Georgia Sample Letter for Debt Collection for Client

Description

How to fill out Sample Letter For Debt Collection For Client?

It is feasible to spend hours online searching for the legal document template that complies with the state and federal requirements you need.

US Legal Forms offers numerous legal templates that are reviewed by professionals.

You can easily obtain or print the Georgia Sample Letter for Debt Collection for Client from my service.

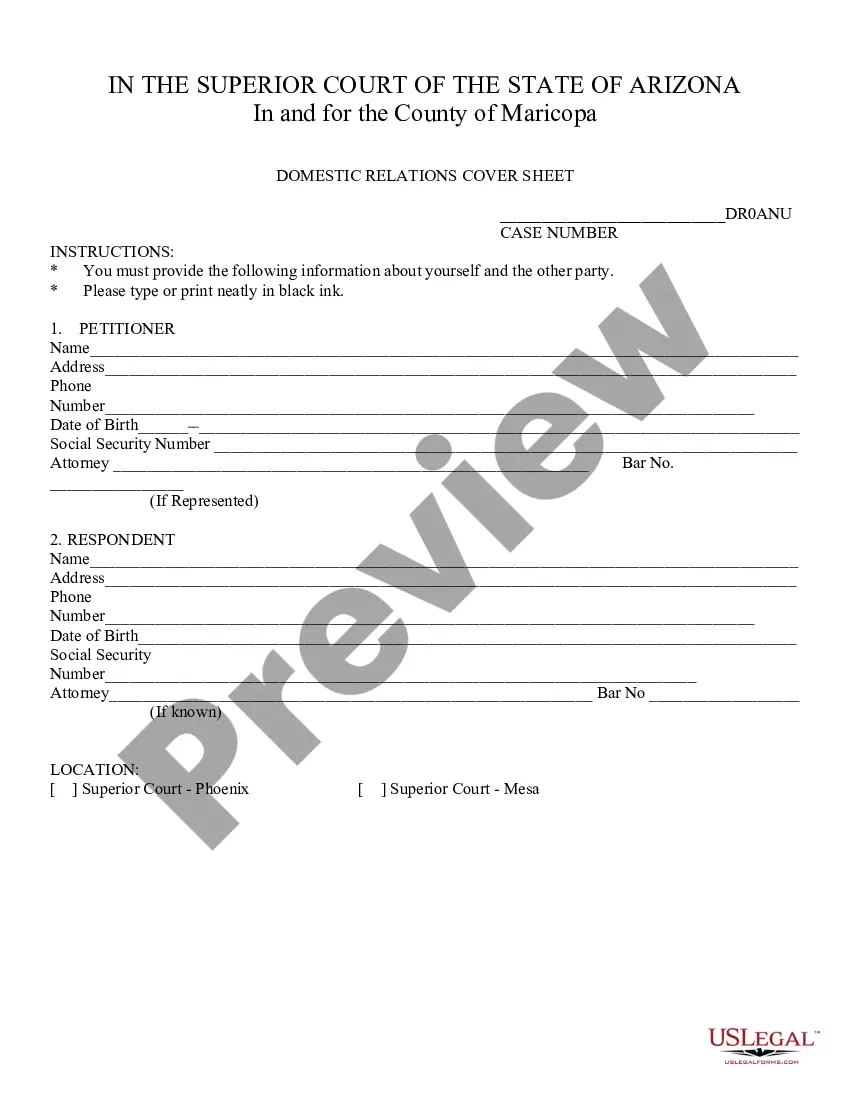

If available, use the Preview button to view the document template as well. If you wish to find another version of the form, use the Search field to locate the template that meets your needs and requirements. Once you have found the template you want, click Buy now to proceed. Choose the pricing plan you prefer, enter your details, and register for your account on US Legal Forms. Complete the transaction. You can use your credit card or PayPal account to purchase the legal document. Select the format of the file and download it to your device. Make adjustments to your document if possible. You can complete, modify, sign, and print the Georgia Sample Letter for Debt Collection for Client. Acquire and print thousands of document templates using the US Legal Forms website, which provides the largest selection of legal forms. Utilize professional and state-specific templates to address your business or personal needs.

- If you possess a US Legal Forms account, you can Log In and then click the Download button.

- After that, you can complete, modify, print, or sign the Georgia Sample Letter for Debt Collection for Client.

- Every legal document template you acquire is yours permanently.

- To retrieve another copy of the purchased document, go to the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have chosen the correct document template for the state/region of your choice.

- Review the form summary to confirm that you have selected the right template.

Form popularity

FAQ

Write a debt settlement letter to your creditor. Explain your current situation and how much you can pay upfront. Also, provide them with a clear description of what you expect in return, such as the removal of missed payments or the account shown as paid in full on your report.

I am requesting that you provide verification of this debt. Please send the following information: The name and address of the original creditor, the account number, and the amount owed. Verification that there is a valid basis for claiming I am required to pay the current amount owed.

If you don't receive a validation notice within 10 days of the first contact, request one from the debt collector the next time you're contacted. Ask for the debt collector's mailing address at this time as well, in case you decide to request a debt verification letter.

Elements to include in your collection letter are: Brief statements:Use simple language in your letter that briefly describes the service you provided and clearly details that the client is past-due on their payments. Keep it brief, relevant and easy for clients to quickly read through.

Summary: A "creditor" is not required to inform their clients before passing an account to collections. A debt collection agency is responsible for sending an initial demand letter, also known as a ?validation notice,? to notify your debtor about their account being assigned to the agency.

What do you include in a debt collection letter? The amount the debtor owes you, including any interest (attach the original invoice as well); The initial date of payment and the new date of payment; Clear instructions on how to pay the outstanding debt (banking details, etc);

How to Request Debt Verification. To request verification, send a letter to the collection agency stating that you dispute the validity of the debt and that you want documentation verifying the debt. Also, request the name and address of the original creditor.

Under the Fair Debt collection Practices Act (FDCPA), I have the right to request validation of the debt you say I owe you. I am requesting proof that I am indeed the party you are asking to pay this debt, and there is some contractual obligation that is binding on me to pay this debt.