The following form is a general form for a declaration of a gift of property.

Georgia Declaration of Gift

Description

How to fill out Declaration Of Gift?

Are you presently in a position where you often need documents for either business or personal purposes.

There are numerous authentic document templates accessible online, but locating ones you can trust is challenging.

US Legal Forms offers thousands of form templates, such as the Georgia Declaration of Gift, designed to comply with state and federal regulations.

Once you find the appropriate form, just click Get now.

Choose the pricing plan you want, fill out the necessary information to create your account, and pay for the order using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Georgia Declaration of Gift template.

- If you don’t have an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you need and ensure it is for your correct city/state.

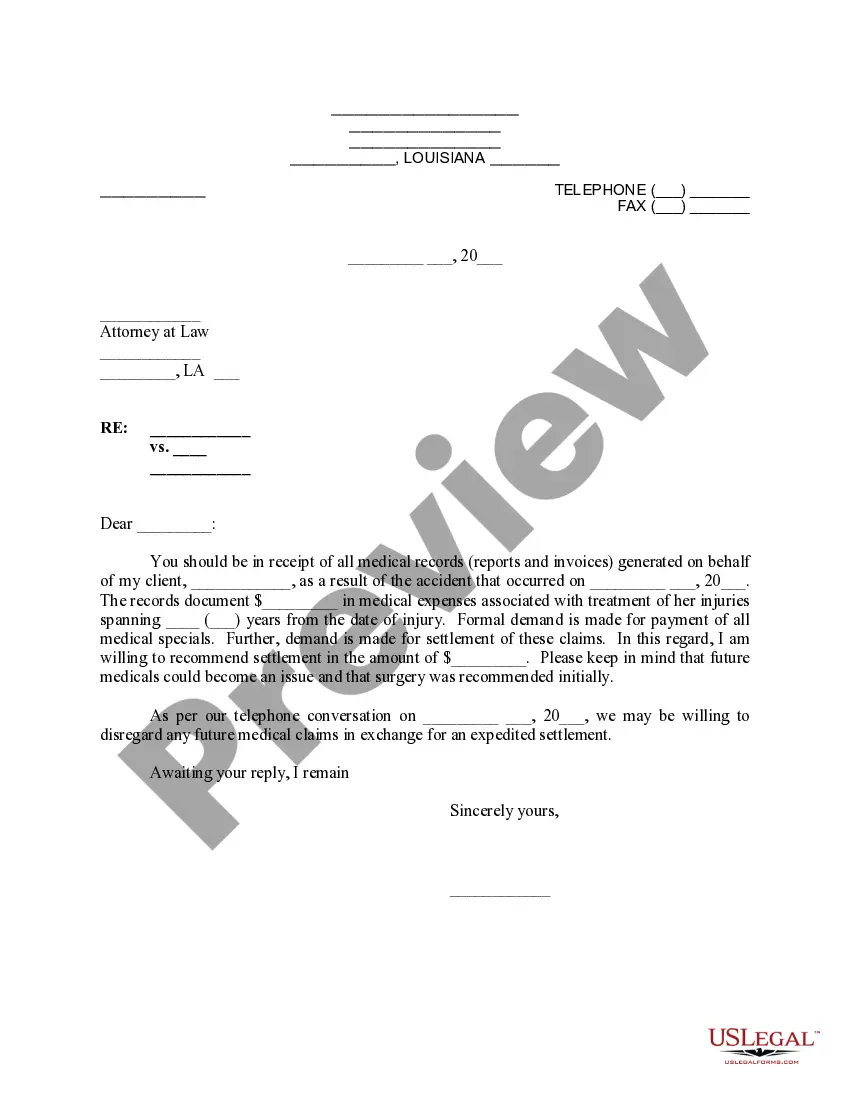

- Utilize the Review button to examine the form.

- Read the description to confirm you have chosen the right form.

- If the form is not what you’re looking for, use the Search field to find the form that fits your needs and requirements.

Form popularity

FAQ

Gifts can be regifted, meaning a recipient has the right to give the item to someone else. However, the original giver cannot reclaim the gift once it has been transferred. Utilizing a Georgia Declaration of Gift can help outline intentions and rights when gifting, making the process clearer for all parties involved.

In Georgia, once a gift is made, it is generally considered final. If you want to reclaim it, you may face legal hurdles as the recipient has ownership rights. This can be further complicated by the nature of the gift and existing agreements. A Georgia Declaration of Gift can be beneficial for establishing clear terms and expectations in gift-giving scenarios.

Demanding a gift back can be challenging as it often depends on the circumstances surrounding the gift. Generally, once a gift is given, it belongs to the recipient unless there is a clear agreement stating otherwise. Using a Georgia Declaration of Gift can help clarify ownership rights, but enforcement may require legal assistance if disputes arise.

As of 2024, Georgia does not impose a state gift tax on individuals. However, federal tax regulations should not be overlooked, as they can affect larger gifts. It's important to consider the federal gift tax exemption and to document gifts accurately using a Georgia Declaration of Gift, especially for substantial transfers.

While it is technically possible to ask for a gift back, the legal standing typically favors the recipient after the gift's transfer. A Georgia Declaration of Gift outlines the intent of the giver, which may support the recipient's claim to ownership. If you feel you need to reclaim a gift, consulting legal resources can provide guidance on your options based on specific circumstances.

In Georgia, a gift is legally considered a transfer of ownership. If the giver wants the item back, they must provide a compelling reason, as generally, the recipient has the right to keep it. However, verbal agreements or titling may complicate the situation. Understanding your rights with a Georgia Declaration of Gift can clarify ownership matters effectively.

Gifting property in Georgia requires you to draft and execute a deed that reflects your intention to transfer ownership. You should sign the deed in the presence of a notary and file it with the county clerk's office. For ease of documentation and to ensure everything is in order, consider using the Georgia Declaration of Gift.

Yes, Georgia follows the federal guidelines concerning gift tax exemptions. Individuals can give gifts up to the federal limit without facing any gift tax. To streamline your gifting process, using the Georgia Declaration of Gift may help clarify your intentions and maintain proper records.

Gift tax exemption is generally available to individuals giving gifts under the annual exclusion limit. Family members, friends, and acquaintances can receive these gifts without incurring gift tax. It is vital to document this gifting process with a Georgia Declaration of Gift to ensure everything is clear and organized.

In Georgia, there are currently no state inheritance taxes, which means you can inherit any amount without paying state taxes. However, federal estate tax rules still apply for large estates. Having a Georgia Declaration of Gift can help clarify your intentions regarding gifts and what your heirs can inherit smoothly.