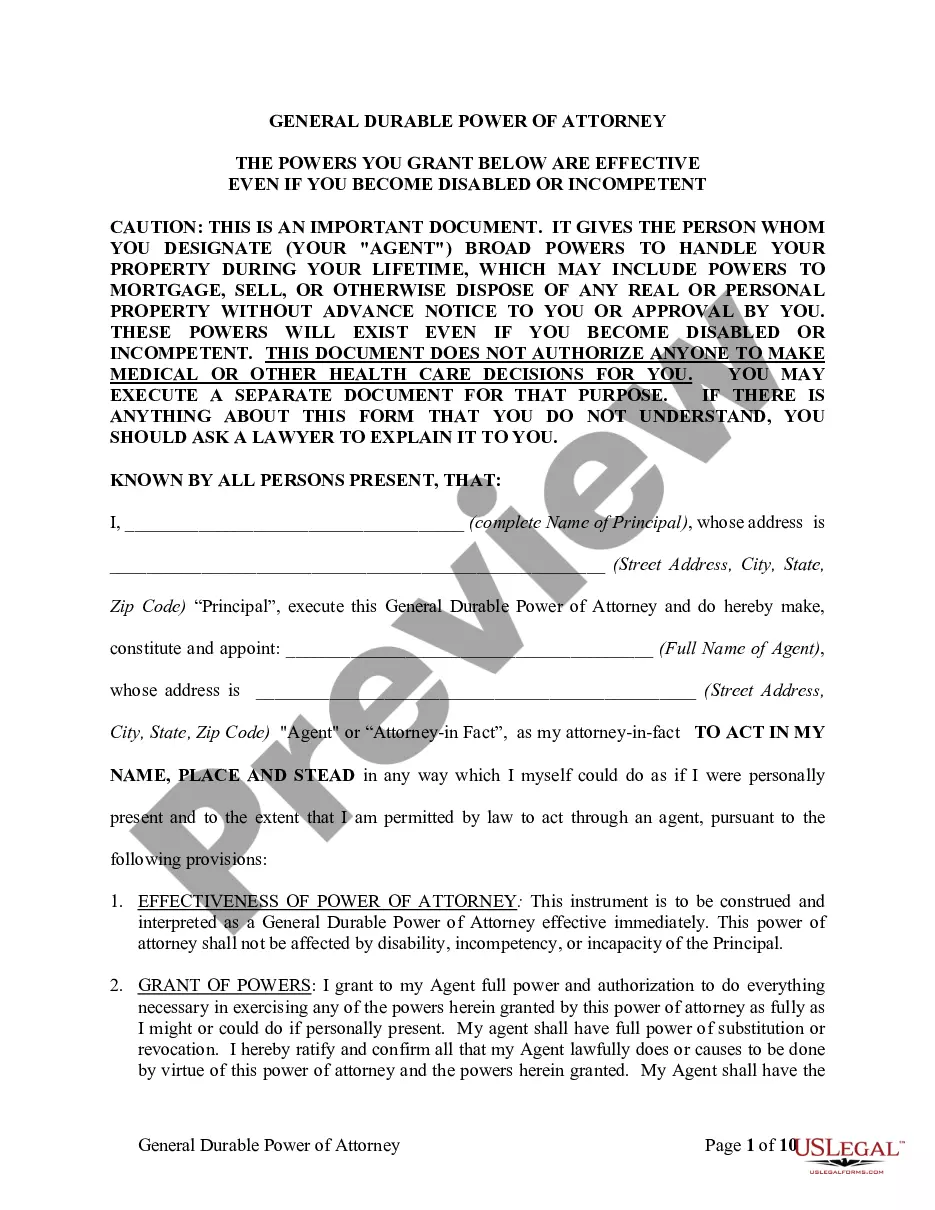

How to fill out Sample Letter For Issuance Of New Check?

If you have to complete, download, or produce legal papers layouts, use US Legal Forms, the biggest variety of legal forms, which can be found on the Internet. Make use of the site`s simple and convenient look for to discover the paperwork you require. A variety of layouts for enterprise and individual reasons are sorted by classes and claims, or keywords and phrases. Use US Legal Forms to discover the Georgia Sample Letter for Issuance of New Check within a couple of mouse clicks.

If you are already a US Legal Forms consumer, log in to your accounts and click on the Acquire key to have the Georgia Sample Letter for Issuance of New Check. Also you can entry forms you earlier delivered electronically inside the My Forms tab of your respective accounts.

If you are using US Legal Forms the first time, follow the instructions below:

- Step 1. Make sure you have selected the form to the appropriate area/nation.

- Step 2. Use the Preview solution to look over the form`s articles. Do not overlook to read the description.

- Step 3. If you are not happy with the kind, take advantage of the Lookup industry on top of the display screen to locate other variations of the legal kind web template.

- Step 4. After you have identified the form you require, go through the Acquire now key. Choose the prices strategy you favor and add your qualifications to sign up for an accounts.

- Step 5. Method the financial transaction. You can utilize your credit card or PayPal accounts to perform the financial transaction.

- Step 6. Pick the file format of the legal kind and download it on the gadget.

- Step 7. Comprehensive, revise and produce or signal the Georgia Sample Letter for Issuance of New Check.

Each legal papers web template you acquire is your own forever. You might have acces to every single kind you delivered electronically inside your acccount. Select the My Forms section and decide on a kind to produce or download once more.

Remain competitive and download, and produce the Georgia Sample Letter for Issuance of New Check with US Legal Forms. There are millions of expert and state-distinct forms you may use for your personal enterprise or individual demands.

Form popularity

FAQ

Here's how much you can expect to receive based on your filing status: Single tax filers and married individuals who file separately could receive a maximum refund of $250.

To check the status of your Georgia state refund online, go to . Then, click on the ?Where's My Refund?? button. After that, you will be prompted to enter: Your Social security number or ITIN.

Most of our letters provide specific instructions of what you need to do, for example: Log in to the Georgia Tax Center and follow the directions provided, or. Let you know that your vehicle registration is suspended or will be suspended soon. The letter will tell you what you need to do to legally drive your vehicle.

To check the status of your Georgia state refund online, go to . Then, click on the ?Where's My Refund?? button. After that, you will be prompted to enter: Your Social security number or ITIN.

You do not have to be a Georgia resident to qualify, as long as you paid taxes in the state, ing to the Georgia Department of Revenue website. The amount of your refund depends on your income and the taxes you paid. Single taxpayers can receive up to $250. Those filing head of household can get up to $375.

You may be eligible for the HB 162 Surplus Tax Refund if you: File your Individual Income Tax Return for tax year 2021 and tax year 2022 by the April 18, 2023 deadline (or by October 16, 2023 if an extension was granted) Had a tax liability for tax year 2021. Are a Georgia resident, part-year resident, or nonresident.

Atlanta, GA ? Governor Brian P. Kemp and the Georgia Department of Revenue (DOR) announced today that the first round of surplus tax refund checks have been issued to Georgia filers.

Call the DOR automated telephone line at 877-423-6711 to check the status of your tax refund. Press option 2 (?Individual Income Tax Information?), then option 2 to inquire about the status of your refund. Follow the prompts to check your tax refund status.